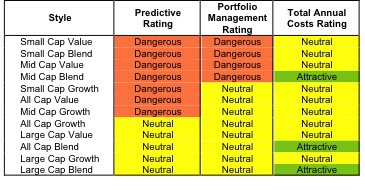

None of the fund styles earn a rating better than Neutral. See Figure 1 for my rankings on all twelve investment styles. My style ratings are based on the aggregation of my fund ratings for every ETF and mutual fund in each style.

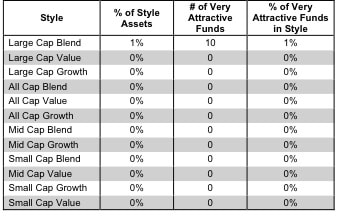

Only one style, Large Cap Blend, contains any funds that earn a Very Attractive rating. Figures 4 and 5 provide details. The primary driver behind a Very Attractive fund rating is good portfolio management, or good stock picking, with low total annual costs.

Note that the Attractive-or-better Predictive ratings do not always correlate with Attractive-or-better total annual costs. This fact underscores that (1) low fees can dupe investors and (2) investors should invest only in funds with good stocks and low fees.

See Figures 4 through 13 for a detailed breakdown of ratings distributions by investment style. See my free ETF & mutual fund screener for rankings, ratings and free reports on 7000+ mutual funds and 400+ ETFs. My fund rating methodology is detailed here.

Prior reports on the best & worst ETFs and mutual funds in every sector and investment style are available here.

Figure 1: Ratings For All Investment Styles

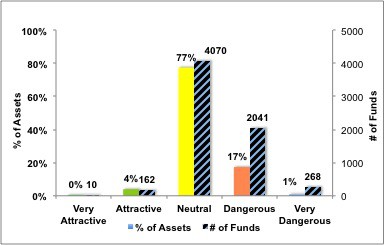

To earn an Attractive-or-better Predictive Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only 172 style ETFs and mutual funds meet these requirements, which is only 4% of all style ETFs and mutual funds.

GMO Trust: GMO Quality Fund (GQLOX) is my top Style mutual fund. It gets my Very Attractive rating by allocating over 57.9% of its value to Attractive-or-better-rated stocks.

The Coca-Cola Company (KO) is one of my favorite stocks held by GQLOX. KO earns my Attractive rating due to its 14.7% ROIC and low valuation (price-to-economic book value of 1.1). While we usually look for stocks with a price-to-EBV of less than one, Coke is the leader in a highly profitable industry. Coke’s ROIC is nearly 50% higher than its competitor PepsiCo Inc.’s (PEP) ROIC of 10%. That is a big difference in returns and commands a premium valuation. High returns on capital also give Coke greater cash flow to reinvest in the business to grow profits faster than lower-ROIC competitors. While Coke isn’t at a bargain basement price, its 2.6% dividend yield and modest valuation certainly make it a superior alternative to bonds for investors seeking income.

Bhirud Funds, Inc: Apex Mid Cap Growth Fund (BMCGX) is my worst Style mutual fund. It gets my Very Dangerous rating by allocating over 42% of its value to Neutral-or-worse-rated stocks, and to make matters worse, charges investors annual costs of 10.46%.

Clean Energy Fuels Corp (CLNE) is one of my least favorite stocks held by BMCGX. Under our five years of coverage, CLNE has never generated positive free cash flow. As it has invested more and more into its business, profits have not followed. This has led economic earnings to decrease (grow more negative) each year. To justify its current share price, CLNE would have to grow revenues by 30% annually for 14 years, with an operating margin of 3%. Considering CLNE has yet to turn an operating profit, it would be best for investors to avoid this stock as it is already priced for perfection.

Figure 2 shows the distribution of our Predictive Ratings for all investment style ETFs and mutual funds.

Figure 2: Distribution of ETFs & Mutual Funds (Assets and Count) by Predictive Rating

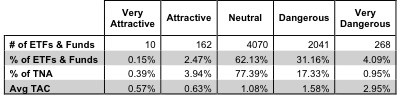

Figure 3 offers additional details on the quality of the investment style funds. Note that the average Total Annual Cost of Very Dangerous funds is over 5 times that of Very Attractive funds.

Figure 3: Predictive Rating Distribution Stats

Source: New Constructs, LLC and company filings

This table shows that only the best of the best funds get our Very Attractive Rating: they must hold good stocks AND have low costs. Investors deserve to have the best of both and we are here to give it to them.

