Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Online real estate service Move, Inc. (MOVE) is in the Danger Zone this week. MOVE operates home and apartment listing sites Realtor.com and Move.com as well as the moving service information site Moving.com. 80% of MOVE’s revenue comes from advertising on these sites.

MOVE has had strong cyclical winds at its back in recent years, and the stock is up 95% year-to-date. The stock is richly valued, and several red flags hidden in the footnotes raise questions about the company’s ability to justify its stock price. MOVE operates in a niche field with significant competition from companies like Zillow (Z) and Trulia (TRLA), not to mention Yahoo (YHOO), which has its own real estate listing site. Clever earnings management and the recovery in the housing market has helped propel MOVE upward this year, but don’t expect the ride to continue. The company is already lagging its competitors and continuing to lose market share.

Managing Earnings To Create The Illusion Of Profits

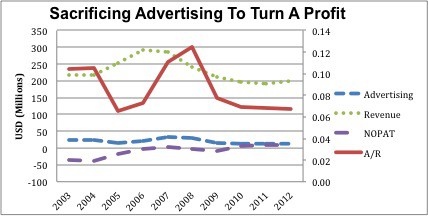

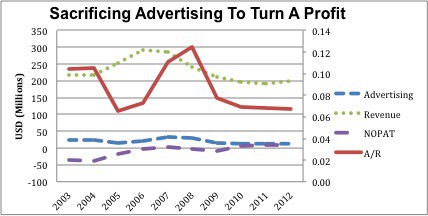

In 2012 and 2011, MOVE had two straight years of positive GAAP earnings for the first time since the height of the housing bubble. Despite the fact that its 2012 revenue was 30% less than in 2006, MOVE made a profit by cutting down on expenses. Specifically, MOVE cut back on discretionary spending costs like advertising. In 2012, advertising expenses were only $13 million, or 7% of revenue, while in 2008 advertising expenses were $32 million, or 12% of revenue. Without this $19 million decrease in advertising expense, MOVE would have lost money in 2012 rather than earn an operating profit (NOPAT) of $8 million as it did.

Figure 1: Advertising Expense, Revenue, and NOPAT

That chart should worry investors, as decreasing advertising expenditures in a competitive, fragmented industry can significantly undermine future profits. This survey showed that nearly 80% of corporate executives are willing to sacrifice long-term value in order to hit earnings estimates in the near term. Cutting advertising expense can help in the short-term, but it will likely be a value-destroyer in the long term.

Losing Market Share

MOVE’s cost-cutting efforts are already creating problems. Despite it being a more established site, traffic on MOVE’s flagship Realtor.com has already been surpassed by Z, which spent 10% of its revenue on advertising in 2012, and TRLA, which increased its ad spending fivefold in 2012.

Z had an average of 61 million unique monthly visitors in 3Q13, a year over year increase of 69%, and TRLA had an average of 42 million unique monthly visitors, a year over year increase of 42%. MOVE, on the other hand, had only 28 million unique monthly visitors and 22% growth year over year. The sector as a whole might be growing, but MOVE is at the back of the pack and falling further behind.

Red Flags From the Footnotes

MOVE has several red flags hidden in its filings that either take away from the cash flow available to shareholders in the future or cast doubt on the company’s ability to create more cash flow.

- Employee Stock Option liabilities: MOVE has 7 million options outstanding, which at its current price represents a liability of $67 million, or 11% of its market cap. Outstanding stock options are a dangerous liability as they increase in value as the stock price goes up.

- Off-balance sheet debt: MOVE has no reported debt, but it does have $23 million in operating lease obligations, which represents about $20 million in off-balance sheet debt when discounted to its present value.

- Asset write-downs: Since 2006, MOVE has accumulated write-downs of nearly $50 million, or 50% of reported net assets. Large write-downs are a sign of management allocating capital poorly. This history of write-downs should make investors skeptical of the prospects for recent acquisitions TigerLead and Relocation.com.

Asset write-downs are generally disclosed on the income statement, but one has to dig into the footnotes to find the reasons for them. Outstanding stock options and operating leases are not disclosed on the income statement and can only be found in the financial footnotes of a company’s annual Form 10-K.

Dangerous Valuation

Even without the competitive headwinds it faces, MOVE is priced beyond any reasonable growth expectation. MOVE’s current valuation of $14.75/share implies that the company will grow after-tax profit (NOPAT) by 25% compounded annually for 19 years. I’m not sure that any investor out there is willing to make a straight-faced argument that MOVE can meet those expectations.

MOVE hit its five-year high in mid-October and has since lost nearly 20% of its value. Z and TRLA have similarly seen big drops in the past two months. It appears that investors are souring on the online real estate business as a whole. Normally, I caution against investors trying to short momentum stocks, but it looks as though the momentum for MOVE has already been stopped. At these levels, MOVE represents an attractive shorting opportunity with significant downside remaining.

If we give MOVE credit for 14% compounded annual NOPAT growth for 20 years, the stock is worth only $2.50 today. I think MOVE could be a potential acquisition target for a large company like Google (GOOG) or Facebook (FB), so adding a generous buy out premium we can put the fair valuation at about $5/share. I don’t see any company buying out MOVE with its current market cap of $585 million because it would probably be cheaper to develop their own site instead.

I don’t see any real upside for MOVE. The company is growing revenue, but extraordinary revenue growth is already baked into its price. Competitors like Zillow are already attracting more traffic, and the threat of entry by a larger company looms over the industry. MOVE is overpriced and falling behind in a competitive industry.

Avoid ETFs and Mutual Funds with MOVE

Investors should avoid Advisors’ Inner Circle Fund: Rice Hall James Micro Cap Portfolio (RHJSX) due to its 2.1% allocation to MOVE and Dangerous overall rating.

Sam McBride contributed to this article.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Photo credit: CeBIT Australia