Orbotech (ORBK: $56/share) – Closing Long Position – Up 60% vs. S&P +7%

Orbotech (ORBK) was one of four semiconductor equipment stocks we recommended to investors in our June 12 article “Selling Shovels in a Gold Rush: Buy This Sector to Profit from the Internet of Things.” We also featured the stock the month before as one of the new additions to our Most Attractive Stocks list. As with the other stocks on the list, we believed ORBK to be a good buy due to 1) strong industry trends; 2) a cheap valuation compared to peers; and 3) high and growing economic earnings.

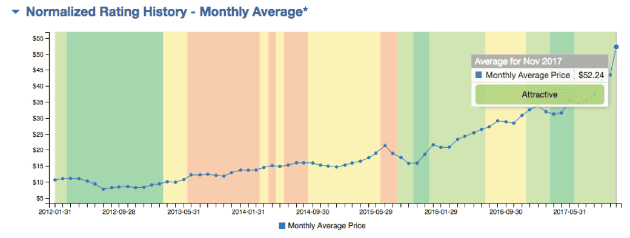

During the subsequent 167 day holding period, ORBK outperformed as a long position: gaining 60% compared to a 7% gain for the S&P 500 (net out-performance of 53%). The increase was due primarily to an expansion of the company’s price to economic book value (PEBV) as a couple of earnings beats helped convince the market that ORBK’s strong profits were sustainable.

Figure 1: ORBK Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings.

Due to the increase in its valuation, ORBK has been downgraded from Attractive to Neutral, and we are no longer recommending investors buy the stock.

However, the other three stocks from our original report all still earn our Attractive or Very Attractive rating.

Combined, the four stocks from the report are up an average of 32%, compared to 7% for the S&P 500 and 12% for the NASDAQ ex-financials (QQQ). We hope investors benefited from this outperformance and continue to hold our other top stocks in the semiconductor equipment sector.

This article originally published on November 27, 2017.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.