Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

We think adding Tesla (TSLA: $586/share) to the S&P 500 symbolizes the reckless investment environment of our day and brings huge downside risk to the index.

As detailed in Most Dangerous Stock of 2020, adding Tesla to the S&P 500 was a bad idea when the S&P decided against it in September, and it is even worse now based on:

- Steeply declining electric vehicle (EV) market share in Europe

- Steeper competition in the U.S. and China

- Continued inability to match incumbents’ scale and quality

- Fading edge in battery technology and manufacturing

- Valuation implies it will produce over 100% of all EVs by 2030.

S&P 500 Got It Right the First Time

By leaving Tesla out of the S&P 500 in September, the committee seemed to indicate that the quality of a firm’s earnings was an important factor to consider. The committee appears to have softened its stance on this front.

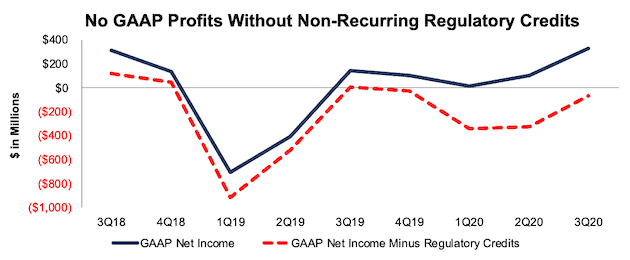

As most investors are aware, Tesla is only able to achieve positive GAAP net income through selling non-recurring regulatory credits to other automakers. Selling credits is not a viable long-term revenue stream as firms will purchase fewer credits from Tesla as they ramp up their own EV production.

Tesla reported its fifth straight quarter of GAAP profits in 3Q20, but when excluding regulatory credits, GAAP net income is negative in each of the past four quarters and five of the past six, per Figure 1.

Figure 1: Tesla’s GAAP Net Income With & Without Regulatory Credits: 3Q18 – 3Q20

Sources: New Constructs, LLC, company filings

While Telsa’s source of GAAP profits remains unchanged, Tesla’s competitive position has worsened.

Tesla Is Losing Market Share in Europe

While Tesla delivered an all-time high139,300 vehicles in 3Q20, the firm is rapidly losing EV market share in Europe. Tesla’s Western European market share (which includes the EU plus the United Kingdom, Iceland, Norway, and Switzerland) has fallen from 34% in 3Q19 to just 14% in 3Q20. The Renault Nissan Mitsubishi Alliance and Volkswagen Group each sell more than Tesla in Western Europe. With competition selling lower-priced vehicles at higher volume, Tesla will have a difficult time regaining its Western European market share.

First Mover Advantage Is Gone

The precipitous drop in Western European market share portends market share losses for Tesla in the rest of the world as incumbent automakers’ EV production comes online. Tesla’s first mover advantage is gone.

GM’s Hongguang Mini, which sells for ~11% of the price of the Model 3, just surpassed Tesla to become the bestselling EV in China. Over the three-months ended October 31, 2020, GM sold 55,781 Hongguang Minis compared to just 35,283 Model 3s over the same time.

It may not be long before we see a similar pattern in the U.S. Since March 2019, General Motors (GM) has committed to spend upwards of $4.5 billion at three U.S. manufacturing sites to accelerate the production of GM EVs, with an additional $2 billion planned across six more facilities. The firm will also invest $2.3 billion to build a battery cell manufacturing plant in Lordstown, Ohio.

Ford recently announced $3.2 billion in investments for EV vehicles and plans to invest $11.2 billion in EVs through 2022.

Meanwhile, Tesla has been unable to match its competition’s EV investments as the firm has reduced its capital investments, presumably in its pursuit of short-term profitability. In 2019, the firm’s capex was just 62% of its depreciation, amortization, and impairment. Tesla’s TTM capex of $2.4 billion is much smaller than the combined $82 billion Volkswagen, GM, Daimler, and Ford plan to invest in EV between 2022 to 2025.

Tesla Will Have Trouble Keeping Up with Incumbents’ Scale and Quality

While incumbent automakers are simply converting existing factories to produce their EVs, Tesla needs to scale up by building new gigafactories to meet its production targets. Scaling up also increases the likelihood that Tesla will have quality issues with its vehicles. Consumer Reports is no longer recommending the Model S and notes the Model Y has “well below average reliability.” Overall, Tesla ranked second to last in Consumer Reports’ reliability study. On November 25, 2020, the Motley Fool reported that Tesla “is recalling over 9,100 Model X cars and 400 Model Y SUVs just six days after Consumer Reports questioned the reliability of several models.”

While Tesla aims to ramp up scale through the creation of multiple factories, competition is ready to utilize existing factories to quickly scale and sell a projected ~3.1 million EVs by 2025.

- Volkswagen plans to produce 1.5 million EVs in 2025.

- General Motors plans to sell 1 million EVs by 2025.

- Toyota plans to produce 500,000 EVs and ~5.3 million electrified vehicles (EVs and hybrids), or half its global sales in 2025.

- Ford is expected to sell ~332,000 EVs in 2025.

Tesla’s Battery Edge Is Fading

Another sign that Tesla’s first mover advantage is wanning is the erosion of the firm’s once sizable advantage in the quality and size of its battery factories. Firms such as GM and Volkswagen are quickly eliminating cost advantages Tesla once had with its batteries. Competition is also ramping up with battery range. GM has already matched Tesla’s feat of offering a 400-mile-range battery. With each passing day, Tesla’s competition is becoming more advanced and are closing the gap in the advantage Tesla once held in battery technology.

