Cheap Funds Dupe Investors — 1Q2015

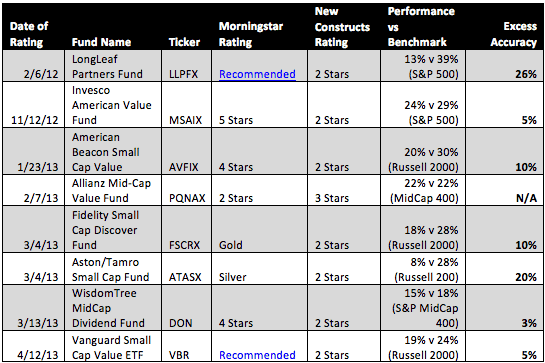

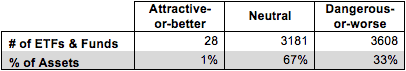

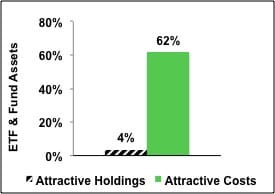

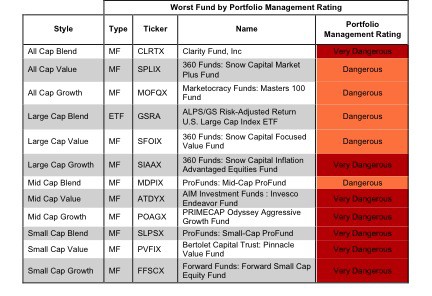

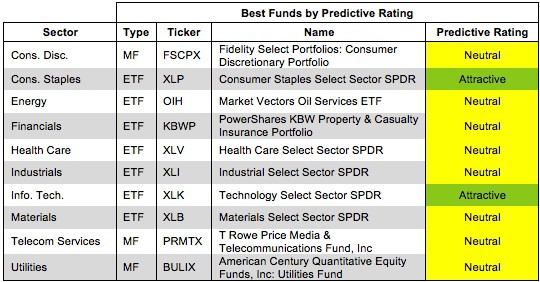

Fund holdings affect fund performance more than fees or past performance. A cheap fund is not necessarily a good fund. A fund that has done well in the past is not likely to do well in the future. 1Q15.

Kyle Guske II, Senior Investment Analyst, MBA