As the market reaches new highs, almost daily, finding good stocks only gets harder. Unlike many other investors, we are not going to tell you to chase performance. A good company is not always a good stock. No matter how profitable a company may be, if it’s valuation already reflects that profitability, then it is, fundamentally, not a good stock. I explained this concept in detail in my recent e-letter on Nvidia (NVDA).

One of New Constructs’ greatest advantages is the size of our proprietary database. Because we cover ~3,400 stocks and refresh our models daily, we have a very large group of companies from which we can select the best stocks. Add in the fact that we can leverage proven-superior fundamental data and reverse discounted cash flow model, and we think our ability to scour the market to find the few remaining opportunities where a good business is still undervalued is unmatched.

For example, this week, we’ve identified: an industry leader with strong cash flows that trades at a discount.

Our process for picking stocks is about as rigorous as it gets, and we’re proud to show our work. We’re not giving you the ticker for this pick, but there’s so much here to share; so, you know where to set the bar when evaluating research providers.

Below is an excerpt from the full report, available to Pro and Institutional members. And, you can buy the full report a la carte here.

This stock presents quality Risk/Reward based on the company’s:

- operations in oil-rich regions,

- investments in cleaner technologies to lower emissions and drive down costs,

- market leading position in refining,

- commitment to returning capital to shareholders,

- superior profitability amongst peers, and

- cheap valuation.

Production & Demand Continue to Move Higher

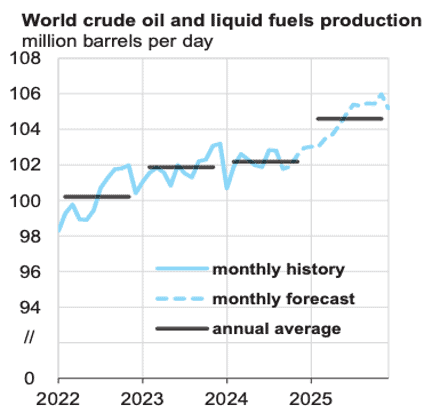

Across the globe, countries are producing increasing levels of crude oil and liquid fuels (such as gasoline). The U.S. Energy Information Administration (EIA), in its September 2024 Short-Term Energy Outlook, projects global crude oil production to grow 3% year-over-year (YoY) in 2025. See Figure 1.

On the demand side of the equation, the EIA projects global liquid fuel consumption will increase by 0.9 million barrels per day in 2024 and 1.5 million barrels per day in 2025.

On the price front, the EIA expects oil prices to rise from recent lows, as OPEC+ further delayed production increases, which will cause more oil to be taken from inventories in 4Q24 than originally expected. Relatively stable input prices, alongside stable output prices, allow integrated energy companies to better manage their business and generate consistent profits.

Figure 1: Global Crude Oil and Fuels Production Estimate: 2022-2025

Sources: U.S. Energy Information Administration, Short-Term Energy Outlook, September 2024

Longer-term, although the transition to non-fossil-fuel energy is inevitable, it will take much longer than many market projections suggest. This long-term fossil-fuel energy demand expectation underscores our belief in the sustained profitability of integrated energy companies for the foreseeable future. It also points to the need for energy companies to use current profits to prudently invest in alternative energy sources.

TMX Pipeline Benefits the Entire Region

In May 2024, the Trans Mountain pipeline expansion finally commenced operations. The pipeline connects oil producers in landlocked Alberta to the coast of Canada. Prior to this expansion, pipeline constraints led Canadian oil producers to sell oil at a discount. However, this new expansion should ease this discount, as the expansion increases the pipeline’s capacity from 300,000 barrels per day to 890,000 barrels per day.

Record Production and Cost Reductions

Figure 1 paints a clear picture: demand for energy is rising and oil/natural gas production is trending higher.

In 2Q24, this company’s upstream production was the highest second quarter production in 30 years when adjusted for the prior divestment.

Production at a key joint venture matched the best-ever second-quarter production and resulted in record first-half production.

Improving Fundamentals Provide Strong Footing

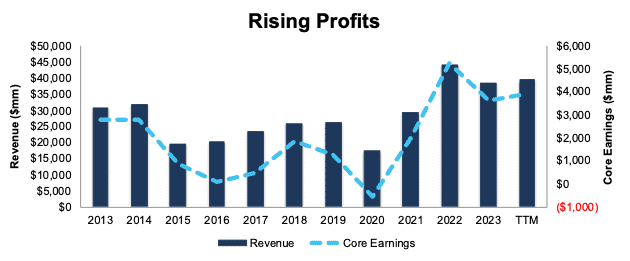

This company can focus on expanding its business, lowering costs, and building more renewable opportunities while generating significant profits from its existing assets. The company has grown revenue 26% compounded annually since the COVID-19 lows of 2020 while improving Core Earnings from -$546 million (the only negative Core Earnings in the history of our model) to $3.9 billion over the trailing-twelve-months (TTM).

Longer-term, the company has grown revenue and Core Earnings 2% and 3% compounded annually, respectively, over the past decade. See Figure 3.

Net operating profit after-tax (NOPAT) margin improved from 9.3% in 2013 to 10.3% over the TTM The company increased invested capital turns from 1.0 to 1.7 over the same time. Rising NOPAT margin and IC turns drive return on invested capital (ROIC) from 9% in 2013 to 17% over the TTM.

Figure 3: Revenue & Core Earnings: 2013 – TTM Ended 2Q24

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.

Interested in starting your membership to get access to all our Long Ideas? Get more details here.