Growth without profit (i.e. value) offers no investment merit. Conversely, value without growth offers little upside incentive for investing in any business. New Constructs’ methodology and tools encourage investors to incorporate an assessment of both the growth and value of businesses into their investment decision-making process. Figure 1 below clearly shows that there is no such thing as economic profit growth without value creation. Growth without value leads to an economic and investment dead-end. Value creation without growth means there is no economic earnings growth and the company is unable to extend its Growth Appreciation Period (GAP). Investors must evaluate both the profitability (Economic Earnings Margin) and growth (Revenue CAGR) of businesses in order to make informed investment decisions.

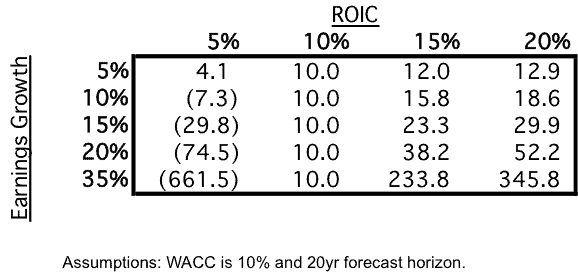

Figure 1: P/E Ratios That Result From ROIC and Earnings Growth Forecasts

Return on Invested Capital Is the Critical Driver of Value

In Figure 1 above, we use our discounted cash flow framework to show how ROIC is the key valuation driver as measured by a Price to Earnings (P/E) multiple. The results from the 20 different Earnings Growth and ROIC forecasts show that a company must achieve ROIC greater than WACC (set to 10%) for growth to contribute to the value of a business. Growth has no impact on value if the business’ ROIC is equal to its WACC. Growing a business that earns a ROIC below WACC increases the rate of value destruction.

When ROIC equals 10%, the same as WACC in Figure 1, the value of the business does not change no matter how much the company grows. This result stems from the fact that a business with ROIC equal to WACC neither creates nor destroys value. Growth from companies not earning ROIC above their WACC destroy value. The faster a business with ROIC less than WACC grows, the more value it destroys resulting in a lower, eventually negative, P/E multiple. Looking toward the right side of the chart reveals that a company with high revenue growth and ROIC above WACC can be very valuable.

Key Takeaways

1. P/E multiples are a results of value creation/destruction – not a determinant.

2. Investors must understand that the economics of a business are more important than measuring a company’s growth.