Ratings by Investment Style

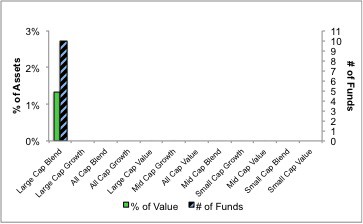

Figure 4 presents a mapping of Very Attractive funds by investment style. The chart shows the number of Very Attractive funds in each investment style and the percentage of assets in each style allocated to funds that are rated Very Attractive.

Only 10 investment style funds earn our Very Attractive rating.

Figure 4: Very Attractive ETFs & Mutual Funds by Investment Style

Figure 5 presents the data charted in Figure 4

Figure 5: Very Attractive ETFs & Mutual Funds by Investment Style

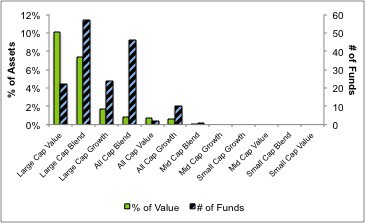

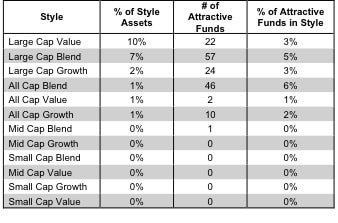

Figure 6 presents a mapping of Attractive funds by investment style. The chart shows the number of Attractive funds in each style and the percentage of assets allocated to Attractive-rated funds in each style.

Note that the Large and All Cap Value/Blend/Growth are the only styles with Attractive-rated funds.

Figure 6: Attractive ETFs & Mutual Funds by Investment Style

Figure 7 presents the data charted in Figure 6.

Figure 7: Attractive ETFs & Mutual Funds by Investment Style

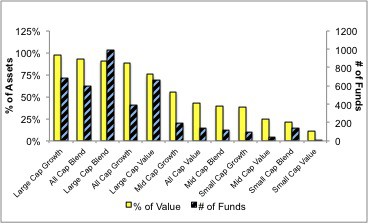

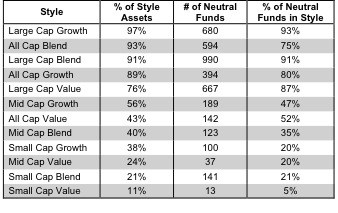

Figure 8 presents a mapping of Neutral funds by investment style. The chart shows the number of Neutral funds in each investment style and the percentage of assets allocated to Neutral-rated funds in each style.

Figure 8: Neutral ETFs & Mutual Funds by Investment Style

Figure 9 presents the data charted in Figure 8.

Figure 9: Neutral ETFs & Mutual Funds by Investment Style

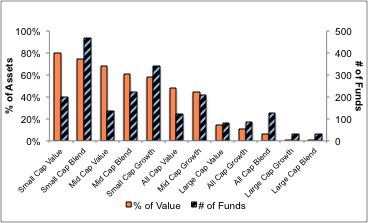

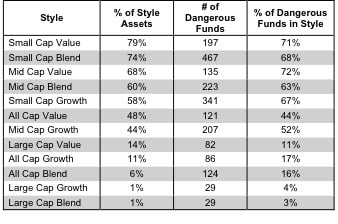

Figure 10 presents a mapping of Dangerous funds by fund style. The chart shows the number of Dangerous funds in each investment style and the percentage of assets allocated to Dangerous-rated funds in each style.

Small Cap style funds allocate, on average, over 70% of their assets to Dangerous-rated Funds.

Figure 10: Dangerous ETFs & Mutual Funds by Investment Style

Figure 11 presents the data charted in Figure 10.

Figure 11: Dangerous ETFs & Mutual Funds by Investment Style

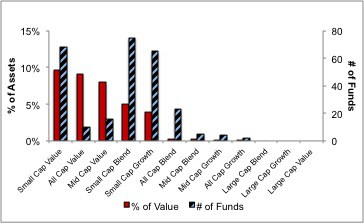

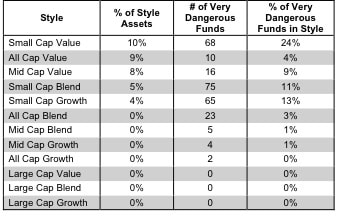

Figure 12 presents a mapping of Very Dangerous funds by fund style. The chart shows the number of Very Dangerous funds in each investment style and the percentage of assets in each style allocated to funds that are rated Very Dangerous.

10% of Small Cap Value fund assets are allocated to Very Dangerous stocks.

Figure 12: Very Dangerous ETFs & Mutual Funds by Investment Style

Figure 13 presents the data charted in Figure 12.

Figure 13: Very Dangerous ETFs & Mutual Funds by Investment Style

Disclosure: I receive no compensation to write about any specific stock, sector or theme.