Netflix (NFLX: $360/share) reported earnings on Wednesday, and disappointing subscriber growth numbers promptly caused the stock to plummet 20%. This disappointing report reaffirms my bearish call from last November. Loads of new competition will continue to kill the company’s margins. The company cannot raise prices without risking loss of market share to low-cost offerings from competitors. Contents costs will continue to rise whether it is original or licensed. The days of high margins and rapid revenue growth are gone. Momentum investors beware. Once this stock starts to trade on fundamentals like free cash flow, it has a long way to fall.

More Competition Taking Market Share

Wednesday’s earnings report wasn’t the only big news that affected NFLX. Earlier in the day, Time Warner (TWX) announced that HBO would begin offering its programming online without requiring a cable subscription. Netflix downplayed the news in its press release and argued that many people will subscribe to both Netflix and HBO. While this is undoubtedly true, it’s hard to believe there won’t be some cord-cutters in the future who will pick HBO at the expense of Netflix.

HBO is not the only competitor making inroads against Netflix’s lead in the digital streaming industry. CBS (CBS) announced its own subscription streaming service on Thursday. The new service, “CBS All Access,” will allow users to stream most of CBS’s current and past shows on demand and watch live streams of local affiliate stations. At $5.99/month, CBS All Access is cheaper than Netflix, which is now $8.99/month. NFL games are not currently available on the web service, but CBS officials are reportedly in discussion with the league to get the rights to stream the games, which would be a huge draw to potential subscribers.

Other existing streaming competitors are making big strides. Amazon (AMZN) recently had its first hit in original content with the critically acclaimed series Transparent. Yahoo Screen (YHOO) looks set to take a big step forward in original programming with the new season of cult favorite Community. Netflix remains the clear leader in streaming content, but the competition is permanently taking market share.

Content Costs Are Killing Free Cash Flow More Than the Company Admits

Due in part to the proliferation of competing streaming services of what is becoming commoditized content, Netflix must invest more in proprietary content to differentiate itself. In August, Netflix spent $2 million/episode to acquire the rights to the NBC drama The Blacklist. More recently, Netflix announced its push into feature film development with a sequel to Crouching Tiger, Hidden Dragon and four movies with Adam Sandler.

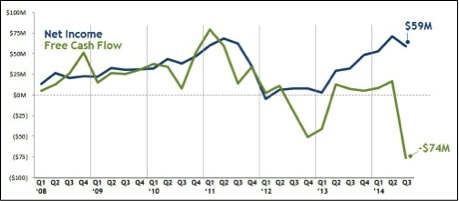

Figure 1: Netflix’s Free Cash Flow Is Dramatically Low

Sources: http://www.sec.gov/Archives/edgar/data/1065280/000106528014000024/nflx-093014xex991.htm

Netflix’s streaming content obligations, which I highlighted in April, increased by $1.2 billion in the last quarter alone, from $7.7 billion to $8.9 billion. Year over year, streaming content obligations in the quarter are up $2.4 billion, or 37%. The steadily increasing cost of content continues to hurt Netflix’s free cash flow, which the company acknowledged in a graph on page six of its earnings announcement.

In truth, that graph actually understates the problem for Netflix. Their measure of free cash flow adds back stock compensation expense to operating cash flows and only factors in current capital expenditures and not contractually obligated future payments for capital already in use by Netflix.

The company’s real free cash flow is much worse that what it reports (not unlike Amazon’s free cash flow propaganda). Netflix’s negative free cash flow actually began in 2011, and over the past three years the company has averaged -$500M in free cash flow.

Slowing Subscriber Growth Caps Growth Potential

Questions over whether Netflix’s recent price hike would impact subscriber growth were answered this quarter as Netflix’s subscriber growth came in well under expectations. Netflix added just 3 million subscribers in the most recent quarter rather than the 3.7 million that were projected.

Of the 3 million new subscribers, just 1 million came from Netflix’s domestic streaming segment, while the international segment gained 2 million. The low growth in domestic streaming subscribers suggests Netflix might be nearing saturation domestically. Its 37 million streaming members in the U.S. represent roughly 1/3 of total households, and that doesn’t include the numerous people getting access to the service via shared passwords. Given that some streaming customers will certainly opt for other services (or pirated streams), one has to wonder how much market share remains for Netflix domestically.

The 2 million subscriber adds internationally also came in below forecasts as the company was hoping for more traction with its launch in six European countries, including Germany and France, in September. I argued in May that Netflix would have a harder time growing internationally than it did in the U.S.

In addition to the low subscriber growth, Netflix continues to face significant profit losses in Europe. These losses should get even worse, as new Value Added Tax (VAT) rules in Europe should cost the company an extra 5% of revenue according to CFO David Wells.

Valuation is Still Dangerously High

Despite shedding 1/5 of its market cap overnight, NFLX’s valuation still implies unrealistic profit growth. In order to justify its current valuation of ~$360/share, NFLX must grow NOPAT by 32% compounded annually for 11 years. Decelerating subscriber growth and rising content costs makes it hard to argue that such an optimistic scenario is possible. Slower growth and increasing pressure on margins look to be the new normal for Netflix.

If NFLX can grow NOPAT by 16% compounded annually for 15 years, the stock is worth just $120/share today, a 66% drop from the current price. Don’t be fooled into thinking the recent drop is a buying opportunity. NFLX remains significantly overvalued.

Momentum investors who chase sentiment sometimes get lucky, as they did with NFLX in 2013. Fundamentals always catch up with a stock in the end though, and the fundamentals say NFLX could have a lot farther to fall.

Avoid These Funds

Investors should avoid these funds due to their significant allocation to NFLX and Dangerous-or-worse rating.

1. RBB Fund, Scotia Dynamic Fund (DWUGX): 4.9% allocation to NFLX and Very Dangerous rating.

2. RidgeWorth Funds: Aggressive Growth Stock Fund (SCATX): 4.8% allocation to NFLX and Dangerous rating.

3. Hennessy Technology Fund (HTCIX): 4.3% allocation to NFLX and Dangerous rating.

4. BlackRock Mid-Cap Growth Equity Portfolio (CMGIX): 3.1% allocation to NFLX and Dangerous rating.

5. Advantage Funds: Dreyfus Technology Growth Fund (DTGRX): 3.1% allocation to NFLX and Dangerous rating.

6. Berkshire Focus Fund (BFOCX): 3.0% allocation to NFLX and Very Dangerous rating.

Sam McBride contributed to this report.

Disclosure: David Trainer is short NFLX. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.