LinkedIn (LNKD: $108/share) has fallen nearly 48% from the beginning of February. Market pundits and analysts are trying to “pick the bottom” largely in an effort to save face. 17 Wall Street firms have “Buy” or “Strong Buy” ratings, 13 firms have “Hold” ratings, and 0 firms have “Underperform” or “Sell” ratings on LinkedIn. While we know that ratings are nearly worthless and the bias is almost always positive, there is a lack of credible research on “just how low can LNKD go?” Our answer has not changed much since we put LinkedIn in the Danger Zone back in August 2013. We think the bottom for this stock is closer to $20/share.

Thesis Remains Unchanged

Our prior reports (from 2013 and 2014) were among the very first to note several problems with LinkedIn:

- Significant competition from the likes of Facebook, Twitter, and job search sites such as Monster.com.

- Revenue growth was slowing

- NOPAT margins were on the decline

- Hidden liabilities significantly reduced the value of the company

- Valuation implied astronomical growth rates

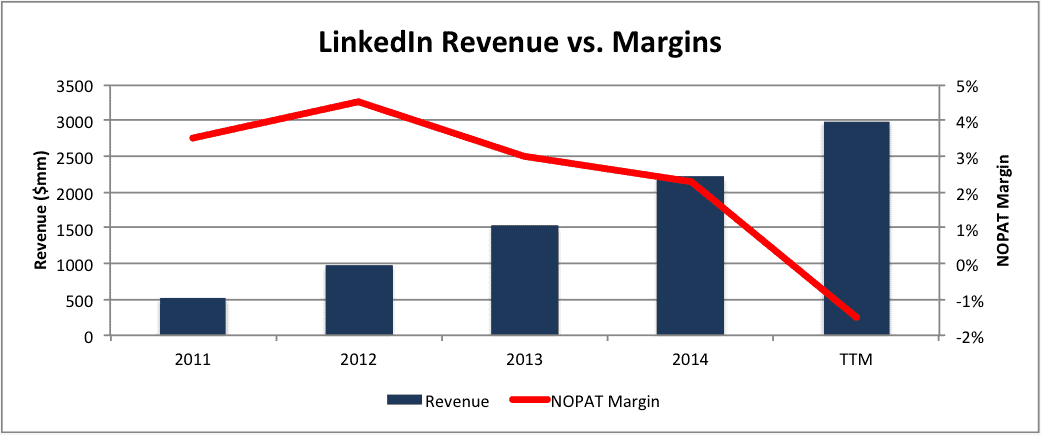

Our thesis has proven true. The problems above have only worsened. As Figure 1 shows, LinkedIn’s revenue, which grew 86% year-over-year in 2012, only grew 35% YoY in 2015. Even worse, margins have declined from 3.5% in 2011 to -1.5% over the last twelve months.

Figure 1: LinkedIn’s Declining Margins

Sources: New Constructs, LLC and company filings

Hidden Liabilities Undermine Valuation

Because LinkedIn finances its office space and data centers through the use of off-balance sheet debt in the form of operating leases, it has significant hidden obligations. In fact, LinkedIn has a total of $1.4 billion in future operating lease obligations, which we discount to a present value of $1.1 billion (24% of net assets and 8% of market cap). LinkedIn also has $132 million in outstanding employee stock option liabilities that must be removed from shareholder value.

Valuation Still Implies Unrealistic Growth Rates

Even after its 40% price cut, LNKD remains significantly overvalued. In order to justify its current price of $108/share, the company would need to immediately achieve a pre-tax margin of 4%, which was achieved in 2014, but has since fallen to -2.7% over the trailing-twelve-months. After achieving this margin, LinkedIn must grow NOPAT by 35% compounded annually for the next 13 years. This expectation seems even more improbable given that, since 2012, LinkedIn has only grown NOPAT by 7% compounded annually.

Even if LinkedIn can achieve 6% pre-tax margins (average since 2011) and grow NOPAT by 18% compounded annually for the next decade, the stock is worth $20/share today – an 81% downside. This scenario would imply nearly triple LinkedIn’s historical NOPAT growth. It’s not hard to see just how overvalued shares remain.

Valuation Is Unrealistic Even Given Acquisition Premium

With LinkedIn’s lowered valuation, one must wonder if a competitor such as Facebook (FB: $100/share – Dangerous Rating) could come pick up the pieces in an acquisition. Let’s take a look at LNKD’s valuation through the lens of a potential acquirer.

Let’s assume that Facebook acquires LinkedIn and upon acquisition LinkedIn immediately achieves Facebook’s margins and ROIC. In this scenario, the company would still have to grow revenue by 20% compounded annually for the next 11 years to justify buying LinkedIn at is current price (~$108/share). In this scenario, the value of LinkedIn’s business based on the value of the firm if it achieves FB’s 21% NOPAT margin in year 1 of the acquisition is $62/share – a 43% downside. The takeaway is that we think Facebook’s management is smart enough to wait for LNKD to drop to a more reasonable level before swooping in. No need to pay more than you have to.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Terry Chay (Flickr)

1 Response to "LinkedIn: How Low Can It Go? $20/share"

Absolutely love your analysis! Brilliant stuff