Gotta love Tesla investors. The company beats a beaten down deliveries number, and the market treats it like a huge success, a big win. Meanwhile, deliveries are down 4.8% versus the same quarter last year. That’s not as bad as the prior quarter when deliveries sank 8.5% year over year.

I think my readers will get a kick out of my interview with BNN Bloomberg about Tesla last Monday. The hostess used all the same tricks that other bulls have used:

- They beat the number… isn’t that a good thing?

- The stock is up so this must be good news.

- Why do you think fundamentals matter?

- The stock is up a lot in the last month; so how can you say everything is not going great?

- Why would valuation matter? Why should we care about valuation?

I think I do a good job of refuting each one. You tell me.

Figure 1: My July 2 Interview with BNN Bloomberg on Tesla

Sources: Tesla is one of the most overvalued stocks: New Constructs CEO

The part of all this Tesla hubbub last week that bothers me most is the fact that the stock rallies after beating what was a significantly reduced delivery estimate…in other words, a fake number.

From Chat GPT:

“Between April 15 and June 30, 2024, analysts significantly revised their estimates for Tesla’s vehicle deliveries. Initially, the Wall Street consensus was around 470,000 deliveries for Q1 2024. However, as the quarter progressed and more data became available, estimates were consistently downgraded. By the end of June, the consensus estimate had fallen to approximately 431,000 deliveries (Electrek) (Electrek).”

As you probably know the actual delivered came in at 443,956 vehicles, which is 6% below the analysts estimates in April. In other words, at the beginning of the 2nd quarter, analysts estimated that Tesla would deliver far more vehicles than they actually delivered. But, in the last few months, they lowered and lowered their estimates to a level that the company could beat. And, the stock jumps on a delivery beat, when in reality the deliveries are much lower than originally expected and 4.8% lower than last year.

This reminds me of what I saw back when I worked on Wall Street during the tech bubble. Among the many unsettling practices I saw back then, the worst was the two sets of earnings estimates that the top technology sector analysts told me they used to help the stocks they like beat their numbers. The context here is important. I was meeting with the co-heads of research for Credit-Suisse’s technology equity research group. I was trying to get them to use my Value Dynamics Framework model that nearly all the analysts at Credit Suisse, who were not in the technology group, were using. These guys gave me all the normal excuses, which I refuted politely. Then, they finally gave up the real reason they could not use my model, and I learned how Wall Street analysts use fake numbers to fool main street investors. Here’s how that part of the conversation went 28 years ago:

Co-heads of research: “David – if we use your model, then people will realize our estimates are way too low and the stock will look too expensive.

Me: “what do you mean, are these stocks for which you have a ‘Buy’ rating? If so, then why would you have a ‘Buy’ rating on companies that you think will have such low earnings.”

Co-heads of research: “Oh come on, you know how it works. Stocks go up when they beat the number. So, for the stocks we like, we publish extra low estimates so they can more easily beat the number.”

Me: “Ok, I did not know that. Do you publish extra high estimates for stocks for which you do not have a ‘Buy’ rating so it is harder for them to beat the number?”

Co-heads of research: “Yes.”

Me: “I think I understand. The issue is that if you use your published estimates in our reverse DCF model, the valuation of the stock will look opposite of what your rating on the stock implies. Buy-rated stocks will look expensive. Hold or Sell-rated stocks will look expensive. Correct?”

Co-heads of research: “Yes.”

Me: “ok, so then how do you come up with target prices for your Buy-rated stocks with such low earnings estimates?”

Co-heads of research: “oh, we have a different set of estimates that we use for target prices and talking with clients.”

Me: “ok. I think I understand. You want to keep the higher estimates that you use to value the stock a secret while using the lower estimates to help the stock go up by keeping the consensus estimates lower. Correct?”

Co-heads of research: “Yes.”

The meeting ended shortly thereafter. When I shared the contents of that meeting with my mentor at the time, he immediately kicked me out of his office and told me to meet with his boss, the Global Head of Equity Research. I did not realize at the time that the methods that the Co-heads of research shared were likely highly illegal. My mentor wanted nothing to do with that…I think he feared that just knowing that earnings estimates manipulation was going on could implicate him.

Getting back to Tesla… after that story, you can see why I object to the idea that Tesla beat any number. I believe the deliveries estimates were purposely lowered by the bullish Wall Street analysts to engineer a “beat.” There’s no reason the stock should rise on the deliveries news.

For that matter, there is no fundamental reason that I can see that the stock should rise at all. Clearly, the automobile division of Tesla is in decline. I’m not talking about decelerating growth, we are talking about negative growth. The revenues and deliveries are shrinking. This is a broken growth stock story. Don’t forget that auto and auto related revenues accounted for 94% of total revenues in 2023. Auto revenues were lower at 89% of revenue for Q1 2024, but that’s because they fell while energy related revenues were up just slightly. Addition by subtraction.

