Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

The only justification for mutual funds to have higher fees than ETFs is “active” management that leads to out-performance. How can you outperform if you do not have meaningfully different holdings than your ETF benchmark? This week, Saratoga Advantage Trust: Financial Services Portfolio (SFPAX, SFPCX, SFPIX) funds are in the Danger Zone due to charging egregiously high fees while closet indexing.

Closet Indexing Makes Outperformance Unlikely

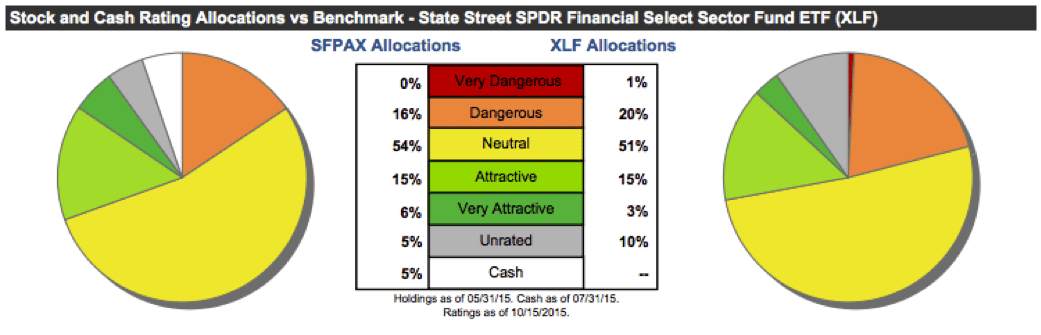

Saratoga Financials Services Portfolio’s asset allocation nearly mirrors its benchmark and borders on closet indexing, which makes outperformance unlikely. Of Saratoga Financial Services Portfolio’s top 10 holdings, nine are the same as XLF. Those nine stocks represent 40% of Saratoga’s assets. Figure 1 has more details on the similarity of the portfolios. The take away is that they are very similar. How can one expect outperformance when you hold mostly the same stocks?

Figure 1: Saratoga Financial Services Portfolio Asset Allocation

Sources: New Constructs, LLC and company filings

The Most Expensive Fund Under Coverage

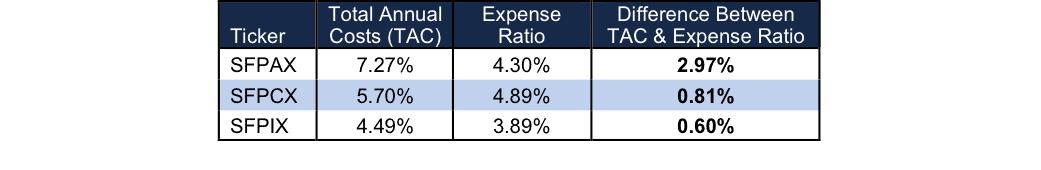

With total annual costs (TAC) of 7.27%, SFPAX is the most expensive fund out of the 834 sector ETFs and mutual funds under coverage. SFPCX (TAC of 5.70%) and SFPIX (TAC of 4.49%) also rank within the top 25 most expensive sector funds. Further details can be seen in Figure 2. For comparison, the benchmark State Street SPDR Financial Select Sector (XLF) charges total annual costs of 0.17%.

Figure 2: Saratoga Financial Services’ Understated Costs

Sources: New Constructs, LLC and company filings.

Over a 10-year holding period, the 2.97 percentage point difference between SFPAX’s TAC and its reported expense ratio results in 34% less capital in investors’ pockets.

To justify its higher fees, the fund must outperform its benchmark by the following over three years:

- SFPAX must outperform by 7.1% annually.

- SFPCX must outperform by 5.52% annually.

- SFPIX must outperform by 4.32% annually.

The Importance of Proper Due Diligence

One thing we’ve learned while analyzing tens of thousands of company filings over the past twenty years is never underestimate how wild or bad disclosures may be. As soon as you say, “there’s no way a company would do that”…we find a company that has done that. The same is true for mutual funds. Who would imagine that a fund would copy an ETF and try to charge so much more? Fortunately, it appears few investors are falling for this trick, as the fund’s AUM is under $5 million.

Without proper analysis of fund holdings, investors might be overpaying or disappointed with performance.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Paul Downey (Flickr)