Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Pinnacle Foods (PF) is a packaged foods company that sells frozen and other foods under many brands, including Duncan Hines, Vlasic, Ms. Butterworth’s, Van de Kamp’s, Snyder and Wishbone. The company was taken out from under the umbrella of the Blackstone Group (BX) in an IPO in March 2013. Since then, the stock has risen over 74% to $39/share today.

Pinnacle, which normally flies under-the-radar, found itself in the news last year when Hillshire was forced to cancel its merger deal with Pinnacle on June 30 in order for Hillshire to sell itself to Tyson (TSN). Pinnacle received a $153 million breakup fee as a parting gift, and the stock is up 24% since then. However, we believe that this Consumer Staples stock is not only overvalued, but in a poor position in a struggling industry. Pinnacle also makes our Most Dangerous stocks list for March.

All is Well on the Surface…

Pinnacle has a large market share in several food categories. The company’s Birds Eye brand owns a quarter of the frozen vegetable market and 25% of the complete bagged meals market. Even more impressive is the fact that Pinnacle’s Lender’s brand commands a 60% share of the frozen bagel market.

On the surface, things look okay. Revenue was up 5% last year, not bad for a mature, multibillion-dollar company in a sector not exactly known for its growth.

But Below the Surface, Things Aren’t so Rosy

While Pinnacle’s GAAP net income has grown by 118% compounded annually since 2012, Pinnacle’s after-tax operating profit (NOPAT) has grown by only 2% compounded annually. It looks like many investors have been buying on overly optimistic (but misleading) data for the past year. In 2014 alone, Pinnacle’s GAAP net income showed an increase of 179% while our NOPAT calculation showed an increase of just 8%.

Our NOPAT calculation strips out non-operating and non-recurring income like Pinnacle’s $153 million breakup fee from Hillshire to provide a more accurate measure of the company’s core, recurring profitability.

Taking a closer look at Pinnacle’s revenue stream also reveals some specific issues. That 5% growth number looks good on paper, but less good when you learn that 6 whole percentage points of that growth was due to Pinnacle’s Wishbone salad dressings acquisition, and 0.3 percentage points were due to the Garden Protein acquisition (these gains were offset by pricing and currency costs to reach the 5% figure). So without these acquisitions, Pinnacle’s revenue would have actually declined by 1%. Of its three segments — Birds Eye, Duncan Hines, and Specialty Foods — the only one that saw organic sales growth in 2014 was Birds Eye, which saw organic sales rise just 1%. And while these acquisitions may have boosted sales, both divisions registered a loss in the years of their acquisitions.

In addition to its declining organic sales, Pinnacle had free cash flow (FCF) of only $112 million last year, which gives an FCF yield of just 1.5%. Note that Pinnacle needs at least $106 million to fund its dividend payments alone.

Poor Competitive Position

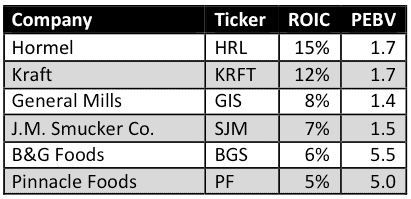

Figure 1 shows how Pinnacle stacks up against a large slate of prepackaged food companies in terms of return on invested capital (ROIC) and price to economic book value (PEBV).

Figure 1: No True Competitor

Sources: New Constructs, LLC and company filings.

Pinnacle’s closest competition in terms of product offerings is B&G Foods (BGS) and General Mills (GIS). Note that Pinnacle is at the bottom of the list in terms of ROIC despite having a market share lead in many of its product lines.

Pinnacle is already being forced to wage price wars, as evidenced by this statement in its most recent filing: there has been “an increase in the percentage of products sold on promotion and a shift from traditional retail grocery to mass merchandisers, club stores and dollar store channels.” We don’t think PF investors can look forward to margin expansion any time soon as competition is stiff and most frozen food products are undifferentiated commodities. Normalized margins have remained the same for the past three years, and there is plenty of room for competition to undercut Pinnacle on price and put downward pressure on margins.

