“Index” Label Myths

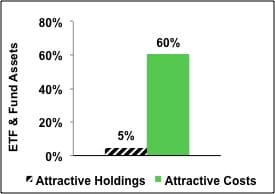

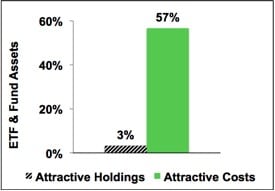

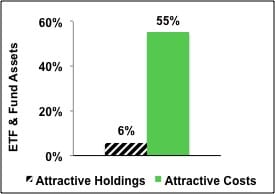

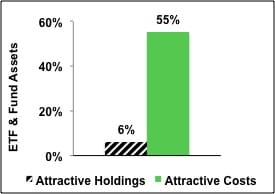

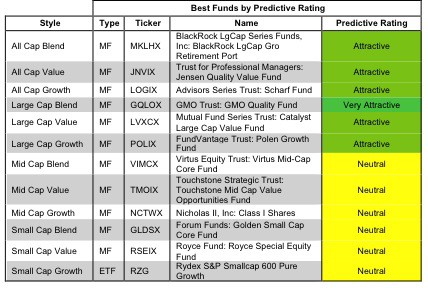

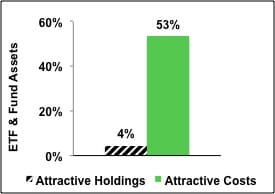

The word “index” in an ETF label does not always mean that investors are getting the specific exposure they seek. Diligence on ETF holdings is necessary despite what the providers might have you believe. Below I dispel the following myths concerning index ETFs.

David Trainer, Founder & CEO