Our latest featured stock is an oil giant whose reported earnings and real cash flows are heading in opposite directions.

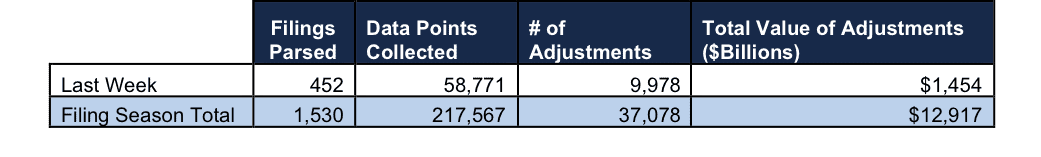

Last week, our analysts parsed 452 filings and collected 58,771 data points. In total, they made 9,978 adjustments with a dollar value of $1.5 trillion. That breaks down into:

- 4,279 income statement adjustments with a total value of $101 billion

- 4,051 balance sheet adjustments with a total value of $605 billion

- 1,648 valuation adjustments with a total value of $748 billion

Figure 1: Filing Season Diligence

Sources: New Constructs, LLC and company filings.

During the past week of filing season, we found significant non-operating expenses from Guidance Software (GUID), a big change in expected return on plan assets for Target (TGT), and several red flags for Valeant Pharmaceuticals (VRX). Follow us on Twitter and check out the hashtag #filingseasonfinds for regular updates on our research.

Every year in this six-week stretch from mid-February through the end of March we parse and analyze roughly 2,000 10-Ks to update our models for companies with a 12/31 fiscal year end. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” The Robo-Analyst uses machine learning and natural language processing to automate much of the parsing process.

A Fiduciary Level of Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe that in time investors will come to demand this level of diligence when it comes to their investment advice.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can advisors go beyond the suitability standard and provide a fiduciary level of diligence to their clients.

One Company To Watch In 2017

Based on our analysis of the Royal Dutch Shell’s (RDS.A) 20-F (the international equivalent of a 10-K) last week, we have downgraded the stock from Dangerous to Very Dangerous.

Analyst Hunter Gray made a number of adjustments to account for hidden non-operating expenses in Shell’s 20-F, including:

- Impairment losses of $1.9 billion on page 129

- Inventory write-downs of $566 million on page 136

- Non-operating pension charges of $169 million on page 141

This may seem like good news for Shell, until we look at its 2015 20-F and see that those non-operating expenses were $9.3 billion, $1.1 billion, and $656 million in 2015.

Shell’s GAAP EPS rose by 91% in 2016, but that increase was entirely the result of the non-operating expenses artificially depressing its profitability in 2015. Shell’s net operating profit after tax (NOPAT) actually declined by 3% last year.

Investors betting on Shell’s recovery need to look past the income statement to see that cash flows are in decline.

This article originally published here on March 13, 2017.

Disclosure: David Trainer, Hunter Gray, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.