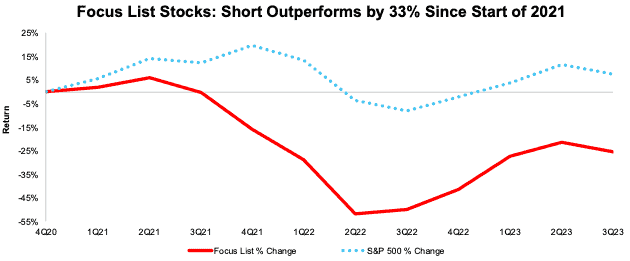

Our Focus List Stocks: Short Model Portfolio, the best of our Danger Zone picks, has beaten the S&P 500 by 33% since the start of 2021.

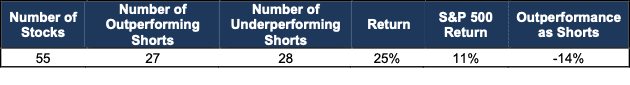

Through the first nine months of 2023, the Model Portfolio returned -25% as a short compared to -11% for the S&P 500 as a short and underperformed shorting the S&P 500[1] by 14%.

For real-time tracking of this Model Portfolio, see the index Thematic created for it.

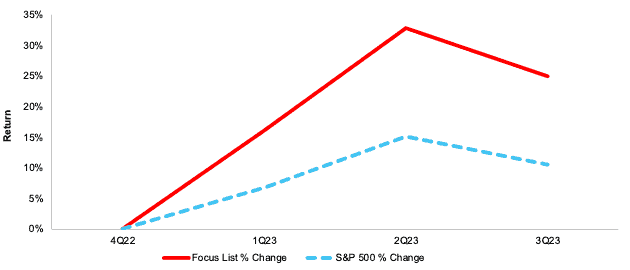

Figure 1: Focus List Stocks: Short vs. S&P 500 in First Nine Months 2023

Sources: New Constructs, LLC

Rising returns indicates poor performance for a Short portfolio, which outperforms as stocks fall.

Figure 2 shows a detailed breakdown of the Model Portfolio’s performance, which includes all stocks present in the Model Portfolio at any point through the first nine months of 2023.

Figure 2: Through Nine Months: 2023 Performance of the Focus List Stocks: Short Model Portfolio

Sources: New Constructs, LLC

Performance includes stocks in the Model Portfolio through the first nine months of 2023 as well as those removed during the same time (one stock).

Underscoring just how important reliable fundamental research is in turbulent markets, this Model Portfolio has beaten shorting the S&P 500 by 33% since the start of 2021.

Figure 3: Focus List Stocks: Short Performance Since Beginning of 2021

Sources: New Constructs, LLC

Professional and Institutional members get real-time updates and can track all Model Portfolios on our site. The Focus List Stocks: Short Model Portfolio leverages superior fundamental data, which provides a new source of alpha.

We’re here to help you navigate these turbulent times. Our uniquely rigorous fundamental research consistently earns SumZero’s #1 All-Time ranking, along with #1 rankings in several other categories.

This article was originally published on October 10, 2023.

Disclosure: David Trainer, Kyle Guske II, Hakan Salt, and Italo Mendonça receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Stocks are in the Focus List Model Portfolios for different periods of time as we open and close positions during the year. When measuring outperformance of the Focus List Model Portfolios, we compare each stock’s return to the S&P 500’s return for the time each is in the Focus List Model Portfolios. This approach provides more of an apples-to-apples comparison of how each stock performed vs. the S&P 500.

2 replies to "Focus List Stocks: Short Model Portfolio Outperforms Over Time Despite First Nine Months 2023"

I would like to see one pick of yours on a low stock under $1 to see if it does anything by Quarter 4 of 2024. I will be happy to subscribe, but I have to have a little proof because I have tried 4 different subscriptions and they did not favor well, but I have always liked New Constructs.

Hi Phil,

Thanks for your comment! Great to hear of your interest in New Constructs. While I’m unable to share a stock pick I do have two resources you might find useful. First, check out our a la carte research – our reports & model portfolios start at $9.99 and there are free downloads of each type to ensure you understand exactly what you’ll be getting before you purchase. And second, you might find our online community, the Society of Intelligent Investors, to be a helpful space. We are creating a space focused on intelligent investing and you’re welcome to join us. It is a great space to discuss broader investment research topics. It is free of charge & obligation.

Best,

Tam