If you run a farmer’s market and sell your own produce, you would likely place your products in the most advantageous spot to maximize your sales.

This week’s Long Idea pick applies that same logic at a national scale. The company leverages control over its shelf space to grow its own private-label brands. At the same time, it is expanding and improving its digital capabilities through several new initiatives.

The good news for investors is that despite these two strong profit growth drivers, the company’s stock remains undervalued.

By leveraging the first truly-reliable AI for investing, we can identify these hidden gems across the entire market and deliver them to clients on a silver platter.

We first made The Kroger Company (KR: $67/share) a Long Idea in August 2022. The headlines around the company have been quite tumultuous since, culminating with the U.S. blocking the potential merger between Kroger and Albertsons (ACI). Beyond the headlines though, the business remains strong. After beating earnings in last quarter (fiscal 2Q26), we believe now is a great time to remind investors Kroger still offers the same attractive risk/reward that led us to make it a Long Idea in the first place.

Kroger remains the second largest grocer in the U.S. and is on track to grow profits off the back of strong digital and private label sales. Best of all, its stock remains cheap.

KR presents quality Risk/Reward based on the company’s:

- 2nd largest grocery retail store footprint and market share in the U.S.,

- eCommerce and private-label brand growth,

- increasingly efficient stores,

- impressive dividends and repurchases supported by strong cash flows, and

- stock valuation that implies profits will never grow again from current levels.

What’s Working

2nd Largest Grocery Retailer in the U.S.

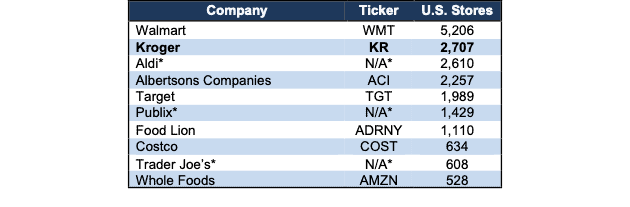

Kroger continues as the 2nd largest grocery retailer in the U.S. in both market share and store count since our original report in 2022. As of mid 2025, Kroger operates just over 2,700 stores across the country, which is more than competitors Aldi, Albertsons (ACI), Target (TGT), Publix, and more. The only competitor with more physical store locations is Walmart (WMT). See Figure 1.

Kroger’s extensive store network provides a crucial advantage in the form of large amounts of shelf space that Kroger can allocate to its own line of private-label products. Being able to showcase its products at guaranteed scale is a privilege traditional consumer brands lack.

Having no control over shelf space is a big disadvantage as we’ve explained in our Danger Zone thesis on Beyond Meat.

Figure 1: Number of Stores of Top Grocers in the U.S.

Sources: New Constructs, LLC and company filings

*privately held

High Quality Data Matters: Even in Grocery Stores

Kroger’s retail presence, along with over 20 years of investing in data science capabilities, provides another distinct advantage over smaller competitors: more data.

With more locations and foot traffic, Kroger can collect more data on consumer preferences, price sensitivity, promotion success and much more. The company can and does leverage the data in many ways to personalize customer experience, adjust its own private-label brands, and focus on the right areas to continue to grow its business. For instance, Kroger recently brought back paper coupons, in part because older shoppers were feeling “disenfranchised” with digital coupons. CEO Ronald Sargent noted on the latest earnings call that as a result, customer price perception “improved in nearly every division this quarter (fiscal 2Q26).”

We’ve long emphasized the importance of quality data, alongside the difficulty of acquiring quality data. There is no better data than that collected directly from the source. By owning and collecting its own data, Kroger removes middlemen and gets a read on exactly what its costumers do and don’t like.

Private-Label Brands Continue to Succeed

Kroger may not need its own data to know that consumers are increasingly choosing private labels over brand products, especially as economic conditions tighten.

Kroger has successfully grown its own private label brands, which include over 13,000 items, to tap into this consumer shift. In the 12 months ended February 1, 2025, Kroger’s private label products, collectively “Our Brands” generated over $32 billion in sales. Our Brands sales have grown from 19% of revenue in fiscal 2020 (period ended Feb 1, 2020) to 22% of revenue in fiscal 2025 (period ended Feb 1, 2025.)

Perhaps most impressive, Kroger has grown Our Brands sales 7% compounded annually over the past five years, while total food-at-home (FAH) nominal expenditures in the U.S. grew 5% compounded annually over the same time.

eCommerce Ramping Up

Beyond private label, Kroger’s eCommerce sales represent another growth opportunity. The company is currently taking steps to improve eCommerce operations, expand availability, and increase profitability.

