Earnings season is off to the races, and banks hit the ground running! JPMorgan (JPM), Goldman Sachs (GS), and Morgan Stanley (MS) reported record 4Q24 results that easily surpassed consensus expectations. The results present a conundrum – companies keep posting record results, but their stocks also trade at record highs and look overvalued by many metrics. Even the banks’ leaders, such as JPMorgan CEO Jamie Dimon, are cautioning investors, with comments like “geopolitical conditions remain the most dangerous and complicated since World War II.”

So, what are investors to do in times like these?

We suggest finding companies that have a proven ability to generate profits throughout any economic cycle and whose stocks trade at a discount. Yes, I know that’s easier said than done, unless you have access to our Ratings and database on over 3,400 stocks.

We scoured our database to find this week’s Long Idea. Despite an industry leading position and strong cash, the company’s stock price trades as if profits will permanently fall.

Our process for picking stocks is about as rigorous as it gets, and we’re proud to show our work. We’re not giving you the ticker for this pick, but we are happy to share large excerpts from the report.

We leverage our proven-superior fundamental research to identify good companies – those that generate lasting profits and create real shareholder value – that are also good stocks. Only by understanding the true cash flows of a business can investors know if a company’s stock price is attractive, no matter the market cycle.

The information below comes from the recent update on our thesis for this stock, available to Pro and Institutional members. And you can buy the full report a la carte here.

We remain bullish about this stock because as it presents quality Risk/Reward based on the company’s:

- leading profitability and position in its industry,

- long history of strong cash flows,

- quality corporate governance that ties executives’ interests with shareholders’ interests, and

- cheap stock valuation.

Global Demand Rebounding

Our long-term thesis, that this company will provide the building materials for robust infrastructure spending, remains intact, though such spending has not occurred as fast as expected. In mid-2024, or about halfway through the five-year Infrastructure Investment and Jobs Act (IIJA), just 38% of the funding had been committed to projects around the country. While the funding remains in place, it still needs to be allocated. Regardless, infrastructure improvements or new infrastructure altogether, depends on steel. Long-term steel demand looks promising for this company given its position in the industry.

Attractive Dividend and Repurchase Yield

This company has increased its regular cash dividend every year since the company began paying dividends in 1973. Since 2018, the company has paid $3.4 billion (12% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.38/share in March 2018 to $0.55/share in December 2024. The company’s current dividend, when annualized, provides a 1.8% yield.

The company also returns capital to shareholders through share repurchases. From 2018 through 3Q24, the company repurchased $10.7 billion (38% of market cap) worth of shares. $6.3 billion of this repurchase activity has occurred since 2022.

In the company’s 3Q24 10-Q, the company states that approximately $1.4 billion remain available for the repurchase of shares under the current program. Should the company repurchase shares at its 2023 rate, it would exhaust its existing repurchase authorization, which would provide an additional 4.9% yield based on the current market cap. Combining share repurchases with a current dividend yield of 1.8% could give investors a 6.7% yield on their shares.

Strong Free Cash Flow

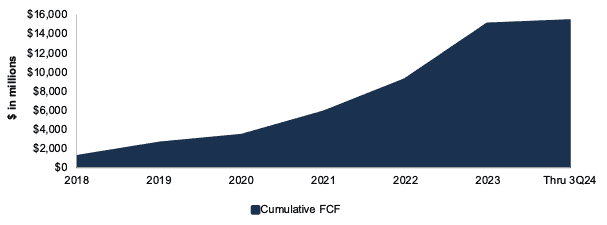

It is important to note that the company’s free cash flow (FCF) easily exceeds its regular dividend payments. From 2018 to three months ended 2024, this company generated $15.3 billion in FCF while paying $3.4 in dividends. See Figure 1.

Figure 1: Free Cash Flow Vs. Cash Dividends Paid: 2018 Through 3Q24

Sources: New Constructs, LLC and company filings

The company has generated a cumulative $15.3 billion in FCF since 2018, which equals 46% of its enterprise value. The company’s large and rising FCF shows the company’s ability to expand capacity while running a profitable business even during times when margins are pressured.

Figure 2: Cumulative Free Cash Flow: 2018 – 3Q24

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.