Best & Worst ETFs & Mutual Funds July 2012: Utilities Sector

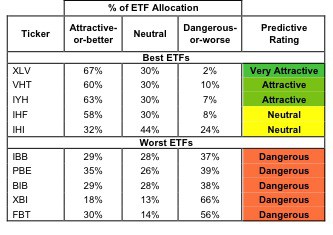

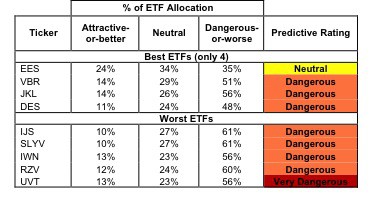

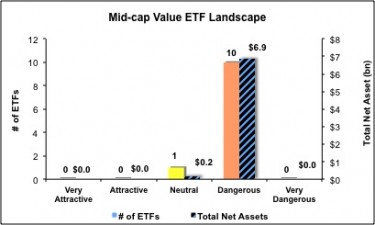

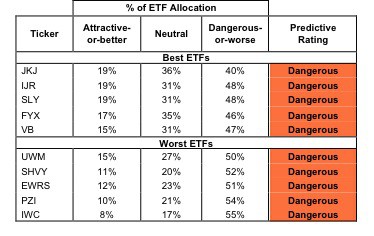

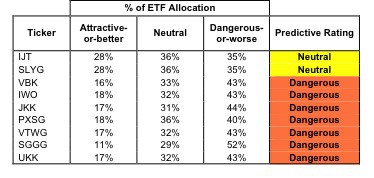

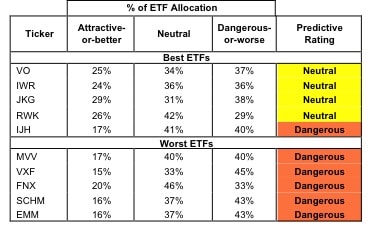

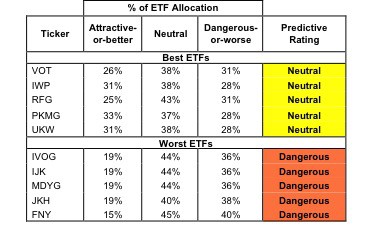

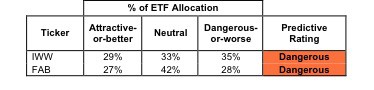

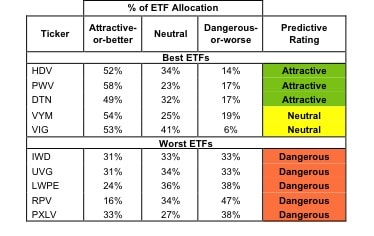

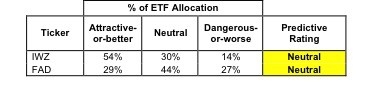

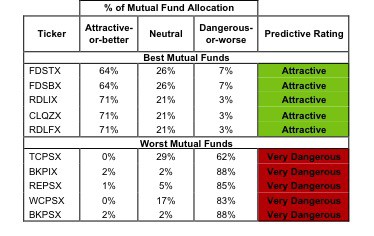

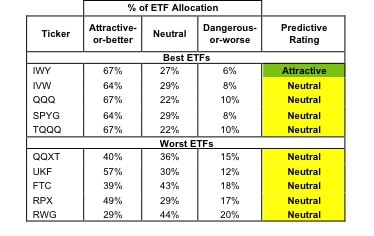

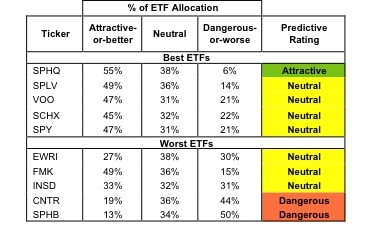

The Utilities sector ranks eighth out of the ten sectors as detailed in my sector roadmap. It gets my Dangerous rating, which is based on aggregation of ratings of 9 ETFs and 33 mutual funds in the Utilities sector as of July 13, 2012.

David Trainer, Founder & CEO