The most profitable products tend to be addictive. If given the choice, few salesmen would turn down the opportunity to sell an addictive versus one that was not addictive. Throw in the fact that cigarettes are relatively cheap to produce and you have an even more compelling value proposition.

I am not a smoker or tobacco user, and I do not like to be around smokers. However, that prejudice does not blind me from the fact that Lorillard, Inc. (LO) is a “very attractive” stock. I recommend investors buy it as well as the following ETFs because of their large allocations to LO and their attractive-or-better investment ratings:

- iShares Dow Jones Select Dividend Index Fund ETF (DVY) – “attractive” rating with 4% allocated to LO

- Rydex S&P Equal Weight Consumer Staples ETF (RHS) – “attractive” rating with 3% allocated to LO

- WisdomTree Dividend Top 100 Fund (DTN) – “attractive” rating with 2% allocated to LO

- PowerShares Buyback Achievers ETF (PKW) – “very attractive” rating with 1% allocated to LO

- SPDR Consumer Staples Select Sector Fund ETF (XLP) – “very attractive” rating with 1% allocated to LO

As one of May’s most attractive stocks, LO is both profitable and cheap.

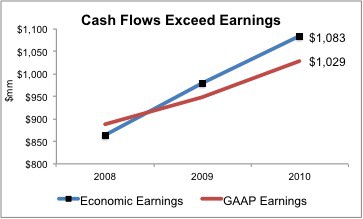

And when I say profitable, I mean that LO’s profits over the past two years rank in the top 1 percentile among companies in the US equity markets. The company achieves this financial feat by being one of only twenty-three companies of the 3000+ we cover whose economic earnings are both positive and greater than its reported accounting earnings over both of the last two fiscal years.

Figure 1: Lorillard’s Profitability Is in the Top 1% Percentile Of US Equities

The company’s return on invested capital (ROIC) is 450%, which also ranks among the very best in the US and beats firms like Apple (AAPL) and Google (GOOG) – both of which also earn our ‘very attractive” rating.

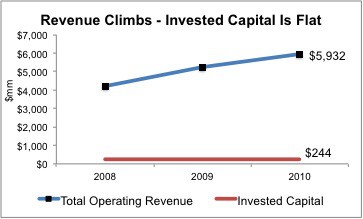

Most investors are likely to overlook the profitability of LO’s business model because it is not as evident on the company’s income statement as it is on its balance sheet. LO’s super high ROIC comes more from its capital efficiency than profit margins. Don’t get me wrong, LO’s net operating profit after tax (NOPAT) margins are impressive at 18.5%, but its invested capital turns are off the charts at 24.3. Figure 2 highlights how Lorillard is growing revenues without requiring much incremental capital, which translates into very strong cash flow generation.

And just looking at LO’s balance sheet is not enough because most of the cash that LO carries is not needed to run its business and is, therefore, excluded from invested capital, the denominator in the ROIC calculation. I call the excluded cash “excess cash”.

LO has $1,944 million of excess cash as of the end of fiscal year 2010, which equals nearly 12% of the company’s market cap when the stock price is below $113/share.

Figure 2: Cash Flows Prosper As LO Grows Without Needing More Capital

Speaking of the stock price, the valuation of LO is mouth-wateringly low. At $113, the valuation of LO’s stock implies the company’s profits will permanently decline by nearly 20%. I say the market is setting the bar quite low for LO’s management.

Assuming no future profit growth, LO’s stock is worth over $137.

I do not think investors should be discouraged by the recent adverse legal decision out of Jacksonville, Florida. This judgment will not derail the LO business model. And I think people will still buy cigarettes no matter what the warning labels say. Really, is there really anyone out there who thinks smoking is good for them…in the long term? Have you seen the warning labels that are on tobacco products in Europe? Those warning labels do not pull any punches, and, yet, there are still many smokers in Europe.

Even if one assumes that cigarette smoking is declining, it is hard to agree with the stock price’s prediction that it will permanently decline by nearly 20% in 2011.

The risk/reward of this stock is quite compelling. Downside risk is low as the valuation at $113/share already implies a permanent 18% decline in profits. Upside reward potential is strong as the stock has to go over $137/share to trade at a value that implies the company’s profits will experience a 0% decline, still a no-growth scenario.

Lorillard’s stock presents an excellent buying opportunity at current levels because it meaningfully underestimates the future cash flow potential of the company.

For details on what causes the difference between economic versus accounting profits during the last five fiscal years, see Appendix 3 on page 10 of our report on LO. See Appendix 4 to learn how LO increased net operating profit after tax (NOPAT) and its NOPAT margin. Appendix 7 shows LO’s ROIC over the past five years.

I am long Lorillard (LO) and Apple (AAPL).

Note: Stock pick of the week is updated every Tuesday.

2 replies to "Lorillard’s Profits Require No Smoke and Mirrors"

[…] accounting profits during the last five fiscal years, see Appendix 3 on page 10 of our report on LO. See Appendix 4 to learn how LO increased net operating profit after tax and its NOPAT […]

[…] accounting profits during the last five fiscal years, see Appendix 3 on page 10 of our report on LO. See Appendix 4 to learn how LO increased net operating profit after tax (NOPAT) and its […]