Tough markets like the one we’re in now test your investment strategy. Many of the strategies that have worked for many years are breaking down.

While trading fads come and go, good fundamental research is required to fulfill your fiduciary duties to your clients and yourself. Without it, realize it or not, you take significant risk that the numbers you use to make a decision are not correct.

We think the recent decline in liquidity is going to lead the market to recognize the true, long-term fundamentals of lots of stocks, a trend that began in 2015 and led to significant outperformance by our Most Dangerous Stocks newsletter as well as many of our Danger Zone picks in 2015. Less liquidity means more natural price discovery, something many experts have warned has been missing for too long. Those same experts have noted that when natural price discovery came back, it could do so with a vengeance. Markets could be volatile for a while. The bull market had to end sometime, right?

As markets have gotten off to an ominous start in 2016, many investors have watched as their portfolios shrink and wonder, “what could I have done to avoid this?”

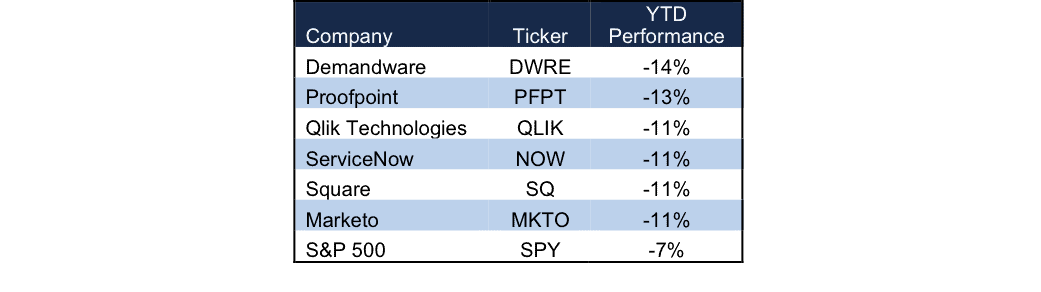

The purpose of good fundamental research is to provide insight into which stocks to avoid during market storms and which stocks will shine when markets become dangerous. Our track record for doing both is worth noting. Our research led us to put 35 stocks into the Danger Zone last year, including Men’s Wearhouse (MW), Groupon (GRPN), El Pollo Loco (LOCO), Twitter (TWTR) and Box (BOX). All of those picks underperformed the S&P by more than 30% in 2015. Through the first week and a half of 2016, several recent Danger Zone stocks are underperforming the market again (see Figure 1).

Figure 1: Danger Zone Stocks Underperform Year To Date

Sources: New Constructs, LLC and company filings

Now, we will be the first to tell you that good fundamental research is rare, extremely time-consuming and very expensive. As a result, by the time many investors realize they need fundamental research, it’s too late. Their portfolios have been crushed.

So where can investors find good fundamental research? We can help you figure that out.

At New Constructs, we have a long history of providing market-beating strategies to our clients. The forensic accounting work we do to close 30+ accounting loopholes is the bedrock of our fundamental research and, to our knowledge, is unmatched by any of our competitors.

In this webinar, CEO David Trainer, a Wall Street veteran, will discuss the state of the market, how New Constructs provides insight into safe investments, and how a portfolio could be strengthened in today’s market.

Click here to download a PDF of this report.

Photo Credit: jk_scotland (Flickr)