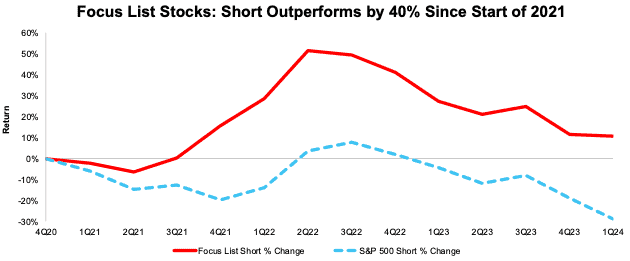

Our Focus List Stocks: Short Model Portfolio[1], the best of our Danger Zone picks, has beaten shorting the S&P 500 by 40% since the start of 2021. See Figure 1. This outperformance underscores how important reliable fundamental research can be.

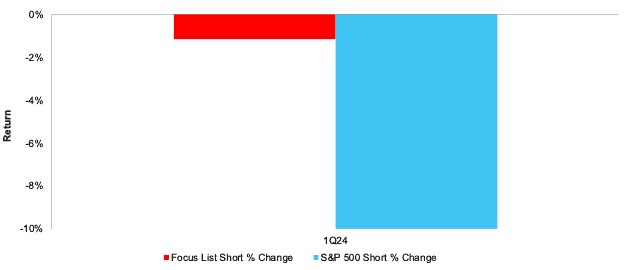

In 1Q24, the Model Portfolio outperformed shorting the S&P 500 by 9% (down 1% vs. -10% shorting the S&P 500). See Figure 2.

Figure 1: Focus List Stocks: Short Performance Since Beginning of 2021

Sources: New Constructs, LLC

As a short portfolio, the Model Portfolio’s return increases when the underlying stocks go down. For real-time tracking of this Model Portfolio, see the index Thematic created for it.

Figure 2: Focus List Stocks: Short vs. S&P 500 in 1Q24

Sources: New Constructs, LLC

Rising returns indicates poor performance for a Short portfolio, which outperforms as stocks fall.

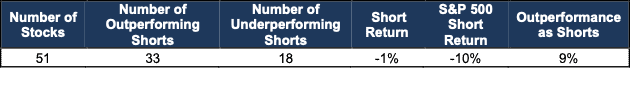

Figure 3 details the Model Portfolio’s performance, which includes all stocks present in the Model Portfolio at any point in 1Q24.

Figure 3: 1Q24 Performance of the Focus List Stocks: Short Model Portfolio

Sources: New Constructs, LLC

Performance includes stocks in the Model Portfolio in 1Q24 as well as those removed during the same time (none).

Professional and Institutional members get real-time updates and can track all Model Portfolios on our site. The Focus List Stocks: Short Model Portfolio leverages superior fundamental data, which provides a new source of alpha.

We’re here to help you navigate these turbulent times. Our uniquely rigorous fundamental research consistently earns SumZero’s #1 All-Time ranking, along with #1 rankings in several other categories.

This article was originally published on April 10, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Stocks are in the Focus List Model Portfolios for different periods of time as we open and close positions during the year. When measuring outperformance of the Focus List Model Portfolios, we compare each stock’s return to the S&P 500’s return for the time each is in the Focus List Model Portfolios. This approach provides more of an apples-to-apples comparison of how each stock performed vs. the S&P 500.