These Adjustments and Red Flags Are Why Pinnacle Gets Our “Very Dangerous” Rating

Earlier in this report, we discussed how Pinnacle’s after-tax operating profit is a better indicator of its recurring profitability. This is because in 2013, we removed $72 million in reported non-operating expenses, and $22 million in hidden non-operating expenses from Pinnacle’s net income to calculate NOPAT. And in 2014, we removed a net $41 million in non-operating income, which includes the $153 million breakup fee Pinnacle received from Hillshire that drastically reduced the expenses Pinnacle reported last year. These adjustments, when combined, yielded our 8% year-over-year profit growth rate as opposed to Pinnacle’s outlandish 178% reported earnings growth.

There are a few additional things in Pinnacle’s financials that reinforce our call here. First is Pinnacle’s $2.3 billion in debt, or 52% of its market value. This large amount could be an issue when interest rates rise, and interest payments will be a drain on already weak cash flows. We subtract this amount from our calculations of economic book value (EBV) and shareholder value, which lowers PF’s valuation in our model.

The second issue is Pinnacle’s $599 million deferred tax liability, over 13% of the company’s market value. Deferred tax liabilities represent real taxes that companies must pay at some point in the future, so we also subtract this amount from our calculation of EBV and shareholder value.

P/E Ratio Isn’t Telling the Whole Valuation Story

Many investors rely on the price-to-earnings ratio to provide a picture of the company’s valuation. While Pinnacle’s P/E of 18 might seem cheap relative to its competitors (SJM has the next lowest P/E at 21), the P/E ratio fails to take into account the cash obligations the company must meet in the future.

That’s why we subtract the company’s debt and deferred taxes in our calculation of the company’s no-growth value: its economic book value. In terms of price to economic book value, PF is the second most expensive large packaged food company behind B&G Foods.

To justify its current valuation of $39/share, Pinnacle must grow NOPAT by over 9% compounded annually for the next 9 years. This is a lofty goal for a company with declining sales.

If Pinnacle can grow NOPAT by just 6% compounded annually for the next 12 years, its shares are worth $24/share, a 38% downside.

Bull Case

The bull case for Pinnacle seems to rest mainly on the company’s revenue growth while ignoring its debt and other cash obligations. If investors cared to look a little closer at what’s behind Pinnacle’s revenue growth, as well as at valuation metrics aside from P/E, they might feel differently.

Several Likely Catalysts

Pinnacle is a house of cards at the moment — any number of small things could go wrong. This company is priced for high growth, when its growth is actually slow or declining. We think that all of the following could have an impact on Pinnacle’s revenue and profitability:

- Lower gas prices will drive consumer spending on more expensive, fresher, premium foods, accelerating the change that is already taking place toward healthier, fresh foods. This trend is already reflected in Pinnacle’s declining organic sales.

- When Blackstone unloads more shares — they own around 19% of Pinnacle — the stock could fall further. PF dropped over 5% the last time Blackstone sold and Pinnacle was forced to buy back some shares. Blackstone recently announced they would be unloading another 14 million shares in a secondary offering in the near future, so this trend is continuing.

- The company’s dividend may not rise due to cash flow concerns, as the company has zero excess cash and already uses a substantial portion of cash flow for dividends.

- Pinnacle has missed on revenue in five of the past six quarters — this looks likely to happen again.

Stupid Money Risk

A buyout of Pinnacle looks unlikely at these inflated levels and with its massive debt. Hillshire attempted a buyout almost a year ago, but this was when Pinnacle was trading at a 25% discount to its current price. We think that with the multitude of pressures on Pinnacle’s stock, any potential buyer will wait until the stock falls from current levels to make a bid.

It is not surprising to see Pinnacle hunting for more acquisitions to boost its falling sales. It’s been rumored the company is looking into purchasing frozen foods company Green Giant from General Mills (GIS). If Pinnacle pays too much, there will be value destruction.

Insiders Selling Is Big

In the past 12 months, there have been no insider buys, but 60 insider sells, which represent over 22% of total insider holdings. Investors might want to follow Pinnacle’s management on the way out.

Short Interest

Short interest stands at 497,743 shares, or less than 1% of float. Short interest was raised by 18% in February.

Dangerous Funds That Hold PF

Investors should avoid the following funds, which allocate heavily to PF and earn our Dangerous rating:

- Professionally Managed Portfolios Villere Equity Fund (VLEQX) — 4.6% allocation to PF and earns our Dangerous Rating

- Baird Small Cap Value Fund (BSVIX) — 3.8% allocation to PF and earns our Dangerous Rating

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo credit: Miran Rijavec