We joined TDA Network’s Morning Trade Live on Wednesday, November 27 to show how Wall Street and companies use earnings distortion to fool investors.

Over the trailing twelve months, GAAP earnings fell 1% while adjusted core earnings fell 6%[1]. Most investors know that GAAP earnings are prone to distortion because they include lots of non-recurring or unusual items. Most investors are not aware that the core earnings (from CompuStat or Wall Street analysts) are also distorted by unusual items. In fact, earnings for the S&P 500 were distorted by 22% on average in 2018.

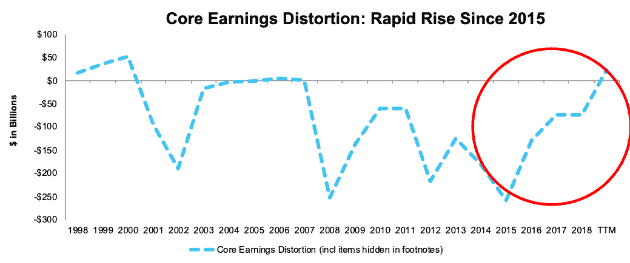

Figure 1: Core Earnings Distortion[2]: Worst Since 2000

Sources: New Constructs, LLC and company filings.

The rapid rise in earnings distortion since 2015 means that an increasing amount of corporate income is coming from unusual or one-time gains, which is not apparent to investors analyzing press releases or income statements. Corporate managers hide the one-time nature of these gains by only disclosing them in the fine print. In other words, managers are dressing up the numbers in an increasingly aggressive manner over the last few years.

Notably, earnings distortion is now positive for the first time since 2007, and the highest it’s been since 2000. Soon after earnings distortion broke into positive territory, in 2006-07 and 1998-2000, the market crashed.

This article originally published on November 27, 2019.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] This analysis is based on the top 1,000 companies by market cap in each measurement period.

[2] This analysis is based on the top 1,000 companies by market cap in each measurement period.