The market is missing footnotes, and our research is the first and best at collecting footnotes data that delivers novel alpha – as proven by Core Earnings: New Data & Evidence, published in The Journal of Financial Economics.

We are very excited to partner with Bloomberg to launch a family of indices and bring more investors access to the proven novel alpha in our proprietary data and research.

Details:

This index takes the top 500 stocks by market cap and tilts toward the companies with high Earnings Capture, based on our proprietary Core Earnings data. We like to think of this index as an enhanced version of the S&P 500, and it is enhanced by weighting the holdings based on Core Earnings instead of market cap.

Official docs: Fact Sheet and the Index Methodology.

On the Bloomberg website or terminal, you can track performance with these tickers:

- Total Return Index B500NCT:IND

- Price Return Index B500NCP:IND

- Net Return Index B500NCN:IND.

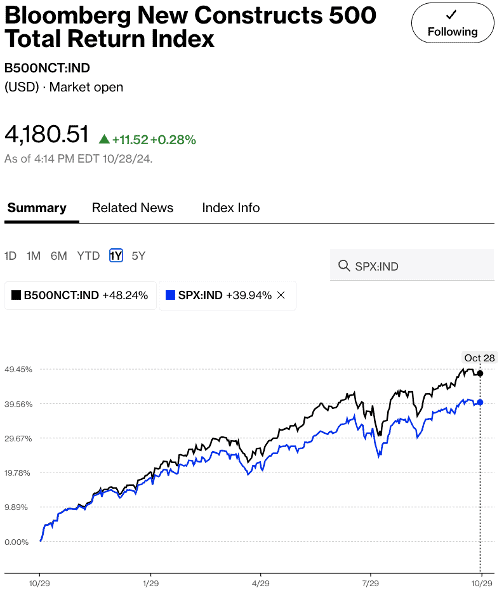

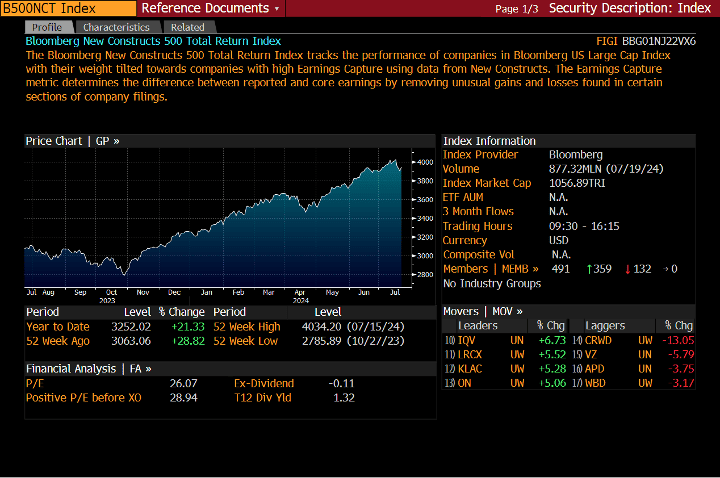

More details in Figures 1 and 2.

Figure 1: Bloomberg New Constructs 500 Index on the Bloomberg website

Sources: New Constructs, LLC & Bloomberg

Figure 2: Bloomberg New Constructs 500 Index on the Bloomberg Terminal

Sources: New Constructs, LLC & Bloomberg

This article was originally published on October 29, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.