Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a common financial metric used to measure the cash operating profits of a business. EBITDA is popular because it is simple to understand and calculate, but it has many flaws and can mislead investors. It ignores real costs of running and growing businesses, the impact of differing tax rates, and important distinctions between business models.

How to Calculate EBITDA

The formula to calculate EBITDA is below:

+ Depreciation and Amortization

= EBITDA

The problems with EBITDA stem from its starting point, Net Income, which fails to capture the true profitability of a firm. EBITDA then ignores the real cost of capital needed to maintain a business through its removal of depreciation and amortization. In the words of Warren Buffett:

“I’ll look at that figure when you tell me you’ll make all of the future capital expenditures for me.”

Different companies also consistently pay different tax rates, so excluding taxes from EBITDA can mislead investors.

Companies also use Adjusted EBITDA, a non-GAAP metric that excludes additional expenses such as stock-base compensation, litigation expenses, and anything else that a company considers non-recurring.

How EBITDA Misleads Investors: ADT (ADT)

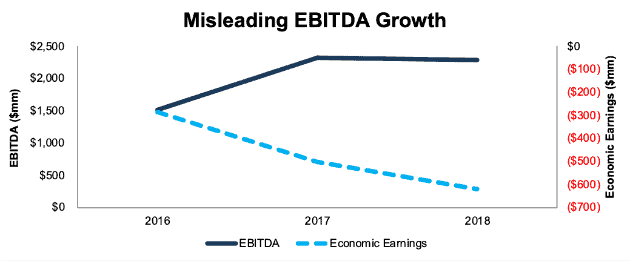

ADT is a great example of how depreciation and amortization represent real expenses. From 2016 to 2018, ADT’s EBITDA grew from $1.5 billion to $2.3 billion, a 50% increase. However, as Figure 1 shows, ADT’s economic earnings – the real cash flows of the business – were negative and declining.

Figure 1: ADT Economic Earnings vs. EBITDA: 2016-2018

Sources: New Constructs, LLC and company filings.

ADT’s EBITDA growth was fueled by depreciation & amortization (“D&A”) rising from $1.2 billion in 2016 to $1.9 billion in 2018. As the company excluded more D&A, its EBITDA rose. However, ADT’s capex increased by a similar amount, from $1 billion in 2016 to $1.8 billion in 2018.

The company’s growing EBITDA didn’t translate into value for shareholders because so much of its EBITDA was plowed back in to the business and lost to shareholders. Further, ADT didn’t generate enough free cash flow to cover its ~$700 million in annual interest expense.

In addition, the tax benefit from the deductibility of ADT’s large interest expense was more than offset by significant non-deductible expenses that resulted in an above average tax rate. We calculated ADT’s cash tax rate to be 31% in 2018, compared to an average of 25% for the market as a whole.

ADT priced its IPO at $14/share in January of 2018. Despite its rising EBITDA, the stock fell to just $7/share over the following year. This poor market reaction shows that economic earnings – not EBITDA – drive valuation.

A Better Version of EBITDA

If investors do want to use EBITDA, they should use a version that fixes the accounting loopholes impacting net income. That’s why we offer Adjusted EBITDA as part of our enhanced value screens. See the formula below:

Total Operating Revenue

+ Total Operating Income

- Total Operating Expense

- Total Net Non-Operating Expense Hidden in Operating Earnings

- ESO Expense (Employee Stock Options)

+ Goodwill Amortization

+ Depreciation and Amortization (Cash Flow)

= Adjusted EBITDA/EBTDA

Adjusted EBITDA/EBITA is a more accurate and comparable calculation of companies’ pre-tax cash earnings.

This article originally published on October 1, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.