Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Wayfair is one of the world’s largest online retailers dedicated to home décor and products. The company sells furniture, kitchenware, bed and bath products, and other housewares. The company has developed proprietary technology that mostly eliminates the need for inventory and allows it to ship orders directly from its suppliers.

Wayfair went public in October for $29/share in an IPO that was largely overshadowed by the Alibaba (BABA) IPO. Shares are currently at $31, but we think that little more than speculation is propping up this company’s crazy valuation.

Why Wayfair?

Wayfair’s situation reminds us of Box (BOX) in many ways. We put BOX in the Danger Zone several weeks ago for a few reasons. First, the company was entering into a highly competitive space with established leaders. Second, the company was nowhere close to being profitable, and burning through cash at an alarming rate. The third reason was the company’s valuation. BOX is down 17% since our call in January, and we’re seeing many of the same warnings signs in Wayfair.

Wayfair’s revenue growth is impressive, especially for a retail business. The company generated 52% sales growth in 2013, which slowed to 44% growth in 2014. However, big issues lie under the surface of this high growth company. .

While we expect businesses like Wayfair to burn a little more money in pursuit of such high growth rates, Wayfair’s losses are alarming. The company’s net operating profit after tax (NOPAT) declined from -$14 million in 2013 to -$143 million in 2014. These increasing losses caused Wayfair’s return on invested capital (ROIC) to fall from -24% in 2013 to -76% in 2014.

What does this mean? That number means that for every dollar invested into Wayfair’s business, the company destroyed an additional 76 cents. All told, -$452 million in free cash flow left Wayfair’s business in 2014. We’re also worried about where all of that money is going. Wayfair was founded (in its original iteration) in 2002, yet the company is still spending 21% of its revenues on marketing. Overstock.com (OSTK) was spending a similar level of its sales on marketing until around 2006-2007, when it started to reduce this level of spending to around 10% of sales. What happened? Revenue growth fell from 63% per year in 2005 to -3% in 2007.

Why Wayfair’s “Special Sauce” Doesn’t Matter

Wayfair is using two points of differentiation to sell itself to investors.

The first is the company’s somewhat unique fulfillment model. Wayfair maintains little to no inventory and ships its products directly from suppliers. The company also receives payment upon shipping, but only pays its suppliers 30 days after the order. This isn’t so unique as Wayfair is making it out be, and is actually called a “negative working capital” model.

This model was made well known by companies like Dell and Overstock.com. Overstock hasn’t really gone anywhere since 2006, so we’re not really sure why this would convince investors that Wayfair is any different.

The second point of differentiation is the company’s social marketing strategy. A quick glance at the company’s front page yields a view of initiatives like “color of the month” and “shop the look.” The company’s Joss & Main brand is a member-only “discovery site” that has “exclusive private” 3-day flash sales on individual items showcasing “distinctive designs and trends” guided by “noted influencers from the interior design community.” Wayfair has also seen noted success in its social media initiatives, especially on Pinterest.

There’s an attempt to create a community here, but due to the lack of data on repeat customers in the company’s annual report, it’s impossible to say if this strategy is working. One competitor, Zulily (ZU), sells clothing and baby products to expectant or current mothers and operates in a similarly niche space and uses social media advertising to similar effect. When this company’s strategy failed to help the company deliver on promised growth, the company’s stock tanked and is now down 73% in the past year.

The Next Amazon?

Wayfair will need to compete with not only Overstock and Zulily, but also the 800-pound gorilla in the room: Amazon (AMZN).

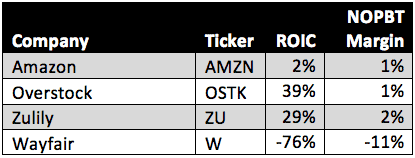

Figure 1 shows how Wayfair stacks up against its closest competitors in terms of ROIC and before-tax operating (NOPBT) margins.

Figure 1: No True Competitor

Sources: New Constructs, LLC and company filings.

