We have recently updated our treatment of Operating Lease Obligations to use a fixed rate as the discount rate for capitalizing the lease obligations and calculating the implied interest for all companies over all history.

The Present Value of Operating Lease Obligations represents the future obligations for which companies are liable according to their lease contracts. Currently, Operating Leases are not capitalized on the balance sheet and are excluded from other interest-beating liabilities. We add this value to Invested Capital as a representation of the off-balance sheet liability imbedded in a leasing contract. In addition, we add the value of Implied Interest from Operating Leases to Net Operating Profit After-tax.

Previously, we used an individual company’s Cost of Debt to discount the future obligations and calculate implied interest. This presented two main problems: companies with higher debt costs benefited from lower capitalized operating leases and changing debt spreads impacted NOPAT.

In order to provide consistency and transparency in our models, we have chosen to use a historically fixed rate we refer to as the Cost of Operating Lease Obligations. This rate is based on an average value for Cost of Debt across our coverage base. In the future, the fixed rate will change only when the cost of debt changes significantly. Ratings changes caused by a change in the Cost of Operating Lease Obligations will be flagged, and notices will be sent to all clients affected.

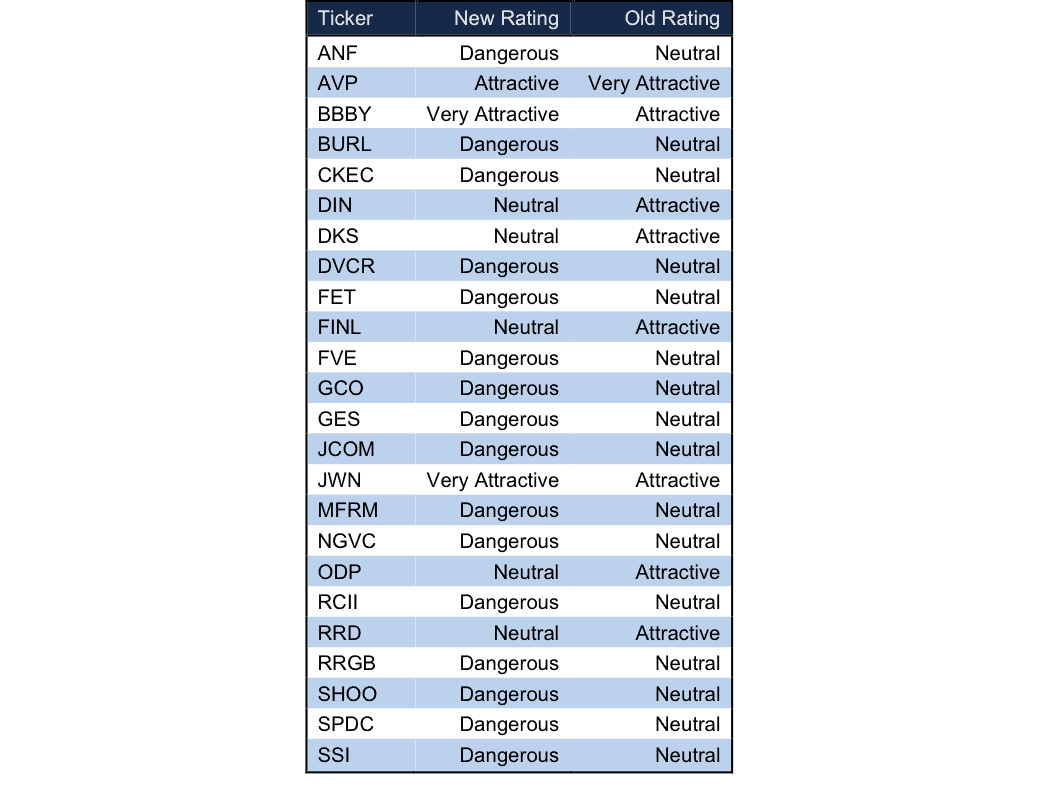

The following is a full list of the 24 ratings changes caused by the new Cost of Operating Lease Obligations:

Operating Lease Obligation Rating Changes

Sources: New Constructs, LLC and company filings

We continue to use Cost of Debt as the underlying estimate because it reflects our treatment of Operating Lease Obligations as interest-bearing liabilities. Both FASB and IASB recently announced changes to requirements for company disclosure of lease obligations that align with New Constructs’ view. In their announcement, both accounting standard bodies noted that the current standard fails “to meet the needs of users of financial statements because they do not always provide a faithful representation of leasing transactions” (link).

In the future, the fixed rate will change only when the cost of debt changes significantly. Ratings changes caused by a change in the Cost of Operating Lease Obligations will be flagged, and notices will be sent to all clients affected.

If you have any questions about the update, please contact us at support@newconstructs.com.

Click here to download a PDF of this report.

Photo Credit: (Gotcredit.com (Flick)