My top-rated mutual fund is GMO Trust: GMO Quality Fund (GQLOZ). It is one of only four funds (out of 7400+) to get my Very Attractive rating. It gets my top rating because 68% of the fund is in Attractive-or-better rated stocks and none of the fund is in Dangerous-or-worse rated stocks. My report has all details.

All of the fund’s top five holdings get my Attractive-or-better rating, including Microsoft (MSFT) – Very Attractive rating. MSFT gets my best rating because the company’s’ ROIC, at 72%, ranks 8th in the S&P 500 while its stock price (~$33/share) implies the company’s profits will permanently decline by about 20%. High profitability and low valuation create excellent risk/reward in a stock.

My definition of good risk/reward for a fund is the same, and my stock research is the foundation of my fund research. Ergo, my fund ratings are predictive just as my stock ratings are predictive. Seems fair, no?

Certainly, no one can claim to have perfect predictive powers, but that is not the point. The point is that the quality of fund research should be closer to the quality of stock research. The backward-looking ratings that dominate fund research are, in many ways, a disservice to investors.

So, after reading Chuck Jaffe’s “Be wary of predictive mutual-fund ratings”, I wondered: should we be wary of backward-looking mutual fund ratings? The answer is “yes”.

Ever hear of the “five-star kiss of death”?

It refers to how funds tend to underperform after getting Morningstar’s highest rating. The cause of the underperformance is thought to be: so much money flows to the top-rated funds that they can no longer execute the strategy that generated the strong performance that got them the five-star rating.

Some decent evidence backs up this theory. According to Mr. Jaffe, “studies show that more than 90% of all money flowing into funds goes into issues that carry four- or five-star ratings.”

There is no question that Morningstar’s fund-rating system beats the drum to which fund investors dance.

And yet, the analysts at Morningstar think rather poorly of the star rating system as reported by Matt Hougan in “Morningstar Star Ratings Vs. Expense Ratios”:

“Individual analysts at Morningstar almost all demur on the value of the star ratings…some of them love Active Share and some of them love Manager Tenure and some of them (the smart ones) love managers who have ‘skin in the game,’…But almost all of them I’ve met agree that the Morningstar ratings don’t do much.” (Bold type added.)

Morningstar in its own research admits that expense ratios are better predictors of performance than their ratings.

So, it should be of no surprise that Morningstar recently introduced a more “forward-looking” rating, which it calls “analyst ratings”. Mr Jaffe explained this new rating system soon after it was released in November 2011. In short, the new analyst ratings group funds into five categories: gold, silver, bronze, neutral and negative.

Mr. Jaffe also noted that the new analyst rating overlay on star-ratings would likely drive even greater concentrations of fund flows as investors would naturally prefer the “Gold-rated” five-star fund to the “Silver-rated” five-star fund.

Accordingly, the “gold-star” kiss of death may be more deadly than its “five-star” older brother.

Before we jump to conclusions, let’s see how the new analyst ratings are playing out so far.

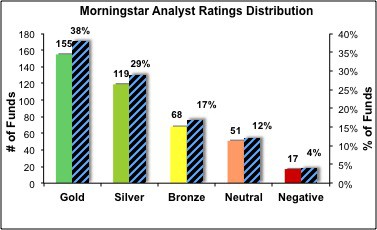

Figure 1 comes from a study that reveals quite a positive bias in the new analyst ratings. Two-thirds (67%) of all analyst ratings are “Gold” or “Silver”. Only 4% get a “Negative” rating as of 12/31/2011. Two more keen insights from the study:

- “Despite the fact that the majority of mutual funds under-perform their benchmarks, only 4% of Morningstar’s 410 analyst ratings are ‘negative’.”

- “Morningstar has still not clarified how 21 index funds have managed to receive ‘medal’ ratings. After all, how does an index fund outperform its benchmark? By their own definitions, the best an index fund should be rated is ‘neutral’. Yet every index fund they have rated up to this point has received a rating higher than Neutral (with the majority getting ‘gold’ ratings).”

Figure 1: Do You See Any Bias Here?

Source: Wall Street Rant: http://www.wallstreetrant.com/2012/01/morningstar-ramps-up-analyst-ratings.html

Source: Wall Street Rant: http://www.wallstreetrant.com/2012/01/morningstar-ramps-up-analyst-ratings.html

Remind you of Wall Street’s stock ratings? Loads of “buy” recommendations and very few “sell” ratings because “sells” are just not good for business.

The same is true for negative fund ratings as Morningstar is much more likely to get licensing fees from funds that want to brag about their “gold” Morningstar rating than a “negative” rating.

If we learned anything about research in the last few years, it is that you cannot trust the coverage of firms who get paid by the entities they are covering. Remember how the credit ratings firms missed the issues in the mortgage backed securities packaged by their Wall Street clients?

Looks as if Mr. Jaffe is right…we should be wary of predictive fund ratings…at least those that show bias.

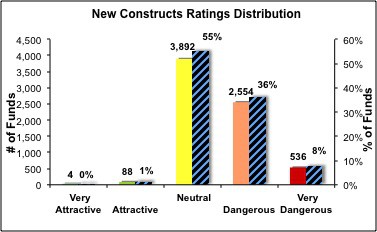

Not every predictive fund rating is biased. And not every predictive fund rating has a mysteriously complex methodology either. Figure 2 shows the distribution of my predictive fund ratings. See any bias there? My methodology is here. You can get all of my fund ratings (and reports) here to replicate Figure 2 if you like.

Figure 2: Fund Ratings With Independence and Integrity

As my regular readers know, my fund ratings are based on my stock ratings on the fund’s holdings. My stock ratings have shown strong predictive ability according to Barron’s.

My track record also shows that I carry no bias in my opinions on stocks. I write a balanced number of positive and negative recommendations. My research is based on financial facts, especially those buried in the footnotes, not subjective opinion. Here are my latest Stock Picks and Pans.

Independent research on stocks has grown tremendously since Spitzer’s Global Research Settlement in 2003. Perhaps, there should be comparable growth in independent research on funds.

Disclosure: I own MSFT. I receive no compensation to write about any specific stock, sector or theme.

2 replies to "Flaws In Traditional Fund Research Should Not Be Tolerated"

I’m extremely impressed with your writing skills and also with the layout on your blog. Is this a paid theme or did you customize it yourself? Anyway keep up the excellent quality writing, it is rare to see a nice blog like this one nowadays..

Greetings Twitter operates well for my situation yet your site

is loading slowly which actually took approximately a few minutes to finally load

up, I’m not sure if it is my very own issue or perhaps your website problem.

Well, I’d like to thank you for placing wonderful content.

I’m guessing it has become useful to lots of people who came

at this point. I personally have to say that you actually have done superb job with this as

well as hope to check out more great content through

you. I have got you saved to my bookmarks to see blog you publish.