Subscribers got access to this report one month early. You can get access to all our actionable reports before they are made available to the public, along with Most Attractive, Most Dangerous Stocks or Best & Worst ETFs & Mutual Funds newsletters for as little as $9.99/month.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Constellation Brands (STZ) is an international producer and marketer of over 100 brands of beer, wine, and liquor. The company’s well-known brands include Corona, Robert Mondavi, Modelo, and Svedka Vodka. Constellation has grown largely through acquisition, a strategy that has looked good on the surface, but is a sham when it comes to profits. Recent improvements in revenue and EPS serve as cover for a cash flow black hole. Since 2002, the company has paid over $6 in capital for every incremental dollar of revenue and paid $17 for every incremental dollar of profit. These trends are disturbing to anyone that cares about cash flow. Stir in some shady acquisition accounting, billions in debt, $726 million in hidden employee stock option liabilities, aggressive insider selling and it is hard to argue that anyone should own this stock. Accordingly, STZ makes our Most Dangerous stocks list for September.

Misleading Profitability Sets Investors Up For A Trap

Since 2002, Constellation’s management spent $12.4 billion to add just $2.0 billion of revenue and $721 million in after-tax profits. In 2014 alone, the company spent $6.6 billion while adding only $250 million in profits (NOPAT), which equates to a 4.6% return on capital far below the company’s weighted-average cost of capital (WACC).

Constellation’s costly acquisitions have caused the company’s debt load to balloon to $7.2 billion, or 43% of its market value. Some of the company’s biggest acquisitions include Hardy Wine in fiscal year 2004, Robert Mondavi in fiscal 2005, Vincor in 2007, Svedka Vodka in 2007, and Fortune Brands in 2008.

These acquisitions have propped up net income but have not increased cash flows. From 2009-2013, Constellation made no major acquisitions and its revenues declined, with the exception of 2013 which saw just 5% revenue growth. Constellation was unable to grow NOPAT at all over this period, with its profits in 2013 falling $1 million below their 2007 levels.

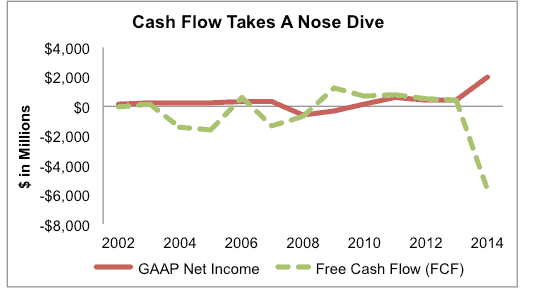

Figure 1 shows Constellation’s trouble generating cash flow — especially in 2014, when free cash flow was -$5.7 billion. Another trend to note is that Constellation’s no-acquisition period of 2009-2013 represents the only years in which the company was able to generate any kind of sustained positive cash flow.

Figure 1: Net Income Growth Is Misleading

Sources: New Constructs, LLC and company filings.

Constellation’s wine and spirits business, which makes up a little more than half its revenues, has grown sales only 5% compounded annually over the past two years, and sales decreased 1% year over year in fiscal 1Q15.

Beer, which makes up the other half of Constellation’s business, is the bright spot. Constellation entered the beer market for the first time with a $4.8 billion acquisition of Crown Imports in 2013. The company’s beer sales grew at 14% year over year in fiscal 1Q15, and it has 2 of the top 15 selling beers in the U.S. with its Corona and Modelo brands.

Shady Acquisition Accounting And Balance Sheet Red Flags

Constellation artificially boosted net income last year by including over $1.0 billion in non-operating and illusory gains from the acquisition of the remaining portion of Crown Imports. Essentially, Constellation paid a premium for the part of Crown that it did not already own and recorded the revaluation of its existing stake in Crown as income. This activity should be highly offensive to investors because it perversely take money out of shareholder pockets and uses it to artificially boost reported profits. Now you see why we do our homework and read footnotes when we analyze stocks.

There is another red flag that can only be found in the financial footnotes. Constellation’s large outstanding employee stock option liability is over $726 million, or more than 4% of STZ’s market cap.

