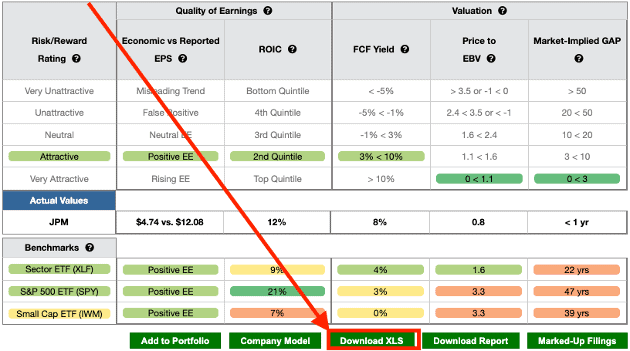

We make our Company Models available in Excel so that our research is as easy to use as possible. Clients access these Excel models by clicking the “Download XLS” button below the stock ratings table. See Figure 1.

We’re excited to announce that we updated the DCF tab in these Excel models to be 100% dynamic; so clients can operate our best-in-market Reverse Discounted Cash Flow (DCF) model in Excel.

Specifically, you can now use excel to edit/change:

- The drivers of our DCF model. These drivers mirror the “Forecast” tab of our web-based models.

- Any valuation adjustments, such as Fair Value of Total Debt and Excess Cash.

- Shares outstanding.

- Weighted average cost of capital (WACC).

For clients who prefer to work in with Excel, you can now integrate our Reverse DCF Models directly into your workflow. You can access your downloaded models anytime and anywhere.

Want access to our models? Contact us about an Institutional membership here.

Figure 1: How to Get our Company Valuation Models in Excel

Source: New Constructs, LLC

This article was originally published on March 30, 2023.

Disclosure: David Trainer, Garrett O’Grady, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.