Before we get started: Yesterday, I held a live webinar explaining the hottest sectors, key stocks to avoid and the proprietary research we have at New Constructs. It’s a limited time presentation and offer. Here’s the replay.

Markets move fast. They can turn on a dime. If you’re investing based on a narrative without understanding fundamentals, you’re playing a very dangerous game. And, I’m going to share a stock that is a perfect example of just how damaging narrative-based investing can be.

I’m not saying your investing process should be 100% fundamentals-based, but I am saying it should NOT BE 0% fundamentals-based. People can say fundamentals don’t matter, and they might be right for a short time, but, in the end, fundamentals always matter. It’s a law of nature: businesses that do not make money cannot survive forever.

Ignoring fundamentals is like playing chicken with a freight train. You’ll be fine if you jump off the track in time, but if you wait too long…splat. If you jump too soon and others HODL longer, you miss out on big gains. You have to wait until the last second, time the market and sell near the peak. Easier said than done. Just ask all the investors who lost a fortune in 2022.

Or, you can use fundamentals to get your cake and eat it too. I mean: use fundamentals AND technicals. Use fundamentals to help you gauge just how far away a stock’s valuation is from its fundamentals so you have a better sense of when to jump off the track. Just a suggestion.

Ok, here’s the perfect example of a Wall Street pump-and-dump stock scheme that was designed to take advantage of unsuspecting investors. This one is so obviously exploitative that it makes me angry to write about it. Having seen so many of these tricks over the years, I honestly get frustrated knowing that these ruses still work. Then, I realize that I’ve been inside Wall Street firms, and I have seen things, terrible things that opened my eyes to the realities of how devious these firms are. And, most people have never had anything like those experiences. So, it is part of my duty to support the integrity of the capital markets to explain what is going on. The bottom line is that most people simply do not realize how sneaky Wall Street analysts can be. So, here’s a perfect example, on April 11th, Wells Fargo analyst Elyse Greenspan raised her price target on Root (ROOT) from $12 to $64, or 500%, while not changing her “Equalweight Rating”. That’s not a typo. [Thanks to Giulio Helmsdorff for bringing that to our attention in a recent post he made in our Society of Intelligent Investors: “Sell Side Analysts Never Fail to Entertain”.]

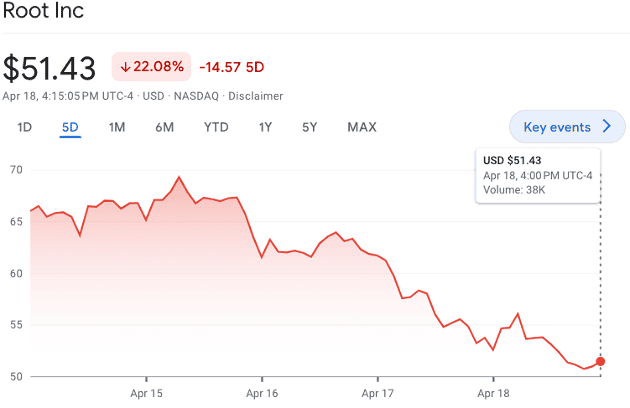

This “upgrade” happened after the stock nearly doubled. See chart below. My guess is that institutional investors needed more time to get out of the stock before it cratered, so Ms. Greenspan stepped up, baited the hook, and the rest is history.

Source: Google Finance

Guess what happened next. That’s right, the stock is down over 20%. Interesting time for a price target upgrade, don’t ya think?

Source: Google Finance

Add to the fact that options activity skyrocketed in ROOT last week, and I can tell you what’s going on. This is a pump and dump scheme. ROOT is trading like a meme stock, going up for no reason while Wall Street insiders use order flow to trade ahead of the market with plans to sell the stock to unsuspecting retail investors. I hope none of our readers took the bait.

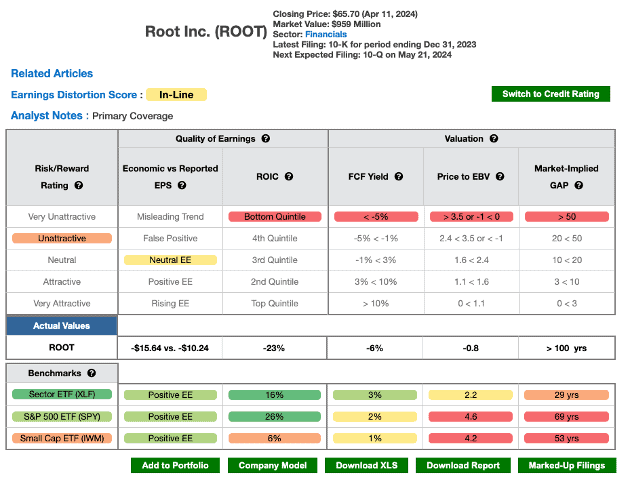

Curious about what New Constructs says about $ROOT. I typed in the ticker and pulled up our Rating on April 11th, and voila. See below. It’s not pretty. Do you wonder how a Wall Street analyst could have such a different opinion? The answer, as I have mentioned before, is that Wall Street analysts’ interests are not always aligned with yours. Oftentimes, Wall Street sees individual investors as “more sheep to lead to slaughter” – that’s a real line that an institutional investor actually said to me a couple years ago. It’s hard to see the $ROOT situation, and not think that’s exactly what’s going on.

I’m not here just to complain and wave red flags. I have solutions too. I hosted a special webinar last week: The Hottest Sectors In The Market Right Now. Replay here. In this webinar, I shared specific sectors that are good investments in this environment along with specific stocks and sectors that are not. With one of the most important earnings seasons upon us, I highly recommend you watch. You’ll see that not only do I provide specific recommendations on stocks to avoid and stocks to buy, but I also make a very special offer on some of our top products so you can, very cost effectively, de-risk your portfolio from the Most Dangerous Stocks and add the Most Attractive Stocks.

And, for those that didn’t know, we do a free live Podcast every month. The next one is on May 10th at 12pmET. Register here. Email us at support@newconstructs.com to make requests for stocks to review. Or, join (use this form to sign up for free) our Society of Intelligent Investors and ask questions and make requests anytime!

In the meantime, buckle your seat belt and get ready for a rocky earnings season. It’s gonna be exciting. Lots of opportunities for those who have our research.

Diligence matters,

David

This article was originally published on April 19, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.