As if Wall Street needed another way to hide the truth from investors. As if payment for order flow was not unfair enough to Mainstreet investors… Now, we have dark pools taking over.

This week, Bloomberg reported:

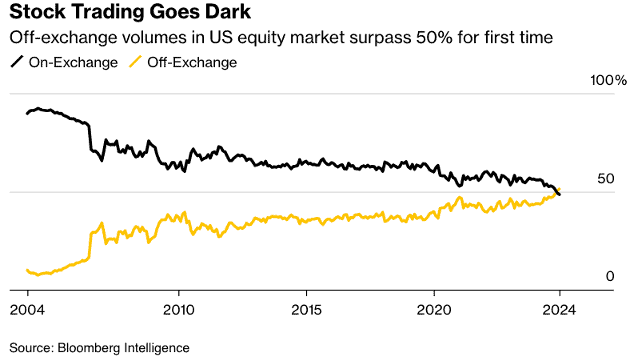

“For the first time on record, the majority of all trading in US stocks is now consistently occurring outside the country’s exchanges,” and …

“…it will be the fifth monthly record in a row, and the third month running that hidden trades make up more than half of all volume.”

This shift means that we can no longer trust the pricing on the public exchanges. In other words, the price of the stock that we regular folk see might not be the true price of the stock.

If you’re new to New Constructs, you’re going to learn quickly that we stand for the opposite of dark pools and misinformation. We’re here to help investors in this crazy time, and I show you exactly what you can and cannot trust in our latest training: Unveiling a Trust-Based Rating System for Smarter Investing.

One of the sad truths about Wall Street is that they are out to make money for themselves not you.

“Using those [dark pool] venues helps institutional investors limit information leaking to the market and adversely affecting prices.” Source: Bloomberg.

That’s another way of saying that institutional investors want to hide the truth about the value of stocks so they can make more money.

Figure 1: On Vs. Off-Exchange Volume U.S. Equity Market: 2004-2024

We put our money where our mouth is by providing free research and training. We want you to see how hard we work so we can earn your trust. How many other firms can say that?

We hope you enjoy this research. Feel free to share with friends and colleagues!

This article was originally published on January 27, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.