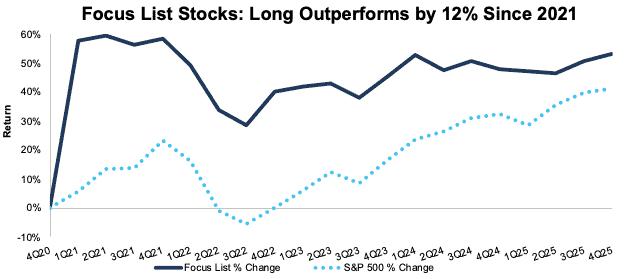

Our Focus List Stocks: Long Model Portfolio[1], the best of our Long Ideas, has beaten the S&P 500 by 12% since the start of 2021 through 2025. See Figure 1. This outperformance underscores how important reliable fundamental research is.

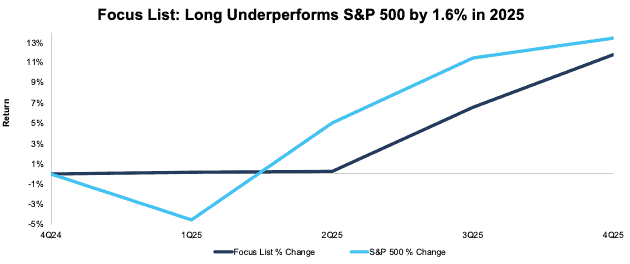

In 2025, however, the Model Portfolio underperformed the S&P 500 by 1.6% (up 11.8% vs. 13.4% for the S&P 500). See Figure 2.

Figure 1: Focus List Stocks: Long Performance Since Beginning of 2021

Sources: New Constructs, LLC

Figure 2: Focus List Stocks: Long vs. S&P 500 in 2025

Sources: New Constructs, LLC

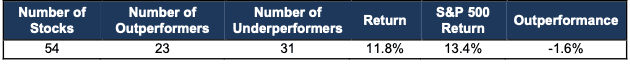

Figure 3 details the Model Portfolio’s performance, which includes all stocks present in the Model Portfolio at any point in 2025.

Figure 3: 2025 Performance of the Focus List Stocks: Long Model Portfolio

Sources: New Constructs, LLC

Performance includes stocks in the Model Portfolio in 2025 as well as those removed during the same time (14 stocks).

The Focus List Stocks: Long Model Portfolio leverages superior fundamental data, which provides a novel alpha. Professional and Institutional members get real-time updates and can track all Model Portfolios on our site.

We’re here to help you navigate any market cycle. Our uniquely rigorous fundamental research consistently earns #1 rankings in several categories on SumZero.

Check Out the Indices Based on New Constructs Research

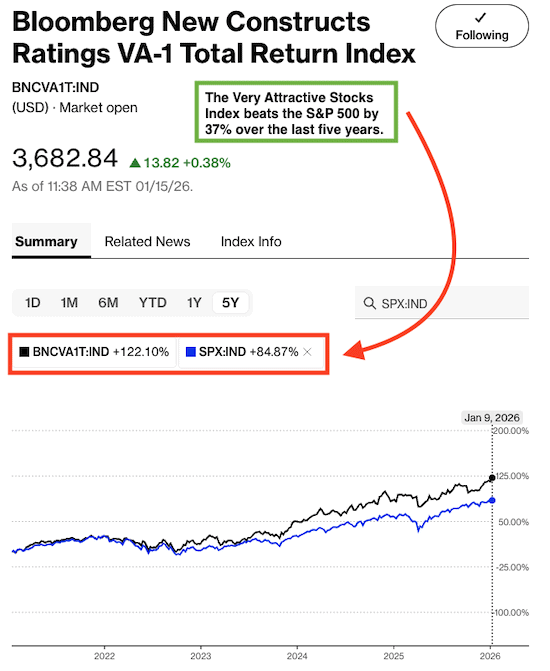

While we’re writing about how our Focus List Stocks: Long Model Portfolio finds winning stocks, we should highlight the indices we’ve developed with Bloomberg’s Index Licensing Group. All three have outperformed the S&P 500 over the past five years. See Figures 4-6.

- Bloomberg New Constructs Core Earnings Leaders Index (ticker: BCORET:IND)

- Bloomberg New Constructs Ratings VA-1 Index (ticker: BNCVA1T:IND)

- Bloomberg New Constructs 500 Index (ticker: B500NCT:IND)

