Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Regulators are cracking down on the financial sector. As they dole out punishments that fit the crimes, regulators are finally closing many of the illegal trading loopholes that have driven so much of Wall Street profits over the past decade. A side-effect of these changes is that investors are beginning to abandon the crowded momentum trading strategies to which they’ve grown so accustomed and return to good old-fashioned value investing.

Enhanced Regulatory Enforcement

Last week, the Department of Justice reached a landmark settlement with JPMorgan Chase (JPM) that results in the bank paying $13 billion for wrongdoing and misrepresentation before and during the financial crisis. More importantly, JPM admitted guilt, which may open it up to more class action lawsuits and fines.

Both the scale of the fine and the admission of wrongdoing would have been inconceivable just a few years ago. In 2010, Goldman Sachs (GS) received a penalty of only $550 million for similar charges, and it escaped without admitting or denying the allegations. In 2011, Citigroup (C) was set to settle with the SEC for only $285 million and no admission of wrongdoing until a federal judge rejected the deal.

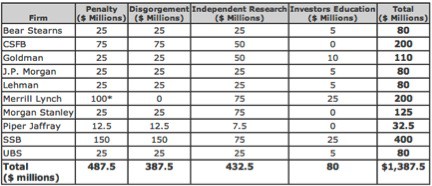

The size of the JPM settlement would have been shocking a decade ago. For comparison, JPM’s $13 billion settlement is significantly larger than the post-tech-bubble fines paid by all financial sector firms from 2001-2003. It is nearly ten times larger than $1.4 billion fine given the ten largest broker-dealers for the Global Settlement reached in 2003. This Global Research Settlement fine is relatively minuscule despite the fact that the SEC had evidence of senior analysts at the offending banks fraudulently boosting stock ratings.

Figure 1: Global Research Settlement Fines Breakdown

Clearly, regulators are reacting more forcefully to the financial crisis of 2008 than they did to the dotcom bubble. This crackdown is not restricted to those dealing in mortgage-backed securities either. Earlier this month, the hedge fund SAC Capital agreed to plead guilty to insider trading charges and pay $1.8 billion in penalties. SAC was the first Wall Street company to plead guilty to financial wrong-doing charges since the 1980’s, and now some of its individual employees are on trial.

Combined with the conviction and prison sentence of former hedge fund manager Raj Rajaratnam for insider trading, these fines and admissions of guilt send a clear message. Wall Street traders and investment bankers face more scrutiny and harsher enforcement than ever before.

What Does This Mean For the Market?

For one thing, it means less trading. SAC Capital alone often made up around 3% of the average daily trading on the NYSE. The restriction of inside information, legal or not, has diminished trading volume in several areas of the market. When Thomson Reuters stopped selling early access to the University of Michigan Consumer Sentiment survey to high frequency traders, the pre-market volume in the S&P 500 Index ETF (SPY) dropped from 200,000 shares in a 10-millisecond window to 400 shares.

Harsher enforcement also means less cash available for these large firms to use for trading. JPM is holding $23 billion in reserves for potential litigation expenses and spent more on legal expenses in 3Q13 than any other expense item. Bloomberg recently reported that the six biggest U.S. banks have piled up $103 billion in legal costs since the financial crisis.

More enforcement also means less market manipulation. A recent Bloomberg article revealed that the Justice Department is investigating JPMorgan and several other large banks for potentially manipulating global foreign exchange markets. Regulators are taking an interest in an instant messaging group between analysts at JPM, Citigroup, RBS, and Barclays that was brazenly referred to as ‘The Cartel’. Those four banks accounted for more than 40% of the trading in the foreign exchange market. If their ability to influence price movements gets taken away, the volume of trading would likely decrease. Earlier this year, JPM agreed to pay $410 million to settle accusations of illegal activity in California electricity markets. That settlement is the largest ever reached with the Federal Energy Regulatory Commission since it received new powers in the wake of the Enron Corp. fiasco.

High Volume Momentum Stocks Suffer

As regulators close the loopholes that allowed for these illegal activities, many others (besides those being fined and prosecuted) will suffer.

For one, momentum investors who piggybacked institutional trading trends to bag quick profits on high volume run-ups will be out of luck. These high-flying momentum stocks present long-term risks that have been routinely ignored over the last decade by investors who have become addicted to the illusion of quick and easy profits. As the trading volume from the Wall Street players dries up, a lot of the hot air in momentum stocks will disappear. Rapid upward price movements will be less frequent while many high-flying stocks drop to earth.

For examples of large investment firms propping up stock prices and fueling large moves, see my recent Danger Zone articles on InnerWorkings (INWK) and Tangoe (TNGO). Both stocks had heavy institutional ownership and rapid upward price moves driven by Wall Street propaganda and momentum traders. Soon after we revealed how disconnected the price moves were from the companies’ fundamentals the stocks fell 30+%.

Big broker-dealers, even the divisions not under investigation, will suffer as well. Many of these companies’ activities, like equity research, were tied to and subsidized by the outsized profits from illegal activities. As those funds dry up, so do the businesses that relied on them.

Declining trading volume also hurts revenues. High volume traders are lucrative clients for these brokers, and they won’t like losing them. Even after SAC plead guilty, Bank of America (BAC), JPM, and GS continued to do business with the hedge fund. They need to keep that business to keep profits up.

Smaller trading firms could suffer as well. E*TRADE (ETFC) and Scottrade depend heavily on commissions and transaction fees for their revenue streams. ETFC swung to a loss in 2012 due, at least in part, to an 11% decrease in commissions and fees due to declining trading activity.

Return to Value Investing

Momentum strategies have become increasingly crowded in recent years, but that trend is on a decline. Closing the loopholes for illegal trading and market manipulation means the big hedge funds and banks have less means to stoke the volume for momentum trades. Recent results from E*TRADE show that individual investors are trading less frequently.

As it becomes harder for institutional investors to beat the market illegally, it will become harder for individual investors to profit from piggybacking off those trades. When this happens, investors large and small will need to find another way to generate returns.

I see a return to value investing coming for the market. We know from Warren Buffet and others that, when done right, value investing can deliver large returns. Though not as sexy as momentum trading, value investing brings peace of mind and long-term trust in one’s decisions. Given all the turmoil and treachery we have seen in the markets, I think investors are ready for some peace of mind and will look increasingly to advisors and strategies they can trust.

Sam McBride contributed to this article.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.