As part of the efforts to make delivery faster and more profitable, the company is closing three automated fulfillment centers. Kroger CEO Sargent noted that Kroger is capable of delivering orders in less than two hours from 97% of its 2,700 stores in the United States. Management expects this new strategy, along with other initiatives outlined below, to increase eCommerce profitability by $400 million next year.

As part of the initiative to grow its eCommerce segment, Kroger is also expanding its relationship with third-parties.

Kroger expanded its relationship with Instacart, doing business as Maplebear (CART), which is already Kroger’s primary delivery fulfillment partner. The two companies will increase access to Express Delivery (less than 30-minute) options on the Kroger website and Instacart will add agentic shopping capabilities in the form of an AI cart assistant to make it easier and faster for customers to build their carts.

Kroger also reached a partnership deal with DoorDash (DASH) to bring Kroger’s full grocery inventory to DoorDash customers.

Last but not least, Kroger recently expanded its partnership with Uber Eats, which will bring Kroger’s full product assortment to Uber Eats’ platform beginning early 2026.

All three of these partners seamlessly integrate Kroger’s loyalty program onto their platforms, which means existing loyalty members will be able to take advantage of loyalty program deals and benefits through the partners’ platforms.

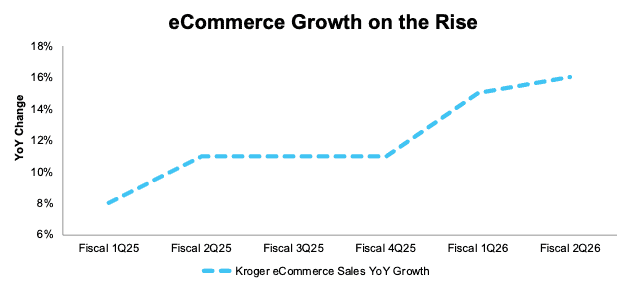

These deals should only accelerate an already fast-growing eCommerce business. Per Figure 2, Kroger has grown eCommerce sales by double digits in each of the past five quarters. Most recently, Kroger grew its eCommerce sales by 16% YoY in fiscal 2Q26 (quarter ended August 16, 2025).

Figure 2: Kroger eCommerce Sales YoY Growth: Fiscal 1Q25 – 2Q26

Sources: New Constructs, LLC and company filings

Same Store Sales Are Rising

Growing top-lines in both its private-label and eCommerce businesses drive Kroger’s same-store sales excluding fuel (what Kroger refers to as “identical sales, excluding fuel”) as well.

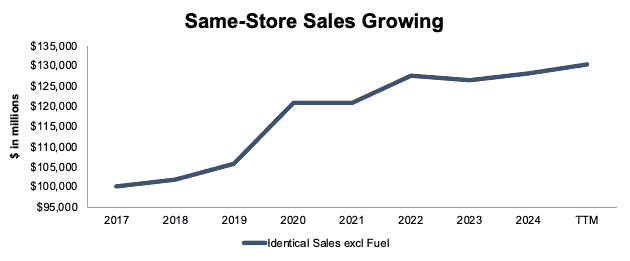

Per Figure 3, Kroger’s same-store sales excluding fuel grew from $100.2 billion in 2017 to $130.5 billion in the TTM, or 4% compounded annually.

Figure 3: Kroger Same-Store Sales: 2017 – TTM

Sources: New Constructs, LLC and company filings

Profits Per Square Foot Are Rising

Not only is Kroger growing its sales excluding fuel, but it’s also improving store efficiencies while growing its total supermarket square footage.

As the company grew total supermarket square footage from 162 million square feet in 2014 to 182 million square feet in 2024, it also improved its net operating profit after-tax (NOPAT) per square foot from $14.8 to $21.8 over the same time.

Decades of Consistent Profit Growth

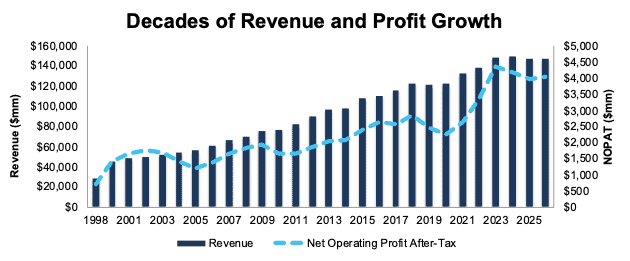

Despite some YoY fluctuations, Kroger has grown profits across nearly three decades. Since fiscal 1998, the first year in our model, Kroger has grown revenue and NOPAT by 6% and 7% compounded annually. See Figure 4.