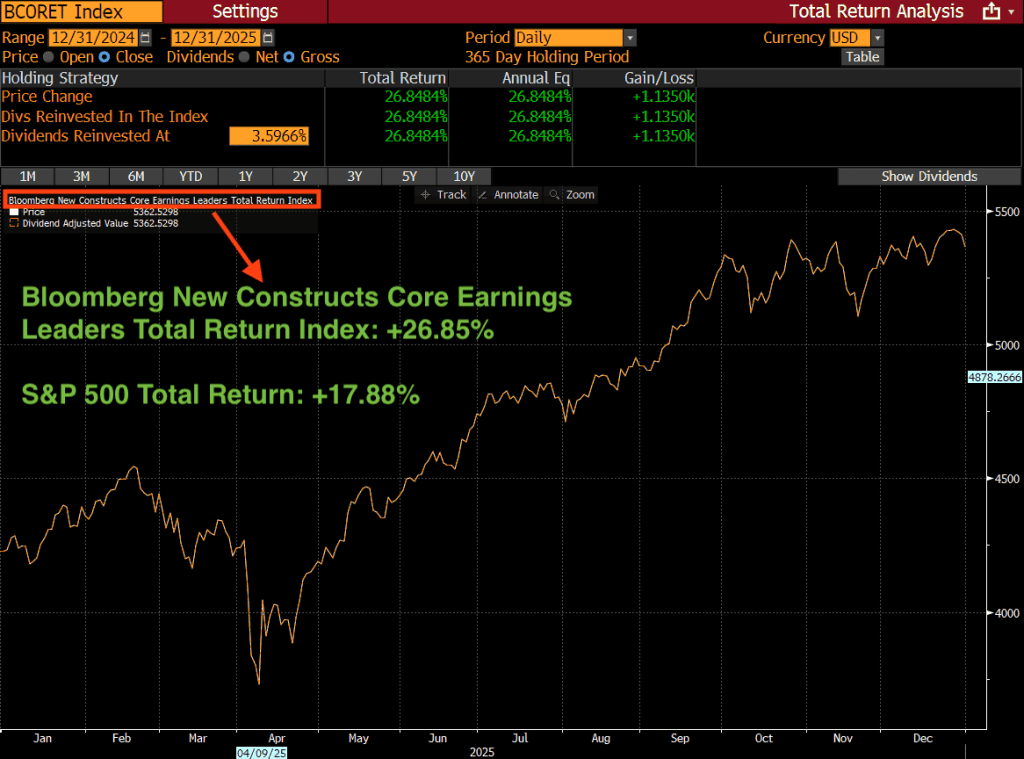

The Bloomberg New Constructs Core Earnings Leaders Index, which allocates based on Earnings Capture and Core Earnings, beat the S&P 500 by 9% in 2025. The Index (ticker: BCORET:IND) was up 27% while the S&P 500 was up 18%.

Figure 4: Bloomberg New Constructs Core Earnings Leaders Index Outperforms S&P 500 in 2025

Sources: Bloomberg as of December 31, 2025

Note: Past performance is no guarantee of future results.

The “Very Attractive Stocks” Index, which allocates to stocks that get a Very Attractive rating by our AI Agent for Investing, beat the S&P 500 by 37% over the last five years. Bloomberg’s official name for the index is Bloomberg New Constructs Ratings VA-1Index (ticker: BNCVAT1T:IND). Figure 5 shows it was up 122% while the S&P 500 was up 85%.

Figure 5: Very Attractive-Rated Stocks Strongly Outperform the S&P 500: Last Five Years

Sources: Bloomberg as of January 9, 2026

Note: Past performance is no guarantee of future results.

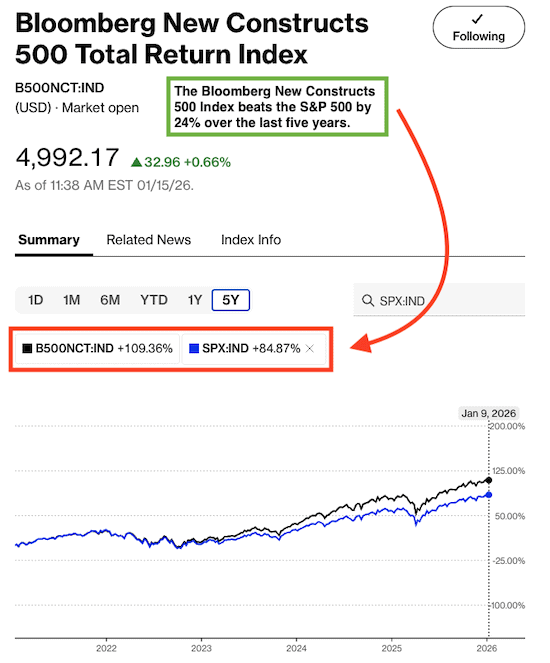

Our “Core-Earnings Weighted S&P 500” Index, which weights the largest 500 U.S. companies by Core Earnings instead of market cap, beat the S&P 500 by 24% over the past five years. Bloomberg’s official name for the index is Bloomberg New Constructs 500 Total Return Index (ticker: B500NCT:IND). Figure 6 shows it was up 109% while the S&P 500 was up 85%.

Figure 6: Bloomberg New Constructs 500 Index Strongly Outperforms the S&P 500: Last Five Years

Sources: Bloomberg as of January 9, 2026

Note: Past performance is no guarantee of future results.

This article was originally published on January 15, 2026.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] Stocks are in the Focus List Model Portfolios for different periods of time as we open and close positions during the year. When measuring outperformance of the Focus List Model Portfolios, we compare each stock’s return to the S&P 500’s return for the time each is in the Focus List Model Portfolios. This approach provides an apples-to-apples comparison of how each stock performed vs. the S&P 500.