Finding the best mutual funds is an increasingly difficult task in a world with so many from which to choose.

You Cannot Trust Mutual Fund Labels

There are at least 231 different Financials mutual funds and at least 630 mutual funds across all sectors. Do investors need that many choices? How different can the mutual funds be?

Those 231 Financials mutual funds are very different. With anywhere from 21 to 539 holdings, many of these Financials mutual funds have drastically different portfolios, creating drastically different investment implications.

The same is true for the mutual funds in any other sector as each offers a very different mix of good and bad stocks. Some sectors have lots of good stocks and offer quality funds. The opposite is true for some sectors, while others lie in between these extremes with a fair mix of good and bad stocks. For example, the Consumer Discretionary sector, per my 3Q Sector Rankings Report ranks fourth out of 12 sectors when it comes to providing investors with quality mutual funds. Consumer Staples ranks first. Utilities ranks last. Details on the Best & Worst mutual funds in each sector are here.

The bottom line is: mutual fund labels do not tell you the kind of stocks you are getting in any given mutual fund.

Paralysis By Analysis

I firmly believe mutual funds for a given sector should not all be that different. I think the large number of Financials (or any other) sector of mutual funds hurts investors more than it helps because too many options can be paralyzing. It is simply not possible for the majority of investors to properly assess the quality of so many mutual funds. Analyzing mutual funds, done with the proper diligence, is far more difficult than analyzing stocks because it means analyzing all the stocks within each mutual fund. As stated above, that can be as many as 539 stocks, and sometimes even more, for one mutual fund.

Any investor worth his salt recognizes that analyzing the holdings of a mutual fund is critical to finding the best mutual fund.

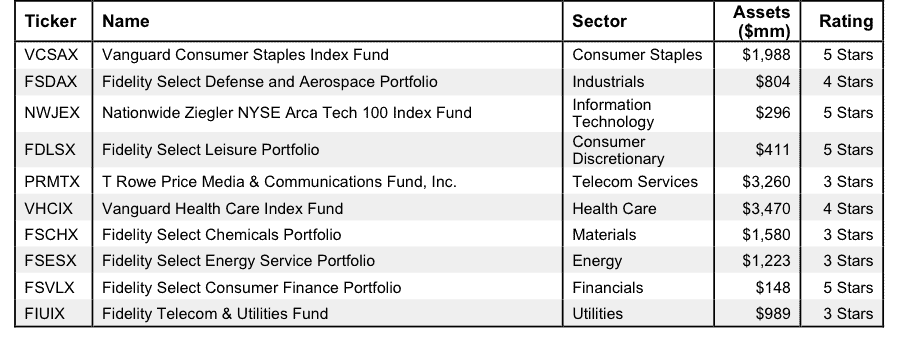

Figure 1: Best Sector Mutual Funds

The Danger WithinSources: New Constructs, LLC and company filings

Why do investors need to know the holdings of mutual funds before they buy? They need to know to be sure they do not buy a fund that might blow up. Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. As Barron’s says, investors should know the Danger Within. No matter how cheap, if it holds bad stocks, the mutual fund’s performance will be bad.

PERFORMANCE OF FUND’S HOLDINGS = PERFORMANCE OF FUND

Finding the Sector Mutual Funds with the Best Holdings

Figure 1 shows my top rated mutual fund for each sector. Importantly, my ratings on mutual funds are based primarily on my stock ratings of their holdings. My firm covers over 3000 stocks and is known for the due diligence we do for each stock we cover. Accordingly, our coverage of mutual funds leverages the diligence we do on each stock by rating mutual funds based on the aggregated ratings of the stocks each mutual fund holds.

Vanguard Consumer Staples Index Fund (VCSAX) is the top-rated Consumer Staples mutual fund and the first-ranked fund overall of the 630 sector mutual funds that I cover.

Sometimes, You Get What You Pay For

It is troubling to see one of the best sector mutual funds, Fidelity Select Leisure Portfolio (FDLSX) have just $411 million in assets despite its Very Attractive or 5-star rating. On the other hand, Neutral-rated Vanguard Consumer Discretionary Index Fund (VCDAX) has $1,227 million in assets. VCDAX has lower total annual costs than FDLSX (0.17% and 1.05% respectively), but low costs cannot drive positive performance. Quality holdings are the ultimate driver of performance.

I cannot help but wonder if investors would leave VCDAX if they knew that it has such a poor portfolio of stocks. It is cheaper than FDLSX, but, as previously stated, low fees cannot growth wealth; only good stocks can.

Sometimes, You DON’T Get What You Pay For

Nationwide Ziegler NYSE Arca Tech 100 Index Fund (NWJEX) is one of the smallest mutual funds in Figure 1 with just $296 million in assets. Sadly, other Information Technology mutual funds with more assets and inferior portfolios charge more than NWJEX. In other words, Information Technology mutual fund investors are paying extra fees for no reason.

Fidelity Advisor Energy Fund (FANAX) is one of the worst mutual funds in the Energy sector. It gets my Very Dangerous rating based off the fact that less than 12% of its assets are allocated to Attractive-or-better rated stocks, while 52% of assets are allocated to Dangerous-or-worse stocks. FANAX also has total annual costs of 3.66%. One would think that FANAX would have fewer assets, but instead it has over $874 million. Investors are paying extra fees for poor holdings.

The worst mutual fund in Figure 1 is Fidelity Telecom & Utilities Fund (FIUIX), which gets a Neutral (3-Star) rating. One would think mutual fund providers could do better for this sector.

I recommend investors only buy mutual funds with more than $100 million in assets. You can find more liquid alternatives for the other funds on my mutual fund screener.

Covering All The Bases, Including Costs

My mutual fund rating also takes into account the total annual costs, which represents the all-in cost of being in the mutual fund. This analysis is complex for mutual funds, as one has to consider not only expense ratios, but also front-end load and transaction fees. A high front-end load not only costs investors at the beginning, it also reduces the growth investors can experience later on. While costs play a smaller role than holdings, my ratings penalize those mutual funds with abnormally high costs.

Top Stocks Make Up Top Mutual Funds

Discover Financial Services (DFS) is one of my favorite stocks held by FSVLX. It earns my Attractive rating and is on the Most Attractive Stocks List for August. DFS has grown its after tax profit (NOPAT) by an impressive 45% compounded annually over the last four years. The company has also increased its return on invested capital (ROIC) from 2% in 2010 to 19% in 2013, which places it in the top quintile of all companies I cover. Despite DFS’s rapid NOPAT growth, it remains undervalued. At its current price of ~$60/share, DFS has a price to economic book value (PEBV) ratio of 1.2. This ratio implies that the market expects DFS to grow its NOPAT by no more than 20% over the remaining life of the company. This expectation seems awfully negative given the past four years of strong NOPAT growth achieved by DFS. Investors should look to DFS for an undervalued stock with excellent upside potential.

Kyle Guske II contributed to this post.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.