The financial sector is one of four sectors to earn our “dangerous” rating and is the worst-ranked sector in the our 3Q11 Sector Roadmap report according to my methodology at New Constructs.

Typically, when a sector gets a dangerous rating, we can find no attractive ETFs in that sector. However, the financial sector ETFs are tricky. There is one attractive-rated ETF, PowerShares KBW Property & Casualty Insurance Portfolio (KBWP) and 21 dangerous-or-worse rated ETFs.

The main take-away is avoid all financial sector ETF except for KBWP. In fact, two of the financial sector ETFs are among the worst of all 400+ ETFs we cover. Both of these ETFs get our “very dangerous” rating:

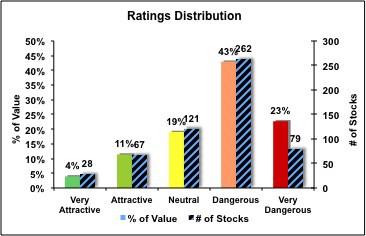

The figure below illustrates why the financial sector is tricky. Though the sector is heavily weighted toward dangerous-or-worse-rated stocks (66% of the value of the sector), attractive-or-better-rated stocks make up 15% of the sector.

With only 95 out of 557 financial stocks getting an attractive-or-better rating, there are not as many good stocks to choose from as there are stocks to avoid.

Hence, the “dangerous” rating for the sector does not necessarily mean there are no good stocks or ETFs in the sector. It means the likelihood of them is low. So, investors must tread carefully.

Figure 1: Financial Sector – Allocation & Holdings by Risk/Reward Rating

My regular readers are aware of some of the worst stocks in the financial sector, namely Citigroup (C – very dangerous rating) and Morgan Stanley (MS – dangerous rating). Click here for my recent article on C and here for the article on MS. As noted above, there are a number of attractive-or-better-rated stocks in the sector, such as Aflac Inc (AFL – very attractive rating) and The Travellers Companies (TRV – attractive rating).

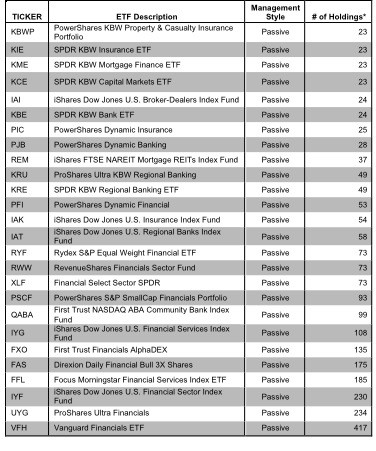

Figure 2: Holdings Count of Energy Sector ETFs

Sources: New Constructs, LLC and ETFdb

Figure 2 clearly shows that not all Financials ETFs are made the same. Different ETFs have meaningfully different numbers of holdings and, therefore, different allocations to holdings. Given the differences in holdings and allocations, these ETFs will likely perform quite differently.

Consequently, it is important to derive a predictive rating for ETFs based on analysis of the underlying quality of earnings and valuation of the holdings in each ETF.

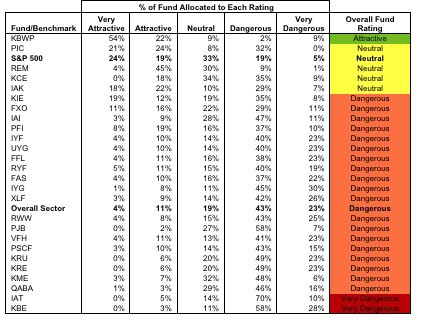

Figure 3 shows how the 26 financial sector ETFs stack up versus each other, the overall sector and the S&P 500 based on their risk/reward ratings and the allocations to their holdings by rating.

Figure 3: Investment Merit Based on Holdings and Allocations

Sources: New Constructs, LLC; DTCC and company filings

Attractive ETFs:

KBWP earns an attractive rating and therefore, is the only financial sector ETF we recommend.

Neutral ETFs:

PIC, REM, KCE and IAK allocate their value in a way that earns them a neutral rating. We recommend investors buy the very attractive and attractive stocks in this sector before buying any of the U.S. equity financial sector ETFs except for KBWP.

Dangerous ETFs:

We recommend investors sell or short KIE, FXO IAI, PFI, IYF, UYG, FFL, RYF, FAS, IYG, XLF, RWW, PJB, VFH, PSCF, KRU, KRE, KME, QABA, IAT and KBE because of their dangerous-or-worse rating.

Methodology

Our analysis is based on aggregating results from our models on each of the companies included in every ETF and the overall sector (557 companies) based on data as of July 12, 2011. We aggregate results for the ETFs in the same way the ETFs are designed.

Our goal is to empower investors to analyze ETFs in the same way they analyze individual stocks.

Given the success of our rating system for individual stocks, we believe its application to groups of stocks (i.e. ETFs and funds) helps investors make more informed ETF and mutual fund buying decisions. Barron’s featured our uniquely predictive ETF research in “The Danger Within”.

Disclosure: I receive no compensation to write about any specific stock, sector or them.