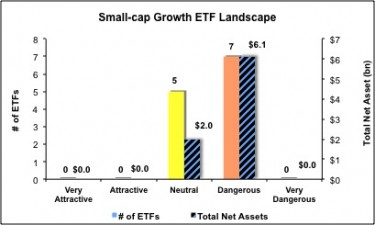

The small-cap growth style ranks ninth out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on aggregation of ratings of 12 ETFs and 463 mutual funds in the small-cap growth style as of May 1, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog and Trading Deck.

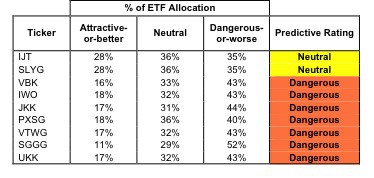

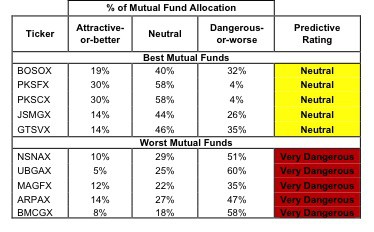

Figure 1 ranks from best to worst the nine small-cap growth ETFs that meet our liquidity standards and Figure 2 shows the five best and worst-rated small-cap growth mutual funds. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the small-cap growth style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any small-cap growth ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

See ratings and reports on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings

Sources: New Constructs, LLC and company filings

Five ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards. See our ETF screener for which ETFs were excluded.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

Sources: New Constructs, LLC and company filings

iShares S&P SmallCap 600 Growth Index Fund [s: IJT] is my top-rated small-cap growth ETF and Boston Trust & Walden Funds: Boston Trust Small Cap Fund [s: BOSOX] is my top-rated small-cap growth mutual fund. Both earn my Neutral rating.

ProShares Ultra Russell2000 Growth [s: UKK] is my worst-rated small-cap growth ETF and Bhirud Funds, Inc: Apex Mid Cap Growth Fund [s: BMCGX] is my worst-rated small-cap growth mutual fund. Both earn my Very Dangerous rating. BMCGX’s total annual costs of 10.46% are the highest of all 7000+ mutual funds I cover.

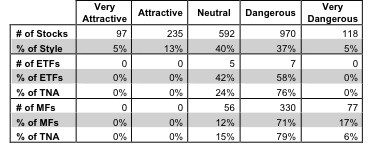

Figure 3 shows that only 332 out of the 2012 stocks (less than 19% of the total net assets) held by small-cap growth ETFs and mutual funds get an Attractive-or-better rating. The low allocation to Attractive-or-better-rated stocks is the reason that no ETFs or mutual funds are worth buying. This provides further evidence that the quality of an ETF or mutual fund is determined by the quality of its holdings.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and small-cap growth ETFs hold poor quality stocks.

Figure 3: Small-cap Growth Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors should not buy any small-cap growth ETFs or mutual funds and seven of the twelve ETFs and 407 of 463 mutual funds should be avoided. Focus on individual stocks instead.

InterDigital Inc. [s: IDCC] is one of my favorite stocks held by small-cap growth ETFs and mutual funds and earns my Very Attractive rating. I’m bullish on the Information Technology sector and IDCC is a prime example why. Earning a return on invested capital (ROIC) of 50% (better than 98% of all Russell 3000 companies) proves this company allocates capital intelligently. As a result, IDCC generates a high level of cash as manifest by their 13.5% free-cash-flow yield, which is better than 93% of all Russell 3000 companies. In spite of it’s strong cash flows, IDCC’s valuation (~$27.72) implies that after-tax cash flows (NOPAT) will permanently decrease by 30%. Coupling strong historical cash flows with low future cash flow expectations makes IDCC a compelling stock.

Plug Power [s: PLUG] is one of my least favorite stocks held by small-cap growth ETFs and mutual funds and earns my Very Dangerous rating. PLUG is a proven value destroyer. Not once in the 13 years I’ve covered the stock has the company generated a positive net operating profit after-tax (NOPAT). And yet, the current stock price implies the company will grow profits at nearly 25% compounded annually for 20 years. No history of profits (NOPAT) and such high expectations for future NOPAT is a major red flag for me. I recommend investor steer clear of PLUG.

Figures 4 and 5 show the rating landscape of all small-cap growth ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all twelve ETFs and 463 mutual funds in the small-cap growth style.

Disclosure: I receive no compensation to write about any specific stock, sector, style or theme.