More recently, the company’s NOPAT margin improved from 1.8% in fiscal 2020 (year-ended Feb 1, 2020) to 2.8% over the TTM, while it’s invested capital turns increased from 2.7 to 2.8 over the same time. Rising NOPAT margins and invested capital turns drive Kroger’s return on invested capital (ROIC) up from 5% in fiscal 2020 to 8% in the TTM.

Figure 4: Kroger’s Revenue and NOPAT: Fiscal 1998 – TTM

Sources: New Constructs, LLC and company filings

Potential for 6.1%+ Yield

From fiscal 2018 through fiscal 2Q26, Kroger paid $5.3 billion (12% of current market cap) in regular dividends. The company increased its regular dividend from $0.14/share in calendar 4Q18 to $0.35/share in calendar 3Q25. When annualized, the current dividend provides investors a 2.1% yield.

Kroger also returns capital to shareholders through share repurchases. From fiscal 2018 through fiscal 2Q26, Kroger repurchased a total of $12.6 billion (29% of market cap) of shares. As of August 16, 2025, the company had $2.5 billion remaining in repurchase authorization.

Should the company repurchase shares at levels consistent with average repurchases over the last three years, it would repurchase nearly $2 billion worth of shares over the next twelve months, which equals 4.0% of its market cap. When combined with dividends, investors could see a yield of 6.1%.

Ample Cash Flow Generation

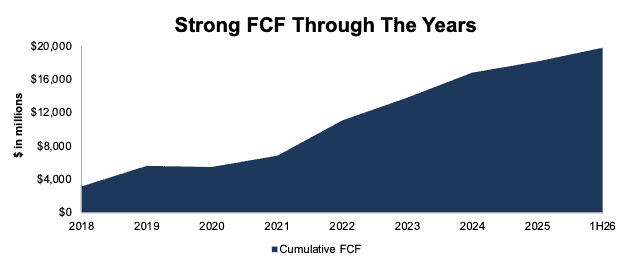

Kroger’s ability to consistently generate quality free cash flow (FCF) provides a level of safety for its shareholder capital return plans and remains one of the reasons its stock provides quality risk/reward.

Kroger generated a cumulative $19.8 billion (28% of enterprise value) in FCF from fiscal 2018 through fiscal 2Q26. In the first two quarters of fiscal 2026 alone, the company generated $1.6 billion in FCF. See Figure 5.

Kroger has generated positive FCF in 24 of the 27 years in our company model.

Kroger’s large FCF generation allows the company to reinvest into growing its business and consistently return capital to shareholders. The company’s cumulative $19.8 billion in FCF is more than enough to cover its $17.8 billion in combined dividends ($5.3 billion) and share repurchase ($12.6 billion) payments since fiscal 2018.

Figure 5: Kroger’s Free Cash Flow: Fiscal 2018 – 1H26

Sources: New Constructs, LLC and company filings

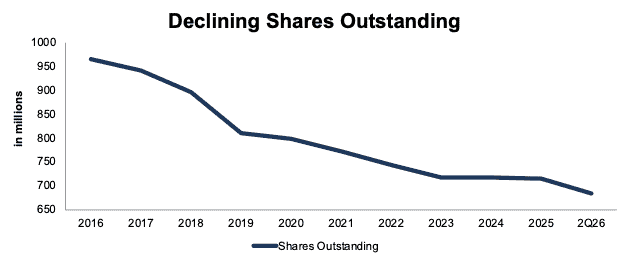

Shares Outstanding Are Moving in the Right Direction

Kroger’s share repurchases have meaningfully reduced the company’s shares outstanding over the last decade.

Per Figure 6, the company’s shares outstanding fell from 966 million in fiscal 2016 to 685 million in fiscal 2Q26.

We like companies that choose to return capital to shareholders instead of spending it on costly acquisitions or executive bonuses that rarely drive shareholder value creation. Companies that sport strong enough cash flows to consistently lower their shares outstanding, like Kroger, offer excellent value.

