Select Sector SPDR-Consumer Staples (XLP) is our top pick for consumer staples sector ETFs. XLP is one of four ETFs, out of the 270 we currently cover, to get our very attractive rating. We also rate the investment merit of the top five consumer staple sector ETFs.

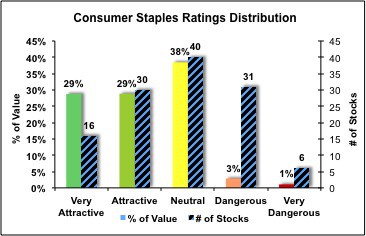

Per our first-quarter-2011 review of U.S. Equity Sector ETFs, the consumer staple sector is one of three sectors that gets our “attractive” rating. Per Figure 2, the consumer staple sector allocates 58% of its value to stocks with an attractive-or-better rating. Only 4% of its values goes to dangerous-or-worse-rated stocks.

Some good stocks in the consumer staple sector to buy individually or as part of an ETF are Wal-Mart (WMT), Proctor and Gamble (PG) and Clorox (CL). Some stocks to avoid, sell or short in the consumer staple sector are Bunge (BG), Whole Foods Market (WFM) and United Natural Foods (UNFI).

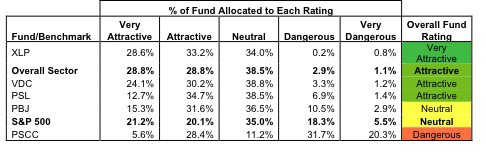

Though the consumer staples sector offers many stocks with strong investment potential, not all ETFs can be trusted. Investors must assess the merits of each ETF based on its constituents. Per Figure 3, there are several ETFs to avoid in this sector.

Figure 1: Consumer Staple Sector – Capital Allocation & Holdings by Risk/Reward Rating

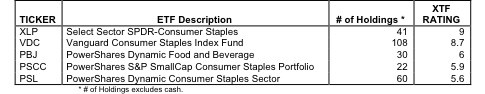

When analyzing the consumer staple sector ETFs, we started by identifying those ETFs with acceptable structural integrity as measured by XTF, an ETF research firm. We chose the 6 ETFs whose XTF rating was above the sector average XTF rating.

Figure 2: Consumer Staple ETFs With Acceptable Structural Integrity

Figure 2 shows clearly that not all consumer staple ETFs are made the same. Different ETFs have meaningfully different numbers of holdings and, therefore, different allocations to holdings. Given the differences in holdings and allocations, these ETFs will likely perform quite differently.

After determining the structural integrity, we analyzed the investment merit of each ETF based on how it allocated value to each stock it held. Figure 3 shows how the five consumer staple sector ETFs stack up versus each other and the overall sector based on their overall risk/reward ratings and the allocation of their holdings by rating.

Figure 3: Investment Merit Based on Holdings and Allocations

Attractive ETFs:

XLP, VDC, and PSL – these 3 ETFs earn an attractive-or-better rating and therefore, they are the only consumer staples ETFs we recommend. Our top pick from this group is XLP.

Neutral ETFs:

PBJ allocates its value in a way that earns it a neutral rating. We recommend investors buy the very attractive and attractive stocks in this sector before buying any of the consumer staples ETFs except those we recommend. Contact us for the full list of 46 consumer staples companies that earn an attractive-or-better rating.

Dangerous ETFs:

We recommend investors avoid or sell short PSCC because of its dangerous rating.

Benchmark Comparisons

Sector Benchmark

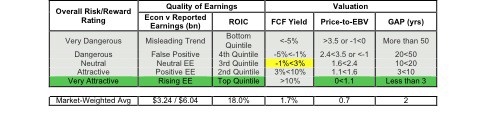

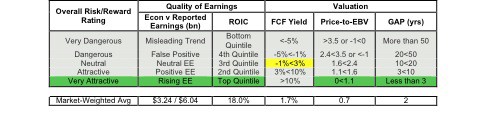

XLP has similar ratings to the overall sector. XLP has a market-implied growth appreciation period (GAP) of only 2 years compared to the overall sector’s GAP of 5 years. XLP’s shorter GAP makes it a more attractive investment than the overall sector.

Figure 6: XLP – Risk/Reward Rating

Figure 5: Consumer Staples Sector – Risk/Reward Rating

XLP more effectively allocates capital than the overall consumer staples sector. Per Figure 4 above, XLP allocates 62% of its value to attractive-or-better-rated stocks while the sector allocates 58%. XLP also allocates less than 1% of its value toward dangerous-or-worse-rated stocks compared to the sector’s dangerous-or-worse weightings of 4%.

For explanation and details behind our risk/reward rating system, see one of our Company Valuation reports, which are available for free here.

Market Benchmark

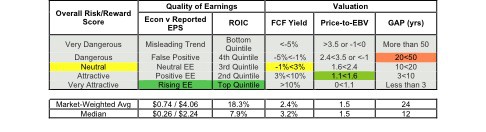

XLP outperforms the S&P 500 in valuation ratings. XLP has a price-to-EBV of only 0.7, earning it a very attractive rating, and a GAP of 2 years compared to the S&P 500’s price-to-EBV of 1.5 and GAP of 24 years.

XLP and the S&P 500 have similar quality of earnings ratings.

Figure 6: XLP – Risk/Reward Rating

Figure 7: S&P 500 – Risk/Reward Rating

XLP allocates capital more effectively than the S&P 500. Per Figure 3 above, XLP allocates 62% of its value to attractive-or-better-rated stocks while the S&P 500 allocates 41%. XLP also allocates less than 1% of its value toward dangerous-or-worse-rated stocks compared to the S&P 500’s dangerous-or-worse weightings of 24%.

Methodology

This report offers recommendations on consumer staples sector ETFs and benchmarks for (1) investors considering buying Consumer Staples sector ETFs and for (2) comparing individual ETFs to the Consumer Staples sector and the S&P 500. Our analysis is based on aggregating results from our models on each of the companies included in every ETF and the overall sector (123 companies) based on data as of April 20th, 2011. We aggregate results for the ETFs in the same way the ETFs are designed. Our goal is to empower investors to analyze ETFs in the same way they analyze individual stocks.

To make an informed ETF investment, investors must consider:

1) The structural integrity of the ETF and its ability to fulfill its stated objective. We use XTF, an ETF research firm, to find the top five ETFs with the best structural integrity rating.

2) The quality of the ETF’s holdings. We determine an ETF’s quality using our stock ratings.

Given the success of our Rating system for individual stocks, we believe its application to groups of stocks (i.e. ETFs and funds) helps investors make more informed ETF and mutual fund buying decisions. Barron’s regularly features our unique ETF research.