There are a couple of takeaways here. Note the extremely low margins across the board — no other online retailer can manage margins above 2%. Online retail is highly competitive and Wayfair investors can expect low-single digit margins if the company ever becomes profitable. In addition, Wayfair has some of the lowest returns on capital in the business. Even the flagging Overstock.com can manage to generate a 39% ROIC.

We’re also not sure where Wayfair expects to distinguish itself in this space. It’s extremely easy to go on Wayfair, find an item, and find the exact same item offered at a lower price with free shipping on Amazon. In addition, while shipping at Wayfair takes around three days to start and a week to deliver due to the company’s “unique” fulfillment model, Amazon will ship your item in two days flat — guaranteed. Wayfair even admits in its filing on page 13 that its competitors have superior shipping terms.

While companies like Amazon and Overstock sell a wide range of goods, it remains to be seen if buying furniture online will take off either. Wayfair sells smaller items as well, but a large portion of the company’s products includes things like tables and headboards. If consumers have to wait and pay for shipping on these large items, how likely will they be to take a chance on a $1,500 dining set that they’ve never seen in person?

This Adjustments is Part of Why Wayfair Gets Our “Very Dangerous” Rating

While Wayfair has no reported debt, you should be aware of the company’s $105 million in off-balance sheet debt due to operating leases (4% of market value).

Wayfair is Priced for Perfection

To justify its current valuation of $34/share, Wayfair must immediately become profitable and achieve 4% pre-tax margins. It must then grow revenues by 26% compounded annually for the next nine years. This doesn’t seem likely to happen based on the company’s deteriorating financials or when considering how similar companies have fared.

If Wayfair can grow revenue by a still-remarkable 20% compounded annually for the next 10 years and somehow achieve industry-leading pre-tax margins of 3%, the stock is worth only $17/share — a 50% downside. And even this scenario is on the optimistic side.

Weak Bull Case

The case for Wayfair’s stock is pretty one-dimensional and rests entirely on the company continuing to deliver on its revenue growth. If the company’s growth slows, what do investors have left to prop up their investment theses?

Wall Street has also been pumping this stock since the company’s IPO, including the company’s IPO banks. Out of 11 banks covering the stock, there are eight with a buy — including some of the underwriters of course and only three with a hold.

Several Likely Catalysts

Wayfair’s sales growth will inevitably slow, and if this surprises investors, the stock will drop. In addition, investors will soon wake up to the company’s unsustainable marketing spending. If investors don’t sell when they tire of the spending, they will almost certainly sell when a reduction in marketing spending leads to declining sales like it did with Overstock.com. There’s also the possibility that there really isn’t a large market for selling furniture online, and Wayfair’s stock will fall to reflect these reduced growth opportunities.

Finally, the company’s IPO lockup expires on March 31, allowing large pre-IPO investors to sell their stakes. If any of these investors sell their stakes in the near future, other investors may panic and follow suit.

Little Stupid Money Risk

Wayfair is trading close to its enterprise value, so it’s possible the company could be bought out by the likes of Amazon, Walmart (WMT), or even Target (TGT). However, we’re not sure what value this would add to any of these businesses except for the elimination of competition. As a result, we don’t see a buyout likely, especially at these levels.

Insiders Have Already Sold

Since Wayfair’s IPO in early October, there has been $860,478 in stock bought and $117 million sold by insiders for a net of $116 million sold. This selling consists mainly of venture funds cashing in on their gains a few days after the IPO.

Extremely High Short Interest

Short interest stands at 8.3 million shares, or 76% of float. A short squeeze is possible with short interest like this, so we can’t recommend shorting this stock in good faith.

Dangerous Funds That Hold W

No funds allocate heavily to W and earn our Dangerous or worse rating.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Photo credit: Rahims (Flickr)

1 Response to "This Stock is Another Sign We’re in a Tech Bubble"

Wayfair down 15% as losses widen after quarterly earnings release