We closed this Long Idea on November 12, 2025. A copy of the associated Position Close report is here.

Economic uncertainty remains elevated. In 2Q25, the percent of U.S. consumer debt in serious delinquency rose to the highest level since early 2020. Nearly 13% of student loan debt entered serious delinquency, which is the highest level in 21 years. Credit scores are trending lower, which reflects rising financial stress among consumers.

With the imminent implementation of new tariffs on August 7 and the approaching August 12 deadline for the U.S. and China trade agreement, the economic outlook is unlikely to stabilize in the near term.

In such an uncertain environment, investing in an income stock that generates robust cash flow and returns capital to shareholders could provide a safe haven. Our Long Idea this week fits that bill and offers upside potential to boot.

Below, we present a large excerpt from our latest Long Idea report published this week, available to Pro and Institutional members. You can buy the full report a la carte here.

We’re not giving you the ticker for this pick, but we are happy to share our hard work because we want you to see how good our research is.

This stock offers favorable Risk/Reward based on the company’s:

- decades of profit growth,

- leading position in growing markets,

- strong cash flow generation and capital return, and

- cheap stock valuation.

Profit Growth Across Decades

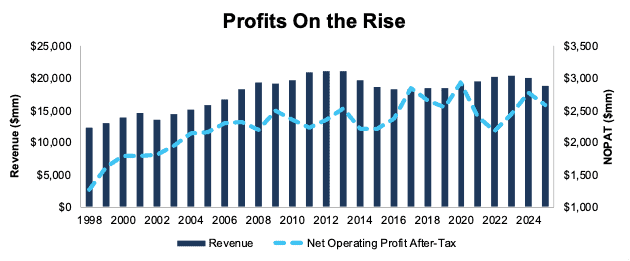

This company leverages its leading market position to grow its top- and bottom-line, consistently, even if at a slower pace than some high-flying names in the market. The company has grown revenue by 2% and net operating profit after-tax (NOPAT) by 3% compounded annually since 1998. See Figure 1.

More recently, this company improved its NOPAT margin from 11% in 2014 to 14% in the trailing-twelve-months (TTM) while invested capital turns held steady at 1.0 over the same time. Rising NOPAT margins drive the company’s return on invested capital (ROIC) from 12% in 2014 to 14% in the TTM.

Figure 1: Revenue and NOPAT Since 1998

Sources: New Constructs, LLC and company filings

Potential for 6%+ Yield

This company has paid a dividend for 91 consecutive years and increased its dividend for 51 consecutive years. Such stability is a welcome sign amongst the volatility and uncertainty in the market today.

In recent years, the company paid over $10 billion (23% of market cap) in cumulative dividends between 2019 and 1H25. The company increased its quarterly dividend from $1.03/share in 2Q19 to $1.26/share in 2Q25. The company’s current dividend, when annualized, provides a 3.8% yield. The company’s consistent dividend earns it a place in our latest Dividend Growth Stocks Model Portfolio.

This company also returns capital to shareholders through share repurchases. From 2019 through 2Q25, the company repurchased $3.3 billion (8% of market cap) of shares.

In January 2021, the company’s Board of Directors approved an authorization to repurchase up to 40 million shares in an amount not to exceed $5 billion with no specified expiration date.

As of 2Q25, the company has 31 million shares available to repurchase under the existing authorization. Should the company repurchase shares at its TTM (ending 2Q25) rate, it would repurchase $964 million of shares over the next twelve months, which equals 2.2% of the current market cap.

When combined, the dividend and share repurchase yield could reach 6.0%.

Strong Cash Flow Generation Supports Capital Return

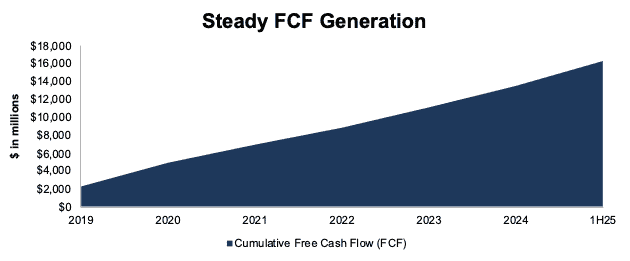

We take comfort in knowing this company will be able to afford to pay its dividends and repurchases based on its large free cash flow (FCF) generation. From 2019 through the TTM, the company generated $16.3 billion in FCF, which equals 31% of the company’s enterprise value.

Figure 2: Cumulative FCF: 2019 – 1H25

Sources: New Constructs, LLC and company filings

…there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

I’ll keep sending information on quality sectors, industries, or specific companies until you’re ready to start your membership, but know that we expect this pick to outperform.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.