As I point out in the interview, the valuation of the stock rests entirely now on AI. Whether that AI comes in the form of the Optimus robot, full self driving, solar panels, batteries or maybe something new that Musk pulls out of his hat at Tesla AI day on August 8th.

But, then again, does valuation matter at all for Tesla. When will it matter? We’ve written 25 reports on Tesla, and we’ve been right for over a decade about how the auto business would eventually struggle. We’ve shown how ridiculous the expectations implied by the stock price have been for years.

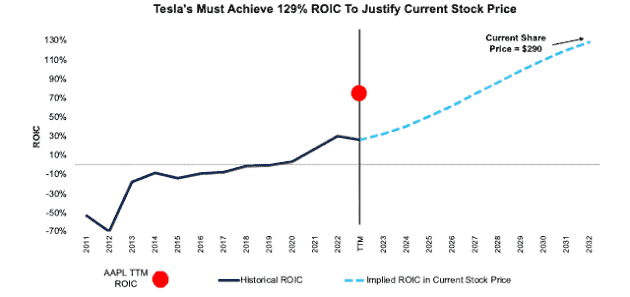

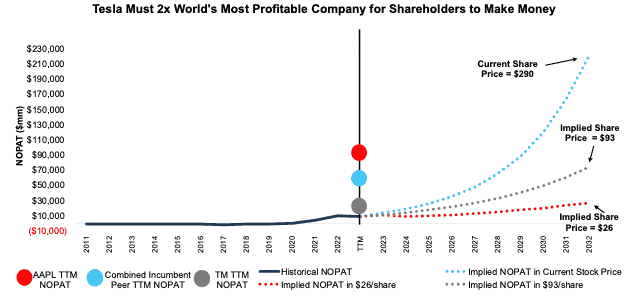

Below are a couple charts from our most recent report.

Figure 2: Tesla’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Figure 3: Tesla’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

People often ask me: “why do you insist on being negative on Tesla…it’s such a great company..?” And, I answer that “I agree it might be a great company, and I think the cars are great. The problem is with the stock’s valuation. It implies ridiculously high vehicle sales, ROIC and profits.”

Most of the time, like the anchor in my BNN Bloomberg interview, people reply with “but why do you think valuation matters?”

And, I answer them like I answer her: “Valuation may not matter now, but it will someday. And, when it does, the stock has a lot of downside.”

Don’t get me wrong…sometimes I imagine how nice it would be to jump on the Tesla bandwagon and, maybe even, make a ton of money in the stock. But, then, I remember why I am in this business. It is not to encourage speculating or make a ton of money speculating. It is to improve the integrity of the capital markets. So, on principle, I cannot ever advocate for a stock that I do not really believe in.

A year or so after my infamous meeting with the Co-heads of research, the LA Times published ‘Whisper Numbers’ Heard Loud and Clear, which explained:

“analysts…whisper a more accurate projection to favored clients such as big mutual funds and pension funds. That gives clients time to buy a stock if it’s expected to beat the consensus number, or sell it if it’s likely to fall short.”

If you google “Whisper numbers 1998” or “Whisper numbers 1999”, you’ll find many more stories like the one above. These stories prove that Wall Street cannot always be trusted. You should assume that Wall Street insiders are looking for an inside scoop or angle to give them an edge over you. It’s always been that way for decades! In fact, before Regulation Fair Disclosure (aka “Reg FD”) in 2000, it was legal for Wall Street analysts to share inside information about upcoming earnings with their clients. I’m not kidding…they had to make a special law in August of 2000 to stop Wall Street analysts from giving favored clients tips on which companies were going to beat or miss earnings. Unbelievable…and it made them a lot of money. To assume that all those old habits just disappeared after Reg FD is naive. More details on this topic are here in Why Investors Need Independent Research, which I wrote for clients back in 2016.

Back to the point of this letter. At New Constructs, I built an entirely different research firm, one that is based on real data, models and rigorous analysis. We have no hidden agendas or conflicts of interest. We’re not working some angle to take advantage of our clients. We go out of way to make our research transparent because:

- We have nothing to hide.

- We want you to see the quality of our work.

- We want you to challenge our competitors to do the same.

Our data and our models support our theses – always. We regularly review our work and research on Long Ideas and Danger Zone Ideas with clients. We want you to know how much work we do! Here’s how we share our work:

- Free live Podcast every month. We just did one on June 12th. Get the free replay from our online community (use this form to sign up for free) and ask questions and make requests anytime! The next Podcast is on July 19th, register here.

- Monthly Let’s Talk Long Ideas webinars (for our Professional and Institutional clients) where we do deep dives into our research, analytics, reverse DCF models and ideas. See when our next session is scheduled here. Replays are here.

If this message resonated with you and you want to start your investing future with us – schedule a meeting with us here.

Diligence (for the sake of diligence) matters,

David

This article was originally published on July 9, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.