Did you know the S&P 500’s Shiller P/E is over 37 and approaching all-time highs? The Shiller Price-to-earnings ratio, also known as the CAPE Ratio, has only been as high as it is today a few times. And, when it gets this high, the S&P 500’s track record is not good.

Adding to the intrigue, this week brings the grand finale of earnings releases with NVIDIA reporting on Wednesday. Will results send the market running higher?

We live in interesting times, for sure. If Jake Paul can go toe-to-toe with Mike Tyson for eight rounds, maybe anything is possible?

On the other hand, investors may be exhausted from all the hype and could turn their attention to how expensive stocks and the overall market are. It’s certainly not all roses across the market. Sprit Airlines filed for bankruptcy, and key market indices seem to be struggling to hit new highs.

I think most investors would agree that the market is due to take a breather soon. How soon, exactly, is hard to tell, but the market cannot keep going up when earnings are not keeping up.

To that end, this week’s Danger Zone pick deserves your attention. In the last year, this stock is up 101%, but profits remain as elusive as ever, unless you trust the company’s “adjusted EBITDA” – which, of course, we do not.

The disconnect between fundamentals and this stock’s valuation is dangerously wide, and we feel the need to warn investors again. Despite improving “adjusted EBITDA”, we believe that the company cannot come close to meeting the future cash flow expectations baked into its inflated stock price.

What sort of downside could we see? Even if the company can double its 5-year average margin and grow revenue at consensus rates, the stock would be worth 90% less than the current stock price. The no-growth value of the business is -$11/share.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on the company’s:

- misleading “Adjusted EBITDA”,

- executive compensation focused on top-line growth, not shareholder value,

- auditor warning about lack of internal controls,

- being among the least profitable companies in its industry,

- continuing cash burn,

- a stock valuation that implies the company will grow profits to 3.1x Wendy’s TTM NOPAT.

What’s Working

The company’s system-wide sales, which include sales from locations owned and locations licensed to other operators, grew 13% year-over-year (YoY) in 3Q24. Sales from owned locations and licensing fees grew 15% and 7% YoY in 3Q24, respectively.

Further boosting the top-line, the company opened 39 new domestic company-operated locations and 33 new licensed locations over the last year.

Beyond the top-line growth numbers, the business fundamentals look far more unattractive.

What’s Not Working

The Company is Profitable – If You Just Remove Expenses

The company like many businesses, presents many different versions of profitability, all of which mask the unprofitability of the company.

For instance, the company reported “restaurant-level profit margin” increased from 19.9% through the first nine months of 2023 to 20.9% in the first nine months of 2024. However, restaurant-level profits remove expenses for corporate overhead, such as general and administrative, depreciation and amortization, pre-opening costs, impairments, loss on disposal of assets, and closures. In other words, the company’s restaurants are profitable, if you just remove the overhead of the corporation. Unfortunately, investors aren’t just buying the restaurant locations, but the entire company, which taken as a whole, generates negative economic earnings.

Additionally, if one just looked at GAAP, or worse, the company’s non-GAAP metric Adjusted EBITDA, the overall company looks much better than the real economics of the business show.

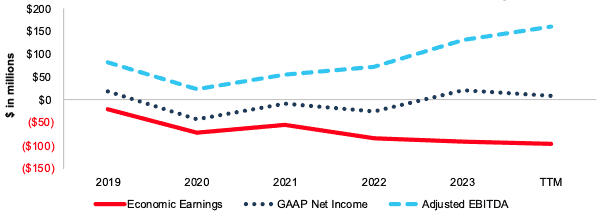

The company’s Adjusted EBITDA rose from $82 million in 2019 to $160 million over the TTM. Over the same time, GAAP net income fell from $20 million to $9 million, while economic earnings, the true cash flows of the business, fell from -$20 million to -$96 million over the same time.

It’s an immediate red flag whenever a company’s preferred profitability metric is rising while its economic earnings are declining.

Figure 2: GAAP Net Income vs. Economic Earnings vs. Adjusted EBITDA

Sources: New Constructs, LLC and company filings

Executive Compensation Ignores Shareholders

The company’s top-line and Adjusted EBITDA growth, at the expense of economic earnings, should come as no surprise because the company’s Board of Directors ties both short and long-term performance executive compensation to total revenue and Adjusted EBITDA goals. Adjusted EBITDA, a flawed and easily manipulated metric, allows management to get big payouts while economic earnings suffer.

Incentivizing top-line growth and Adjusted EBITDA while ignoring real expenses and the balance sheet is rarely a positive for shareholders, as shown by the negative and declining economic earnings in Figure 2.

Instead of incentivizing executives with Adjusted EBITDA and revenue goals, we’d prefer the Compensation Committee tie executive compensation to return on invested capital (ROIC) improvement, which is directly correlated with creating shareholder value.

Can We Trust the Financials?

Investors should take the reported numbers with a grain of salt because the company’s auditor noted in the 2023 10-K that the company “has not maintained effective internal control over financial reporting.” This opinion came just days after the company filed a notification of late filing with the SEC, in regard to its 2023 10-K. In preparing the filing, the company identified issues with the handling of deferred tax assets and had to restate financials for the 2022 and 2021 periods.

In the company’s 3Q24 10-Q, management further notes that as of September 25, 2024, “disclosure controls and procedures were not effective due to the existence of the material weakness in our internal control over financial reporting.”

Specifically, the company identified issues with “the calculation of state deferred taxes and the related income tax expense (benefit).”

The fact that this weakness exists increases the risk that the company’s financials are fraudulent and/or misleading. It could result in future restatements as well as a big hit to the stock price.

This issue should ring familiar, because a very similar warning and a delayed filing happened with Super Micro Computer (SMCI) back in August of this year.

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.