Our “Create Fund” tool gives clients the ability to create a custom basket of stocks, ETFs and/or mutual funds weighted according to traditional and our proprietary factors. This proprietary tool is now available to Institutional members only.

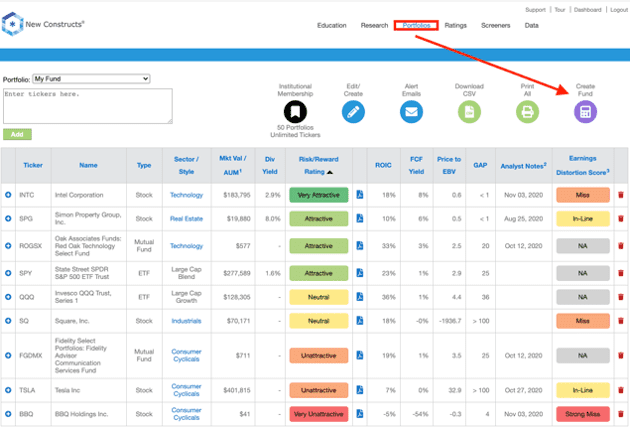

How to Find It: Access the Create Fund tool on the Portfolios page, as seen in Figure 1.

Figure 1: New Constructs Website: Create Fund Button

Sources: New Constructs, LLC and company filings.

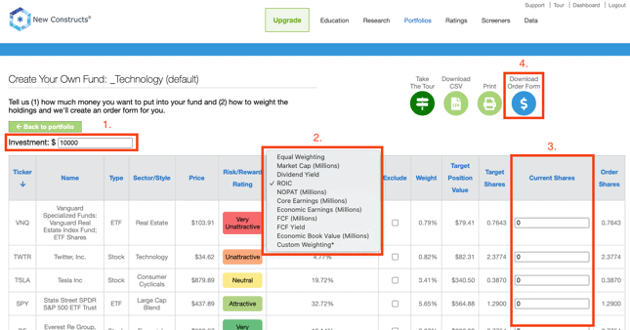

How to Use It: Figure 2 shows where to access key features on the “Create Fund” page:

- Enter any investment amount – our system automatically adjusts your order form for the amount of money you wish to allocate.

- Choose the weighting methodology – we offer 10+ factors, including market cap, dividend yield, our proprietary Core Earnings and return on invested capital (ROIC), as well as custom weightings.

- Enter current shares – enter the number of shares you already own and they’ll be deducted automatically for what you need to order to achieve the Target Shares.

- Download Order Form – get a CSV file with every order needed to create the portfolio on the page. Click here for a sample.

Figure 2: How to Use the “Create Fund” Tool

Sources: New Constructs, LLC and company filings.

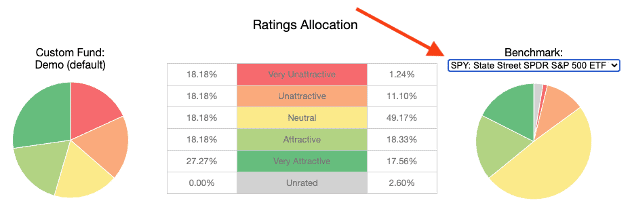

Benchmark the Quality of Your Fund: Figure 3 shows how the Create Fund tool automatically compares the Stock Ratings allocation of your custom fund to one of 23 benchmarks. To select a benchmark, open the drop-down menu to the right of the “Ratings Allocation” table.

Figure 3: Compare Stock Allocation to Benchmarks

Sources: New Constructs, LLC and company filings.

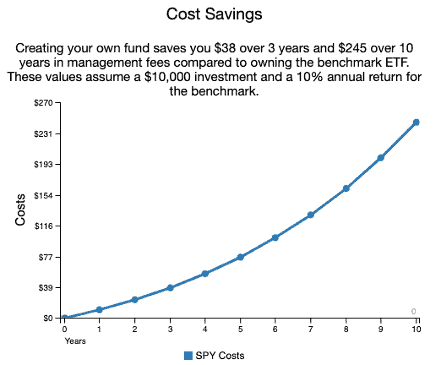

Benchmark the Cost of Your Fund: Figure 4 shows how the Create Fund tool automatically estimates your cost savings compared to investing in a chosen benchmark.

Figure 4: Quantify Your Cost Savings Feature

Sources: New Constructs, LLC and company filings.

Please contact us at support@newconstructs.com if you have any questions.

This article originally published on March 4, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.