Not everyone has the luxury of or stomach for being net short as I recommended in my last “Get Short Now” article.

So, I offer some of my top picks for those that need to be long.

As long as you believe in the long-term viability of the United States, being long should serve you well in the long-term. The key word in the last sentence is “long-term”, which I would define as at least five to ten years.

In the near-term, if you are going to own stocks I highly encourage investors to avoid “technical” strategies based on momentum or what the big mutual funds are selling to avoid reporting under-performing stocks in the quarterly filings.

If you intend to be an investor, as distinct from a speculator, then there is only one, true way to out-perform over time and that is with superior fundamental research.

Superior fundamental research is not nearly as exciting as speculative investing, and it is much more difficult. Instead of analyzing fancy charts and short-term market movements, real investing requires understanding the true economic earnings of companies and the expectations for future earnings that are baked into stock prices. Admittedly, the returns for many value investors have not been as good over the past several years; However, I believe that is going to change for reasons explained here.

In case you couldn’t tell, I consider myself an investor, not a speculator. I have been able to put up a decent track record in both my research (since 2005) and hedge fund (since 2008) leveraging strong fundamental research.

With that lead-in, here are my top 3 stocks to buy and hold. The best ETFs and mutual funds that hold these stocks are at the end.

- Analog Devices [ADI]

- Bristol Myers Squibb [BMY]

- Kla-Tencor [KLAC]

All of these stocks make my December Most Attractive Stocks list because they have:

- Strong and rising economic earnings

- Cheap valuations

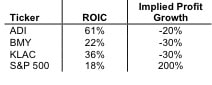

The table below highlights the strong ROICs of my three picks and the low expectations for future growth as compared to the S&P 500.

Once stocks pass my profitability and valuation thresholds, I review the strategic position of their business and sector.

The technology and health care sectors top my list of the best sectors in which to invest.

Both sectors have secular growth prospects that put a bottom on valuations and provide meaningful profit growth prospects in almost any economic environment.

Regarding the technology sector, I think of it as a play on growth opportunities within every sector. What industry does not rely on technology for some part of its operations? Technology is embedded in nearly everything we do. There are exceptions, but that list is shrinking as technological innovation is making processes and things better all the time. The bottom line is the best companies are those that innovate the most, and technology companies are the most innovative companies by a wide margin.

The health care sector is probably second only to technology in terms of its pace of innovation. In addition, no matter the environment or economic cycle, people need health care. The aging of our population and similar demographics around the world mean that health care business will not have any trouble attracting new customers for the foreseeable future.

Each of my picks offer compelling upside potential compared to limited downside risk. Upside potential is strong as these companies have strong businesses in the best sectors. Downside risk is limited by the fact that valuations are already quite low. How much lower can expectations for future earnings get than -20% to -30% permanent profit declines?

If you have to be long, own these stocks or the ETFs and mutual funds below, which allocate meaningfully to these stocks and get my attractive or better predictive fund rating.

- Royce Fund: Royce Special Equity Multi-Cap Fund [RSEMX] – allocates 4% to ADI (no other classes of this fund get my attractive rating)

- ProShares Ultra Semiconductors [USD] – allocates 3% to ADI

- PowerShares Buyback Achievers [PKW] – allocates 5% to BMY

- SunAmerica Focused Series, Inc: Focused Dividend Strategy Portfolio [FDSAX] – allocates 4% to BMY (same applies to B and T classes)

- iShares PHLX SOX Semiconductor Sector Index Fund [SOXX] – allocates 5% to KLAC

- Mutual Fund Series Trust: Catalyst Strategic Value Fund [STVCX] – allocates 2% to KLAC (no other classes of this fund get my attractive rating)

Disclosure: I am long ADI, BMY and KLAC. I receive no compensation to write about any specific stock, sector or theme.