Acadia Healthcare (ACHC: $31/share) – Closing Short Position – Down 42% vs. S&P +19%

We selected Acadia Healthcare as a Danger Zone pick on July 19, 2016 and reiterated our bearish call on the stock on August 7, 2017. Our investment thesis highlighted 1) highly misleading non-GAAP earnings that artificially inflated the company’s profitability; 2) a misguided acquisition roll-up strategy; and 3) a valuation well above its peer group.

During the subsequent 468 day holding period, ACHC outperformed as a short position, falling 42% compared to a 19% gain for the S&P 500 (net out-performance of 61%). The stock’s decline was largely the result of disappointing earnings and revenue results, especially a lackluster 3Q17 report that sent the stock falling 25%. Acquisition driven growth and misleading accounting can only hold up for so long.

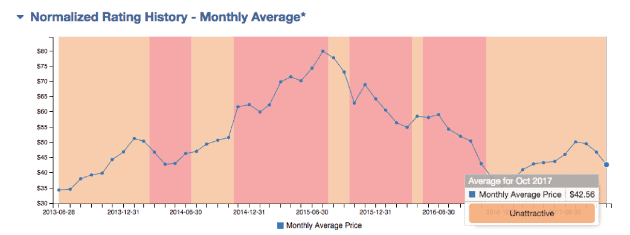

Figure 1: ACHC Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings.

Since our update, ACHC has retained its Unattractive rating. The company’s fundamentals continue to decline, but it now trades at a valuation roughly in line with its peer group. In addition, the increased focus on the opioid crisis could boost the stock in the near-term. We still don’t recommend the stock to investors, but it no longer has the unbalanced risk/reward profile it once did.

We hope investors avoided this portfolio blowup or participated in the 42% short return.

This article originally published on October 31, 2017.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.