Summary

The Asset Allocation Rating informs investors of each fund’s level of allocation to cash (non-equities) as well as how that level compares to other equity mutual funds.

We assume investors in equity funds prefer those funds to be maximally invested in equities given that investors can much more cheaply invest in cash on their own. We do not believe that most investors want to pay the high fees associated with equity funds to invest in cash.

Definitions

- Cash Allocation (Cash %) – the percent of the net asset value of the fund that is attributed to Cash.

- Strategic Cash – cash held because the fund manager believes cash is a more attractive investment than equities.

- Frictional Cash – cash held for non-strategic purposes, such as to meet redemption requirements or to comply with investment policies[1].

Methodology

We assume that investors in non-leveraged equity mutual funds expect nearly 100% equity exposure because they can invest in cash directly and without fees on their own. Equity mutual funds that hold Strategic Cash effectively charge their investors equity-fund expenses for cash investing.

We allow fund companies to hold a reasonable amount of Frictional Cash. We define Frictional Cash as all cash less than 8% of NAV.

Per the table below, there is a substantial drop-off in the number of funds with 5% Cash. Furthermore, other sources show 5% as a logical Frictional Cash breakpoint[2]. We chose 8% to be conservative—we want to ensure that any adjustment we make to the Portfolio Management rating is warranted. Furthermore, other sources show that actively-managed mutual funds maintain cash balances of approximately 8%[3].

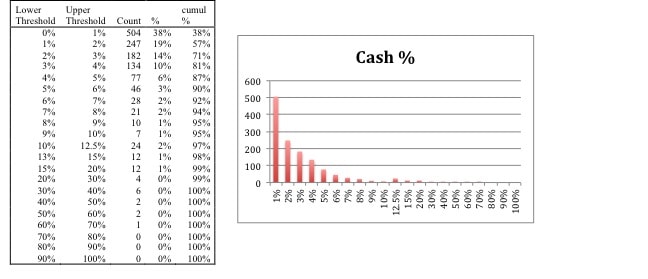

The following table and chart show the distribution of Cash % values as of the data available to us on Oct 18, 2011

The vast majority of funds (94%) have Cash % values less than 8%. These funds have a Neutral-or-better-rated Asset Allocation rating and their Predictive Rating is not penalized. Note that Neutral-or-better-rated Asset Allocation ratings do not improve the Predictive Rating.

Rating Thresholds

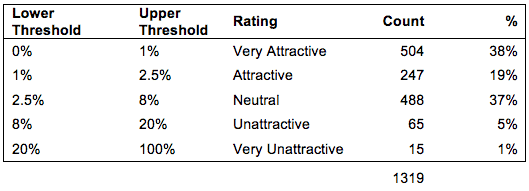

Cash allocation ratings are determined as follows:

Source: New Constructs analytics

Per the explanation above, all Cash % values of less than 8% are Neutral or better. We chose 1% and 2.5% as the Very Attractive and Attractive thresholds as our best guess of sensible thresholds that produce a reasonable count of companies that receive the rating. (It’s not appropriate to assign thresholds based on percentiles since the data is not normally distributed (i.e. many funds have cash % values of 0).

We chose 20% as the Very Unattractive threshold based on the fact that some equity fund management companies have cash management policies that allow them to hold up to 20% in cash[4]. 20% is also on our estimate for a sensible Very Unattractive threshold.

If a fund is classified as leveraged (lipper objective = ‘DL’), then we give the fund a Very Attractive Cash % rating. The Cash % values for leveraged funds are securities used to employ leverage, not Strategic or Frictional Cash.

One could argue that we should be more mathematical in our Cash % rating by effectively treating cash as a Neutral security in the portfolio. We don’t pursue this approach since it doesn’t achieve our goal of the Cash % rating. Our goal of the Cash % rating is to ding funds that aren’t fully invested in equities. Regardless of the attractiveness of a cash investment at a given time, fund investors expect to be fully invested in equities since they can invest in cash on their own and without fees. Furthermore, this methodology may improve the rating of Very Unattractive portfolios (e.g. if 50% of the fund is invested in cash and 50% is invested in Very Unattractive securities, then treating cash as a Neutral security would improve the Very Unattractive rating—we don’t want that to happen.)

[1]http://personalfinance.byu.edu/?q=node/846

[2] http://personalfinance.byu.edu/?q=node/846

[3] http://www.fool.com/school/mutualfunds/costs/turnover.htm

[4] http://www.dfaus.com/pdf/sai/idg_equity_i_sai.pdf