The Consumer Discretionary sector ranks fourth out of the ten major sectors as detailed in our sector roadmap. It gets my Neutral rating, which, like my fund ratings, is based on aggregation of stock ratings for each of the 470+ companies in the sector. The full series of my reports on the Best & Worst Sector and Style Funds is here.

The problem with Consumer Discretionary stocks in an anemic economic environment is that many of them will suffer as consumers and businesses cut back on non-essential products and services. Investors must tread carefully when making investments in this sector. Per previous articles, the best sectors for finding stocks are Technology and Consumer Staples, both of which get my Attractive rating.

If you choose to shop for investments in the Consumer Staples sector, keep in mind that there are no Attractive-rated ETFs or mutual funds. Comparatively, there are plenty of Attractive-or-better rated stocks, which make up over 30% of the value of the sector. It appears that the managers of funds in this sector are not doing a good job of picking good stocks.

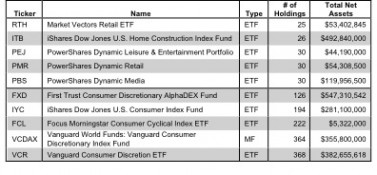

There are 44 funds to chose from within the Consumer Discretionary sector, and they are all very different. Per Figure 1, the number of holding varies widely (from 25 to 368), which creates drastically different investment implications and ratings. Here is the full list of 44 funds.

How do investors pick the right fund out of the sea of choices that will deliver the best returns?

Figure 1: Funds with Most & Least Holdings – Top 5

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 2.

Our predictive fund ratings are based on aggregating our stock ratings on each of the fund’s holdings and all of the fund’s expenses. Investors deserve forward-looking fund research that is comparable in quality to stock research.

Investors should not rely on backward-looking research of past performance for investment decisions.

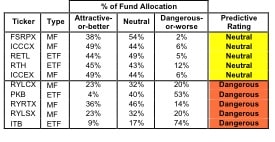

Figure 2 shows the five best and worst-rated funds for the sector. The best funds allocate more value to Attractive-or-better-rated stocks than the worst funds and vice versa. In addition, my ratings account for the total annual cost of investing in a fund or ETF. My ratings (updated daily) on all funds here.

One of my favorite stocks in the Consumer Discretionary sector is Autozone [s: AZO], which gets my Very Attractive rating. The fund that allocates the most to AZO is Fidelity Select Portfolios: Retailing Portfolio [s: FSRPX]. Per Figure 2, it is my top-rated fund in the sector even though it gets a Neutral rating. A copy of my report on the fund is here. FSRPX would earn a better rating if it held more stocks like AZO. It is one of the few stocks that benefits from a weak economic environments as more people look to fix their vehicles themselves rather than pay the premium for someone else to do it. Like all Very Attractive stocks, Autozone has an impressive ROIC of 25% and a low expectations for future cash flows, i.e. a cheap valuation.

One of my least favorite Consumer Discretionary stocks is Wyndham Worldwide [s: WYN], which gets my Very Dangerous rating. Not surprisingly, the fund that allocates the most to WYN is not a favorite either as it gets my Dangerous rating: Fidelity Select Portfolios: Leisure Portfolio [s: FDLSX]. WYN has an astonishingly expensive valuation for a company in a business based almost entirely on discretionary spending. Its current stock price (~$40/share) implies the company will grow its profits at 15% compounded annually for over 20 years. That is setting the bar way too high for my taste.

Figure 2: Funds with the Best & Worst Ratings – Top 5

Sources: New Constructs, LLC and company filings

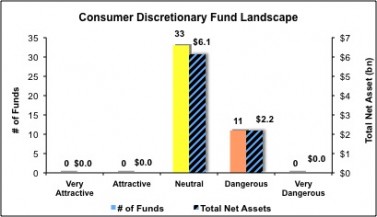

Investors should not buy any Consumer Discretionary funds. None of the 44 funds for the sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive overall rating. Figure 3 shows the rating landscape of all ETFs and mutual funds in the Consumer Discretionary sector.

Our Sector Roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 3: Separating the Best Funds From the Worst

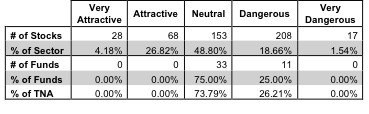

Figure 4 offers additional details on the quality of funds in the sector. Note the large difference between the number and value of stocks versus funds that are Attractive-or-better-rated. Fund managers in this sector are not doing a good job of picking stocks.

Figure 4: Consumer Discretionary Fund Landscape Details

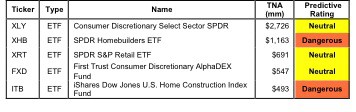

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular Consumer Discretionary funds.

Figure 5: Five Largest Consumer Discretionary Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

The full list of Consumer Discretionary funds and our ratings on each fund is here.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.