Tesla’s Self-Driving Features Aren’t Best-in-Class

Despite boastful statements and marketing of “Full Self Driving”, the real-world results of Tesla’s advanced driver systems don’t stack up against competition. In October 2020, Consumer Reports released their latest test of assisted driving technology and General Motors’ Super Cruise system topped the list, with Tesla “a distant second.” Such a report is not the first instance of Tesla’s assisted driver systems ranking below competition. Earlier this year, MES Insights, an industry research provider, ranked Waymo, GM Cruise, and Ford’s Argo AI startup ahead of Tesla in terms of expertise and capabilities for self-driving. Guidehouse Insights ranked Waymo, Ford and General Motors first, second, and third respectively in their Automated Driving Vehicles leaderboard. Tesla ranked last out of the 18 firms included in the analysis.

Insurance Is Neither Unique nor Material

Tesla bulls will argue that the firm’s foray into providing insurance to drivers of its vehicles is further evidence of the firm’s innovation and unique competitive advantages. However, Tesla is not the first firm to offer insurance on its vehicles.

Porsche launched their own insurance option in June 2019, and General Motors previously offered auto insurance from 1925 through 2008. GM is relaunching the service, first to employees by the end of 2020, and then to the general public by the end of 2021. GM will use data collected through its OnStar service to provide customized discounts based on driver habits and usage. The firm will also provide the service to non-GM owners, albeit without the discounts.

Even if Tesla does successfully enter the insurance business, it will not generate enough profit to put a dent in the future cash flows required to justify its current valuation. Here’s the math. On sales of ~27 million vehicles, General Motors’ auto insurance business generated $1.9 billion in GAAP net income, about $70 per car, from 2004-2006. If we assume Tesla can generate the same level of profit for its insurance business, we’re looking at an additional:

- ~$30 million in net income based on TTM vehicle sales or

- ~$230 million in net income based on optimistically growing its vehicle sales to 50% of the amount of GM’s TTM vehicle sales.

In either case, we are nowhere near the incremental profit growth needed to justify the expectations baked into its stock price.

Tesla’s Valuation Is Even Worse Than When the S&P First Rejected It

Despite the competitive challenges noted above, Tesla’s stock is up over 200% in the past month. Now, to justify its current price of ~$586/share, Tesla must:

- Immediately achieve a 7% NOPAT margin, which is equal to Toyota’s 2020 NOPAT margin and above Tesla’s TTM NOPAT margin of 2%.

- Grow revenue by 36% compounded annually for the next 11 years

- Grow revenue, NOPAT and FCF without increasing working capital or fixed assets – a highly unlikely assumption that creates a truly best-case scenario. For reference, Tesla’s invested capital has grown 56% compounded annually since 2010 and 36% compounded annually over the past five years.

See the math behind this reverse DCF scenario. In this scenario, Tesla would earn $724 billion in revenue 11 years from now and the firm’s NOPAT in 2030 would equal $51 billion (vs. $538 million TTM). For comparison, Toyota, the world’s second largest (by revenue) automobile manufacturer, generated TTM NOPAT of $12.8 billion, or just 25% of Tesla’s implied NOPAT in this scenario.

And Implies it Will Sell Majority of Global EVs

At its current ASP of ~$57k, Tesla’s current stock price implies the firm will sell 12.8 million vehicles in 2030, or 49% of the expected global EV sales. If Tesla’s ASP falls to ~$38k, or the average car price in the U.S. in July 2020, its implied sales volume in 2030 increases to 18.9 million vehicles in 2030, or 73% of projected global EV sales in 2030.

We think it highly unlikely that Tesla will ever sell such a high volume of cars at its current ASP because the luxury car market is not very large relative to the overall automobile market. The fact of the matter is that there are not very many people on earth that are wealthy enough to afford such an expensive car.

So, investors should consider the implied vehicle sales by 2030 based on lower ASPs that are required to justify TSLA’s valuation at ~$586/share:

- 18.9 million vehicles – ASP of $38k (average car price in U.S. in July 2020)

- 30.5 million vehicles – ASP of $24k (equal to Toyota)

- 48.0 million vehicles – ASP of $15k (equal to General Motors)

Below are the percentages of expected global EV sales in 2030 that those numbers of vehicles represent:

- 73% for 18.9 million vehicles

- 117% for 30.5 million vehicles

- 185% for 48.0 million vehicles

One Last Note on the S&P 500: Tesla’s Inclusion Makes Passive Investing Riskier

We highlighted in The Hidden Dangers of Passive Investing the problems with using ETFs in passive investing strategies. Instead of efficiently allocating capital to the most deserving companies, passive index investing allocates money to companies with the largest market caps. Tesla’s inclusion into the S&P 500 will only compound the risks of the passive index trade by further concentrating the index to just a handful of companies. Tesla is likely to join the index as the seventh largest (by market cap) company in the index.

Tesla will not only be one of the least profitable companies ever added to the S&P 500, but it will also be the largest company ever added. Tesla’s current market cap means the firm will comprise ~1% of the index. Once a hallmark of mature, profit-generating businesses, the addition of Tesla to the S&P will likely bring additional volatility and momentum traders to the stored index.

This article originally published on November 30, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.