The Materials sector ranks fifth out of the ten major sectors as detailed in our sector roadmap. It gets my Neutral rating, which, like my fund ratings, is based on aggregation of stock ratings for each of about 150 companies in the sector. The full series of my reports on the Best & Worst Sector and Style Funds is here.

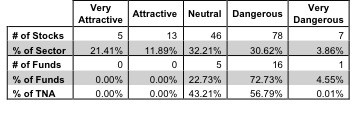

Getting excited about Materials stocks is not easy given the weak outlook for global economic growth and elevated commodity prices. Looking at stocks across the sector through the microscope of my ratings reveals a mixed bag per Figure 1. The majority of stocks and value in the sector get a Neutral-or-worse rating. However, the landscape for funds is much worse. 100% of the funds get a Neutral-or-worse rating.

My analysis of the holdings of the 22 funds in the Materials sector shows that portfolio managers of funds in this sector are not doing a good job of selecting the best stocks in the sector. Investors should avoid funds in this sector. Per previous articles, the best sectors for finding stocks and funds are Technology and Consumer Staples, both of which get my Attractive rating.

Figure 1: Materials Sector Landscape For Funds & Stocks

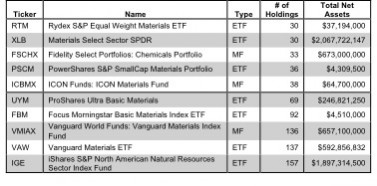

If you are forced to choose a fund in the Materials sector, know that all 22 funds are very different. Per Figure 2, the number of holding varies widely (from 30 to 157), which creates drastically different investment implications and ratings. Here is the full list of 22 funds.

How do investors pick the right fund out of the sea of choices that will deliver the best returns?

Figure 2: Funds with Most & Least Holdings – Top 5

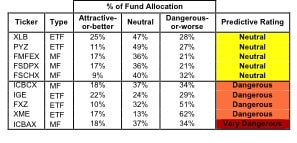

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 2.

Our predictive fund ratings are based on aggregating our stock ratings on each of the fund’s holdings and all of the fund’s expenses. Investors deserve forward-looking fund research that is comparable in quality to stock research.

Investors should not rely on backward-looking research of past performance for investment decisions.

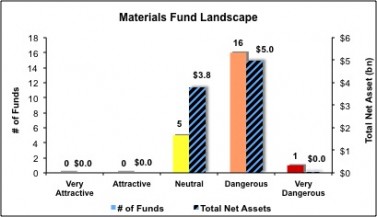

Figure 3 shows the five best and worst-rated funds for the sector. None of the funds in the sector allocate more than 25% of their value to Attractive-or-better rated stocks. In addition, my ratings account for the total annual cost of investing in a fund or ETF. My ratings (updated daily) on all funds are here.

One of my favorite stocks in the Materials sector is Newmont Mining [s: NEM], one of five that gets my Very Attractive rating. It is also one of the largest holdings in my top-rated Materials sector fund: Materials Select Sector SPDR [s: XLB]. My favorite characteristic of NEM is its valuation. The current stock price (~$61/share) implies the company’s profits will decline by 35% permanently. If the company does any better than that low expectation, the stock will rise. I think it is fair to say that the stock has priced in a rather bleak economic future, which means it offers investors a safer bet than most stocks.

One of my least favorite Materials stocks is Dow Chemical [s:DOW], which gets my Dangerous rating. DOW is the second largest holding of ICON Materials Fund [s: ICBAX], the worst-rated fund in the materials sector. DOW is a low ROIC business (5%) with an expensive valuation. It is hard to make a straight-faced argument that the stock has any upside potential. In addition to over $25 billion in debt, the company is saddled with a pension that is underfunded by over $7 billion according to the most recently published 10-K. The current stock price (~$33/share) implies over about 12% growth in profits compounded annually for about 10 years. Those are high expectations when one considers the fact that the average growth rate of the company over the last 5 years has been just over 2%.

Figure 3: Funds with the Best & Worst Ratings – Top 5

Sources: New Constructs, LLC and company filings

The bottom line is: investors should not buy any Materials funds. None of the 22 funds for the sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive overall rating. Figure 4 shows the rating landscape of all ETFs and mutual funds in the Materials sector.

Our Sector Roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best Funds From the Worst

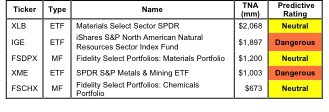

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular Materials funds.

Figure 5: Five Largest Materials Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

The full list of Materials funds and our ratings on each fund is here.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.