Our CEO, David Trainer, recently published a new paper, Distribution is Not Enough, on the rise in importance of proprietary data and analytics technologies for the modern investing market.

Co-authors of the paper Evan Schnidman, founder of EAS Innovation Consulting, and Jeremy Baksht, CoFounder and General Partner at DataFrame Ventures, are highly respected experts on data and analytics in the investing business.

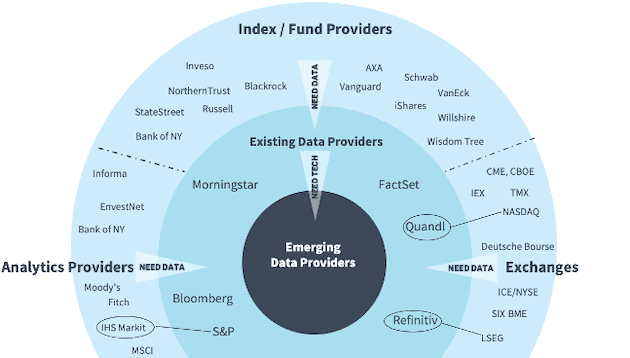

One of the most important points of the paper is that the disproportionately higher number of potential data buyers compared to data sellers, especially for fundamental data, will create a land grab for data assets and technologies that can produce proprietary data assets.

After years of consolidation in search of ever greater scale, investment firms must now focus on differentiating their offerings. Mutual funds and ETFs are fully commoditized as evidenced by the collapse in fees and shift of AUM from active to passive.

To attract AUM in the modern investing market, firms will have to offer investors unique insights, possible only from proprietary data, advanced analytics, or some combination of the two.

Figure 1: Landscape for Data Buyers and Data Sellers

Sources: New Constructs, LLC.

This article originally published on March 11, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

1 Response to "Distribution Is Not Enough: New Sources of Investment Insight Will Reshape Modern Investing"

I hope this comment makes it to Mr. Trainer. It is in regards to his article on Coinbase that I read on MarketWatch.

I see he answered the few comments on his article, so that proves HE DOES CARE! lol

Totally enjoyed the undressing of this Coinbase (COIN) mirage. And it is a mirage. It is an awesome exit strategy for management and VC. This has to be the biggest short opportunity in the history of the capital markets.

My partner and I run a small Crypto mining and investment firm, Electrum Capital LLC. We have used Coinbase since 2018 and we HATE ( HATE , HATE , HATE!!! ) this brokerage. They cannot even provide dual logins to the same corporate account for my partner and I. It is to bloody expensive, has poor overall technology for a 1B$ company, let alone for a soon to be 100B company. They cant even provide basic monthly account statements which increases our stress levels a few times a year. The crap that passes for an “account statement” is insulting.

Being one of the first and only SEC -USA regulated crypto brokerages in the world, it has been able to get away with charging exorbitantly excessive fees while being the only show in town. Fraud was rife in the dawn of crypto so the aura of legality and regulation has helped them immensely. I for one cannot wait until there is more competition and a race to the bottom for trading fees. I am sure there are hundreds of thousands of us that will move and leave Coinbase for dead when a safe competitor is created. We are giving Kraken a go, finally… I dont think they allowed corp accounts back when we set up Coinbase.

Spot on article Mr. Trainer. Had to laugh at a few of the Coinbase defenders. I am sure they were related to CoinBase in some capacity and are holding on for dear life for 48 more hours until they cash out.

I must say I Never heard of New Constructs until now. We are purely crypto movers and shakers and there really is no fundamental analysis in this space…yet! I spent an hour on your site poking around just now. OMG I Love your fundamental analysis and the way you recommend stocks, sectors, etf’s, etc. It makes me want to be a stock investor just so I can use your advise!

I really hope you guys figure out a way to analyze and recommend crypto companies in some capacity. I would be the first customer.

Mr Trainer, I don’t know if this note will even make it to you so I will wrap this up now. Reading your COIN article made my evening. Thank you again for giving a voice to the Coinbase-abused–I look forward to see how this IPO plays out in coming months and year– although we already know the answer, don’t we… ?