We leverage our Robo-Analyst technology to monitor 3,000 stocks across all sectors and issue Danger Zone reports to help clients avoid portfolio blowups. Position Update reports serve as notification that a previous investment idea’s risk/reward profile has shifted and the position has been “closed”.

VirnetX Holding Corp (VHC: $3.50/share) – Closing Short Position – Down 86% vs. S&P +88%

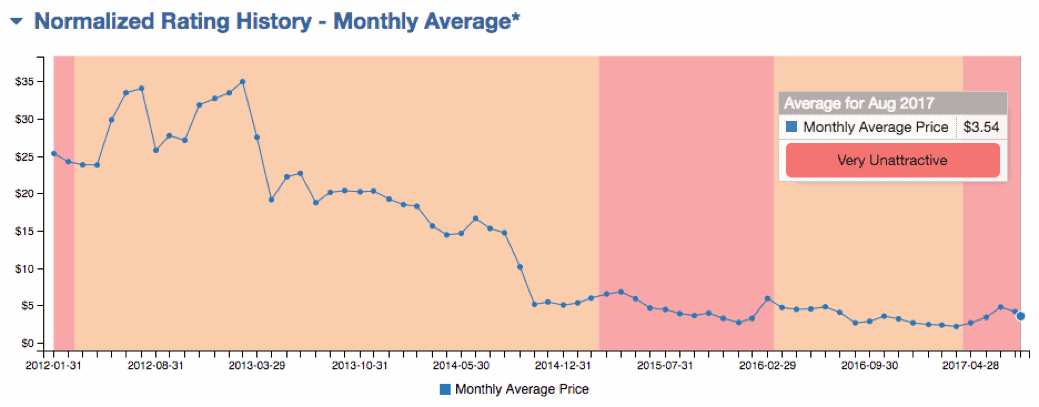

VirnetX Holding Corp was selected as a Danger Zone pick on 4/12/11. At the time of the report, the stock received a Very Unattractive rating. Our investment thesis highlighted: 1) a valuation which implied greater profit growth than Google achieved post IPO; 2) misleading reported earnings; and 3) an “Adverse Opinion” on the company’s internal accounting controls.

During the subsequent 2,311 day holding period, VHC stock outperformed as a short position, falling 86% compared to an 88% gain for the S&P 500. VHC saw large cuts to its valuation after losing patent infringement cases against Cisco (CSCO) and Apple (AAPL) in 2013 and 2014.

Figure 1: VHC Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

Since our original Danger Zone report, VHC has retained its Very Unattractive rating. While business prospects still hinge upon patent infringement rulings, the significantly lower valuation no longer presents the unbalanced risk/reward it once did. We hope investors avoided this portfolio blowup or participated in the 86% short return.

This article originally published on August 14, 2017.

Disclosure: David Trainer, Kyle Guske II, and Kenneth James receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.