Enterprise Value

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Here’s proof from some of the most respected public & private institutions in the world.

Enterprise value represents the value of the firm to all stakeholders.

The theoretical value of Enterprise Value is the total takeover value of the firm. And if that is the case, then all claims on cash flows need to be included.

We go the extra mile with our diligence to ensure all claims are captured in our Enterprise Value formula. For details on these adjustments and more see our Accounting Fixes section.

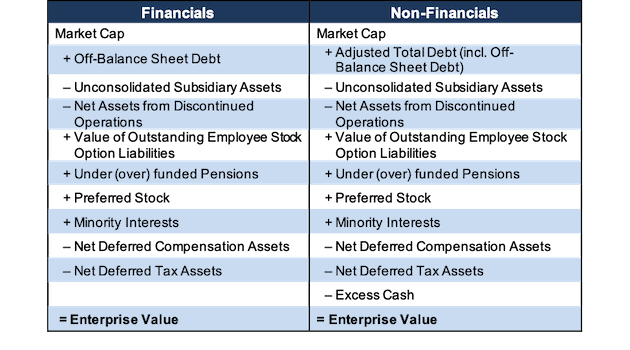

Due to differences in capital structure and operational activities, we calculate Enterprise Value differently for Financials firms compared to non-Financials firms. For example, financials are in the business of selling money; so there is no such thing as Excess Cash for them.

Figure 1 provides the formulas for calculating Enterprise Value.

Figure 1: How to Calculate Enterprise Value for Financials and Non-Financials Firms

Sources: New Constructs, LLC and company filings

Note that Enterprise Value is the denominator in our Free Cash Flow Yield calculation.

Our models and calculations are 100% transparent because we want our clients to know how much work we do to ensure we give them the best earnings quality and valuation models in the business.

Want To Learn More?

Sign up to receive free alerts about all our new research reports including Long Ideas and Danger Zone picks.