Finding the best mutual funds is an increasingly difficult task in a world with so many to choose from.

You Cannot Trust Mutual Fund Labels

There are at least 952 different Large Cap Blend mutual funds and at least 6169 mutual funds across all styles. Do investors need that many choices? How different can the mutual Funds be? Those 952 Large Cap Blend mutual funds are very different. With anywhere from 14 to 1017 holdings, many of these Large Cap Blend mutual funds have drastically different portfolios, creating drastically different investment implications.

The same is true for the mutual funds in any other style, as each offers a very different mix of good and bad stocks. Some styles have lots of good stocks and offer quality funds. The opposite is true for some styles, while others lie in between these extremes with a fair mix of good and bad stocks. For example, the All Cap Value style, per my 1Q Style Rankings Report, ranks sixth out of 12 Styles when it comes to providing investors with quality mutual funds. Large Cap Blend ranks first. Small Cap Value ranks last. Details on the Best & Worst Mutual Funds in each Style are here.

The bottom line is: mutual fund labels do not tell you the kind of stocks you are getting in any given mutual fund.

Paralysis By Analysis

I firmly believe mutual funds for a given style should not all be that different. I think the large number of Large Cap Blend (or any other) style of mutual funds hurts investors more than it helps because too many options can be paralyzing. It is simply not possible for the majority of investors to properly assess the quality of so many mutual funds. Analyzing mutual funds, done with the proper diligence, is far more difficult than analyzing stocks because it means analyzing all the stocks within each mutual fund. As stated above, that can be as many as 1017 stocks, and sometimes even more, for one mutual fund. Any investor worth his salt recognizes that analyzing the holdings of a mutual fund is critical to finding the best mutual fund.

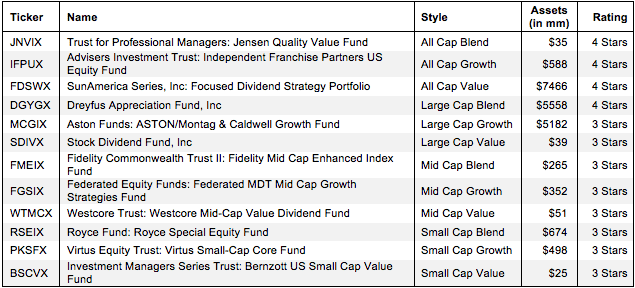

Figure 1: Best Style Mutual Funds

The Danger Within

Why do investors need to know the holdings of mutual funds before they buy? They need to know to be sure they do not buy a fund that might blow up. Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. As Barron’s says, investors should know the Danger Within. No matter how cheap, if it holds bad stocks, the mutual fund’s performance will be bad.

PERFORMANCE OF FUND’S HOLDINGS = PERFORMANCE OF FUND

Finding the Style Mutual Funds with the Best Holdings

Figure 1 shows my top rated mutual fund for each style. Importantly, my ratings on mutual funds are based primarily on my stock ratings of their holdings. My firm covers over 3000 stocks and is known for the due diligence we do for each stock we cover. Accordingly, our coverage of mutual funds leverages the diligence we do on each stock by rating mutual funds based on the aggregated ratings of the stocks each mutual fund holds.

SunAmerica Series Focused Dividend Strategy Portfolio (FDSWX) is the top-rated All Cap Value mutual fund and the overall top-rated fund of the 6,169 style mutual funds that I cover. Investors should be wary of buying mutual funds, as only four of the twelve investing styles (All Cap Blend, All Cap Growth, All Cap Value and Large Cao Blend) produce any Attractive-or-better mutual funds. Even between these four styles, however, only eight mutual funds receive an Attractive-or better rating.

Sometimes, you get what you pay for.

It is troubling to see one of the best style mutual funds, Trust for Professional Managers: Jensen Quality Value Fund (JNVIX) have just $35 million in assets despite its Attractive rating. On the other hand, Dangerous-rated Fidelity Value Fund (FDVLX) has almost $9 billion in assets. FDVLX has lower total annual costs than JNVIX (1.24% and 1.48% respectively), but low costs cannot drive positive performance. Quality holdings are the ultimate driver of performance.

I cannot help but wonder if investors would leave FDVLX if they knew that it has such a poor portfolio of stocks. It is cheaper than JNVIX, but, as previously stated, low fees cannot growth wealth; only good stocks can.

Sometimes, you DON’T get what you pay for.

The smallest mutual fund in Figure 1 is Investment Managers Series Trust: Bernzott US Small Cap Value Fund (BSCVX) with just $25mm in assets. Sadly, other Small Cap Value mutual funds with more assets and inferior portfolios charge more than BSCVX. In other words, Small Cap Value mutual fund investors are paying extra fees for no reason.

American Century Capital Portfolios Small Cap Value Fund (ACSCX) is one of the worst mutual funds in the Small Cap Value style. It gets my Very Dangerous rating based off the fact that barely 5% of its assets are allocated to Attractive-or-better rated stocks, while 54% is allocated to Dangerous-or-worse stocks. ACSCX also has total annual costs of 5.26%, higher than BSCVX’s 1.10%. One would think that ACSCX would have fewer assets than BSCVX, but instead it has over $2 billion. Investors are paying extra fees for poor holdings.

The worst mutual fund in Figure 1 is Investment Managers Series Trust: Bernzott US Small Cap Value Fund (BSCVX), which gets a Neutral (3-star) rating. One would think mutual fund providers could do better for this Style.

I recommend investors only buy mutual funds with more than $100 million in assets. You can find more liquid alternatives for the other funds on my free mutual fund screener.

Covering All The Bases, Including Costs

My mutual fund rating also takes into account the total annual costs, which represents the all-in cost of being in the mutual fund. This analysis is complex for mutual funds, as one has to consider not only expense ratios, but also front-end load and transaction fees. A high front-end load not only costs investors at the beginning, it also reduces the growth investors can experience later on. While costs play a smaller role than holdings, my ratings penalize those funds with abnormally high costs.

Top Stocks Make Up Top Mutual Funds

Coach Inc. (COH) is one of favorite holdings in FDSWX. Coach has grown after-tax profits (NOPAT) by 27% compounded annually over the last twelve years. The company also earns a top-quintile 47% return on invested capital (ROIC) and has generated positive and growing economic earnings for the last five years. Coach’s NOPAT margin has also been above 20% since 2004. One would imagine that these strong indicators of growth and profitability would make COH an expensive buy, but that is not the case. At its current trading price of ~$47/share, COH has a price-to-economic book value ratio of 1.1. This valuation implies that investors expect NOPAT to increase by only 10% over the remainder of Coach’s corporate life. Given COH’s history of growth, these expectations seem overly pessimistic. A strong track record of growth and low expectations make COH an attractive pick for investors.

Jared Melnyk contributed to this post.

Disclosure: David Trainer owns COH. David Trainer and Jared Melnyk receive no compensation to write about any specific stock, Style, or theme.