Accounting rules provide the biggest loopholes to asset intensive businesses. And the off-balance sheet operating lease loophole is one of the biggest.

By exploiting this loophole, Starwood is able to omit nearly $1 billion in debt from its balance sheet in 2010, $200 million (20% of the total) of which was added in 2010.

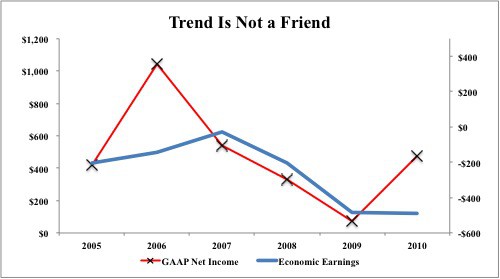

As shown in Figure 1 below, Starwood’s reported net income diverges rather sharply from the economic earnings of the business in the most recent fiscal year.

In addition to overstating accounting earnings, the large amount of hidden debt creates two red flags for investors:

- Free cash flows are about $200 million worse than they appear

- Reported debt and leverage are understated by nearly $1 billion

Figure 1: Accounting Earnings Rise While Economic Earnings Are Flat in 2010

As my more faithful readers know, I always pair my analysis of the true cash flows of a business with valuation of the stocks. It is possible for a company to be terribly unprofitable but a good stock if the future cash flow expectation reflected in its valuation are low enough.

To justify its current price of ~$56.57, Starwood would have to grow its after-tax cash flow (NOPAT) by over 20% compounded annually for 11 years. Those are some high expectations…not just the high level of growth but also the long duration of expected growth.

The highest level of top-line growth achieved by Starwood in the last 10 years is 17% in 2002. Only once in the last 10 years has the company generated consecutive years of double-digit revenue growth (16% and 11% from 2005 to 2006).

A stock price valuation that implies 11 consecutive years of 20% growth in NOPAT is too high for most companies, especially a hotel in a global economy that is expected to be rather weak for the foreseeable future.

With no future profit growth, the value of Starwood’s stock is closer to $2 per share. Though I do not necessarily expect Starwood will achieve no future profit growth, I think the no growth value provides important perspective on how much growth is priced into the stock and how much risk investors take by holding it.

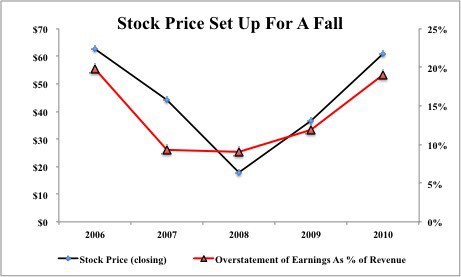

Figure 2 suggests that investors in HOT’s stock could be in for some trouble if history repeats itself. The last time Starwood’s reported earnings overstated its economic earnings by more than 15%, the stock fell over 70%, from the mid $60s to under $20 per share.

Figure 2: Earnings Overstatement Has Maxed Out

I also expect that Starwood’s earnings overstatement will revert to more normal levels because companies can only bend the rules so much before breaking them. In addition, Starwood’s overstatement of earnings as a percent of revenue will have to fall when FASB closes the off-balance sheet debt loophole in 2014.

Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk given the misleading earnings while there is little upside reward given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here.

In a business where investors make money by buying stocks with low expectations relative to their future potential, HOT fits the profile of a great stock to short or sell.

I also recommend selling the following ETFs because of their “dangerous” rating and exposure to HOT. Note the percentile ranks show where each ETF stands among the 375+ US Equity ETFs we cover, where 100% corresponds to the highest-rated ETF we cover. A free report for SPHB is available via the link below. See New Constructs’ website to access more ETF reports.

- PowerShares S&P 500 High Beta Portfolio (SPHB) – 8th percentile

- iShares Morningstar Mid Growth Index Fund (JKH) – 33rd percentile

- Vanguard Mid-Cap Growth ETF (VOT) – 34th percentile

17 replies to "Sell Starwood Before FASB Closes Loophole That Boosts EPS"

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk given the misleading earnings while there is little upside reward given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July™s most dangerous stocks and gets my œvery dangerous” risk/reward rating. There is lots of downside risk given the misleading earnings while there is little upside reward given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July™s most dangerous stocks and gets my œvery dangerous” risk/reward rating. There is lots of downside risk given the misleading earnings while there is little upside reward given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July™s most dangerous stocks and gets my œvery dangerous” risk/reward rating. There is lots of downside risk given the misleading earnings while there is little upside reward given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July™s most dangerous stocks and gets my œvery dangerous” risk/reward rating. There is lots of downside risk given the misleading earnings while there is little upside reward given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]

[…] Starwood is one July’s most dangerous stocks and gets my “very dangerous” risk/reward rating. There is lots of downside risk, given the misleading earnings, while there is little upside reward, given the already-rich expectations embedded in the stock price. More details on my rating and a free report on HOT are here. […]