Figure 6: Kroger’s Shares Outstanding: Fiscal 2016 – 2Q26

Sources: New Constructs, LLC and company filings

What’s Not Working

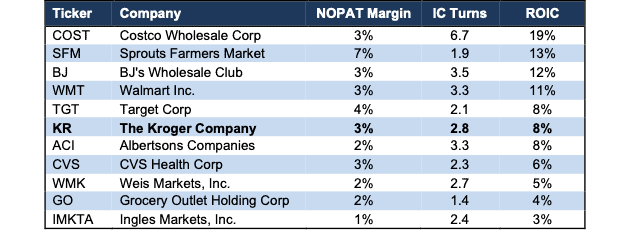

Profitability: Middle of the Road Compared to Peers

Kroger’s profitability ranks squarely in the middle of its competition. Figure 7 compares the profitability of grocery peers, which include Costco (COST), BJ’s Wholesale Club (BJ), Walmart (WMT), Target (TGT), and more.

However, Kroger’s TTM ended fiscal 2Q26 NOPAT margin of 2.8% is up from 2.7% in the TTM period ended fiscal 2Q25. Going forward, management believes it can increase margins through multiple opportunities, including pricing, Our Brands, eCommerce, and sourcing.

It’s no secret that the grocery industry is highly competitive, and Kroger’s ability to generate consistent free cash flows, grow profits, and provide a strong yield throughout all economic cycles is a testament to the strength of its business.

Figure 7: Kroger’s Profitability Vs. Peers: TTM

Sources: New Constructs, LLC and company filings

Fuel Is Dragging Sales

Kroger currently operates over 1,700 fuel centers. One of the biggest drivers of the company’s overall sales decline in the last fiscal year was lower fuel sales due to the declining gasoline and diesel prices. Kroger passed on declining gas prices to its customers as average retail fuel prices fell 5.9% in fiscal 2025. Combined with a 2.6% YoY decrease in fuel gallons sold, the company’s supermarket fuel sales were down 8.4% YoY over the same time.

As lower fuel prices persist, and Kroger’s supermarket fuel sales fell 12% YoY in the first half of fiscal 2026. The EIA expects the gasoline and diesel prices to continue to fall in 2026, so Kroger’s fuel segment is likely to continue to drag on its sales. The good news? Total sales to retail customers without fuel were up 1.1% YoY in the first half of fiscal 2026.

Best of all for investors, Kroger’s current stock price already implies the company never grows profit again, so the drop in fuel sales is already more than priced in, as we’ll show below.

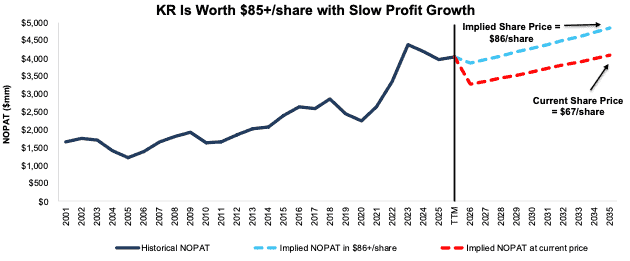

Current Price Implies Profits Never Grow Again

At its current price of $67/share, KR has a price-to-economic book value (PEBV) ratio of 1.0, which means the market expects its profits to never grow from current levels. Below, we use our reverse discounted cash flow (DCF) model to quantify the cash flow expectations for different stock price scenarios for Kroger.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin falls to 2.2% (below TTM margin of 2.8% and 5-year average margin of 2.6%),

- revenue grows at consensus rates in fiscal 2026 (1.1%), fiscal 2027 (2.8%) and fiscal 2028 (2.5%), and

- revenue grows 2.5% each year thereafter through fiscal 2035 (equal to fiscal 2028 consensus rate), then

KR would be worth $67/share today – equal to the current stock price. In this scenario, Kroger’s NOPAT in fiscal 2035 would roughly equal its TTM NOPAT. Contact us for the math behind this reverse DCF scenario. For reference Kroger has grown NOPAT by 11% and 5% compounded annually over the last 5 and 10 years, respectively.

Shares Could Go 25%+ Higher

If we instead assume:

- NOPAT margin immediately falls to 2.6% (equal to 5-year average),

- revenue grows at consensus rates in fiscal 2026 (1.1%), fiscal 2027 (2.8%) and fiscal 2028 (2.5%), and

- revenue grows 2.5% each year thereafter through fiscal 2035 (equal to fiscal 2028 consensus rate), then

KR would be worth at least $86/share today – a 28% upside to the current price. In this scenario, Kroger’s NOPAT would grow just 2% compounded annually over the next decade. Contact us for the math behind this reverse DCF scenario.

Should Kroger grow profits more in line with historical rates, the stock has even more upside. Figure 8 compares Kroger’s historical NOPAT to the NOPAT implied in each of the above DCF scenarios.

Figure 8: Kroger’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

This article was originally published on November 19, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.