Inferior ROIC Means Competitors Can Win On Price

Constellation competes with other beer, wine, and spirits producers and distributors. Its top competition in the United States consists of Anheuser-Busch InBev (BUD), Boston Beer Company (SAM), Brown Forman (BF.B), Craft Brew Alliance (BREW), and Molson Coors (TAP).

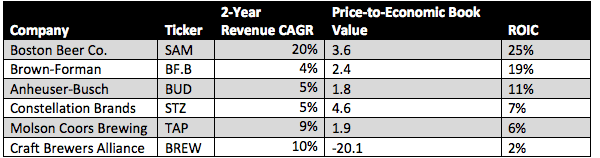

Figure 2 shows that Constellation lags its biggest competitors in terms of return on invested capital (ROIC), and that its revenue growth over the past few years lags the rest of the pack. Constellation’s revenue CAGR was computed by using net sales from its wine and spirits and Crown Imports segments, rather than its simple reported revenues, which exclude beer sales in 2012.

Figure 2: Constellation Underperforming and Overvalued

Sources: New Constructs, LLC and company filings.

Constellation’s profit margins are in-line with its competition, but its ROIC is far behind spirits company Brown-Forman, macro brewer Anheuser-Busch and craft brewer Boston Beer Company. Its sales are also among the slowest growing in the table, ahead of only Brown-Forman, which has also been hit by slow wine and spirits sales.Sources: New Constructs, LLC and company filings.

Reports have surfaced that Anheuser-Busch is exploring financing options to buy the next-largest beer company, SABMiller. If this deal goes through, it would give Anheuser-Busch even more pricing power, pushing down Constellation’s margins in the commoditized macro-beer segment.

Market Is Fooled By Illusory Growth in EPS

One number that should jump out in Figure 2 is Constellation’s price-to-economic book value (PEBV) of 4.6, higher than the fastest-growing company on the list, Boston Beer. This high valuation is out of touch with the company’s growth and profitability. It appears Constellation’s valuation is based entirely on the optimism surrounding the company’s beer business while ignoring its stagnant wine business and huge debt burden.

To justify its current price of $88/share, STZ must grow NOPAT by 13% compounded annually for the next 12 years. This scenario optimistically assumes the company grows profits with a lot less capital than it has needed in the past.

If Constellation continues its balance sheet expansion at the same pace as the past 12 years, the company looks more overvalued. Under this scenario, if we give Constellation credit for 11% compounded annual NOPAT growth for 10 years, the company is worth $44/share. This scenario represents a 50% downside and is optimistic considering the company’s inability to grow profits at all over the last 6 years.

In terms of a catalyst, winter weather may slow Corona sales and lead to an earnings miss. Corona’s marketing is absolutely key to its success, and Constellation has been increasing its selling expenses accordingly ($119mm year over year in the most recent quarter). This dependence on marketing will keep margins and profits low especially when they have to compete with marketing giants like Budweiser and Miller. In addition, a growing American taste for craft beer (as evinced by the double-digit revenue CAGRs of Boston Beer and Craft Brewers Alliance in Figure 2) and younger Americans’ distaste for beer in general could cause Constellation’s beer sales to slow or decline. Either way, the stock is priced for the company to achieve dubiously high profit growth.

Anything less than meeting or beating expectations will likely cause the stock to fall hard.

Insider Transactions

In the last 12 months, insiders have bought 145,474 shares and sold 1,129,100 shares for a net of 983,626 shares sold. These net sales represent 75% of current insider ownership and 43% of insider ownership a year ago.

These startling figures are due to the fact that insiders own less than 1% of STZ shares, which has been caused by net insider selling of $194 million over the past 4 years. Company officers and other insiders have been dumping their shares regularly since 2010, and investors should follow their lead.

ETFs And Mutual Funds That Allocate To STZ

Investors should avoid the following ETFs and mutual funds, as they allocate heavily to STZ and a Dangerous or Very Dangerous rating:

- Greater Western New York Series Bullfinch Fund (BWNYX): Allocates 7.1% to STZ and earns a Dangerous rating

- Wells Fargo Advantage Endeavor Select Fund (STAEX, WECBX): Allocates 4.2% to STZ and earns a Dangerous rating

André Rouillard contributed to this report.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Photo: Kyle May (Flickr)